Solve the following ratios from year 2018-2020. Show complete solutions/computations. -CURRENT RATIO -QUICK RATIO -OPERATING MARGIN -PROFIT MARGIN - RETURN ON TOTAL ASSETS (ROA) - BASIC EARNINGS POWER -RETURN ON EQUITY (ROE) -INVENTORY TURNOVER RATIO -DAYS SALES

Solve the following ratios from year 2018-2020. Show complete solutions/computations. -CURRENT RATIO -QUICK RATIO -OPERATING MARGIN -PROFIT MARGIN - RETURN ON TOTAL ASSETS (ROA) - BASIC EARNINGS POWER -RETURN ON EQUITY (ROE) -INVENTORY TURNOVER RATIO -DAYS SALES

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

1. Solve the following ratios from year 2018-2020. Show complete solutions/computations.

-CURRENT RATIO

-QUICK RATIO

-OPERATING MARGIN

-PROFIT MARGIN

- RETURN ON TOTAL ASSETS (ROA)

- BASIC EARNINGS POWER

-RETURN ON EQUITY (ROE)

-INVENTORY TURNOVER RATIO

-DAYS SALES OUTSTANDING

-FIXED ASSETS TURNOVER

-TOTAL ASSETS TURNOVER

-INVENTORY CONVERSION PERIOD

-TOTAL DEBT TO TOTAL ASSETS

-TOTAL DEBT TO TOTAL CAPITAL

-TIMES-INTEREST-EARNED RATIO

-EARNINGS PER SHARE

-PRICE EARNINGS RATIO

-MARKET BOOK VALUE RATIO

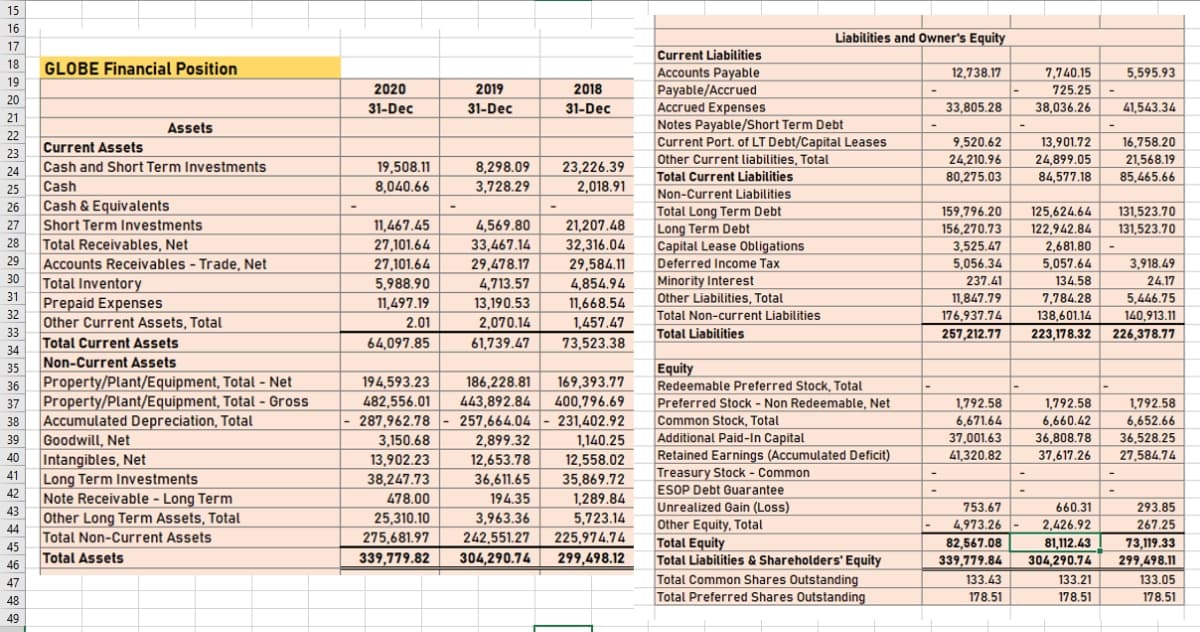

Transcribed Image Text:15

16

Liabilities and Owner's Equity

17

Current Liabilities

Accounts Payable

Payable/Accrued

Accrued Expenses

Notes Payable/Short Term Debt

Current Port. of LT Debt/Capital Leases

18

GLOBE Financial Position

7,740.15

725.25

12,738.17

5,595.93

19

2020

2019

2018

20

31-Dec

31-Dec

31-Dec

33.805.28

38,036.26

41.543.34

21

Assets

22

Current Assets

9,520.62

13,901.72

16,758.20

23

Cash and Short Term Investments

24,210.96

80,275.03

Other Current liabilities, Total

24,899.05

21,568.19

19,508.11

8,040.66

8,298.09

23,226.39

24

Total Current Liabilities

84,577.18

85,465.66

25

Cash

3,728.29

2,018.91

Cash & Equivalents

Short Term Investments

Total Receivables, Net

Non-Current Liabilities

Total Long Term Debt

Long Term Debt

26

159,796.20

125,624.64

131,523.70

27

11,467.45

4,569.80

21,207.48

156,270,73

122,942.84

131,523.70

33,467.14

29,478.17

28

2,681.80

5,057.64

27,101.64

32,316.04

29,584.11

3,525.47

Capital Lease Obligations

Deferred Income Tax

29

27,101.64

5,056.34

3,918.49

Accounts Receivables - Trade, Net

30

Total Inventory

5,988.90

4,713.57

Minority Interest

237.41

134.58

24.17

4,854.94

11,668.54

31

Prepaid Expenses

32

Other Current Assets, Total

33

Total Current Assets

34

11,497.19

13,190.53

Other Liabilities, Total

11,847.79

7,784.28

5,446.75

Total Non-current Liabilities

176,937,74

138,601.14

140,913.11

2.01

2,070.14

1,457.47

Total Liabilities

257,212.77

223,178.32

226,378.77

64,097.85

61,739.47

73,523.38

Non-Current Assets

Equity

Redeemable Preferred Stock, Total

35

Property/Plant/Equipment, Total - Net

Property/Plant/Equipment, Total - Gross

Accumulated Depreciation, Total

Goodwill, Net

Intangibles, Net

194,593.23

482,556.01

287,962.78

36

186,228.81

169,393.77

443,892.84

400,796.69

231,402.92

1,140.25

12,558.02

Preferred Stock - Non Redeemable, Net

Common Stock, Total

Additional Paid-In Capital

Retained Earnings (Accumulated Deficit)

Treasury Stock - Common

37

1,792.58

1.792,58

1,792,58

38

257,664.04

6,671.64

6,660.42

6,652.66

37,001.63

36,808.78

37,617.26

39

3,150.68

2,899.32

36,528.25

40

41,320.82

27,584.74

12,653.78

36,611.65

13,902.23

41

Long Term Investments

42

Note Receivable - Long Term

43

Other Long Term Assets, Total

44

Total Non-Current Assets

45

Total Assets

38,247.73

35,869.72

ESOP Debt Guarantee

1,289.84

5,723.14

225,974.74

478.00

194.35

Unrealized Gain (Loss)

Other Equity, Total

Total Equity

Total Liabilities & Shareholders' Equity

753.67

660.31

293.85

25,310.10

3,963.36

4,973.26

2,426.92

267.25

275,681.97

242,551.27

304,290.74

82,567.08

81,112.43

73,119.33

339,779.82

299,498.12

339,779.84

304,290.74

299,498.11

46

Total Common Shares Outstanding

Total Preferred Shares Outstanding

47

133,43

133.21

133.05

178.51

178.51

178.51

48

49

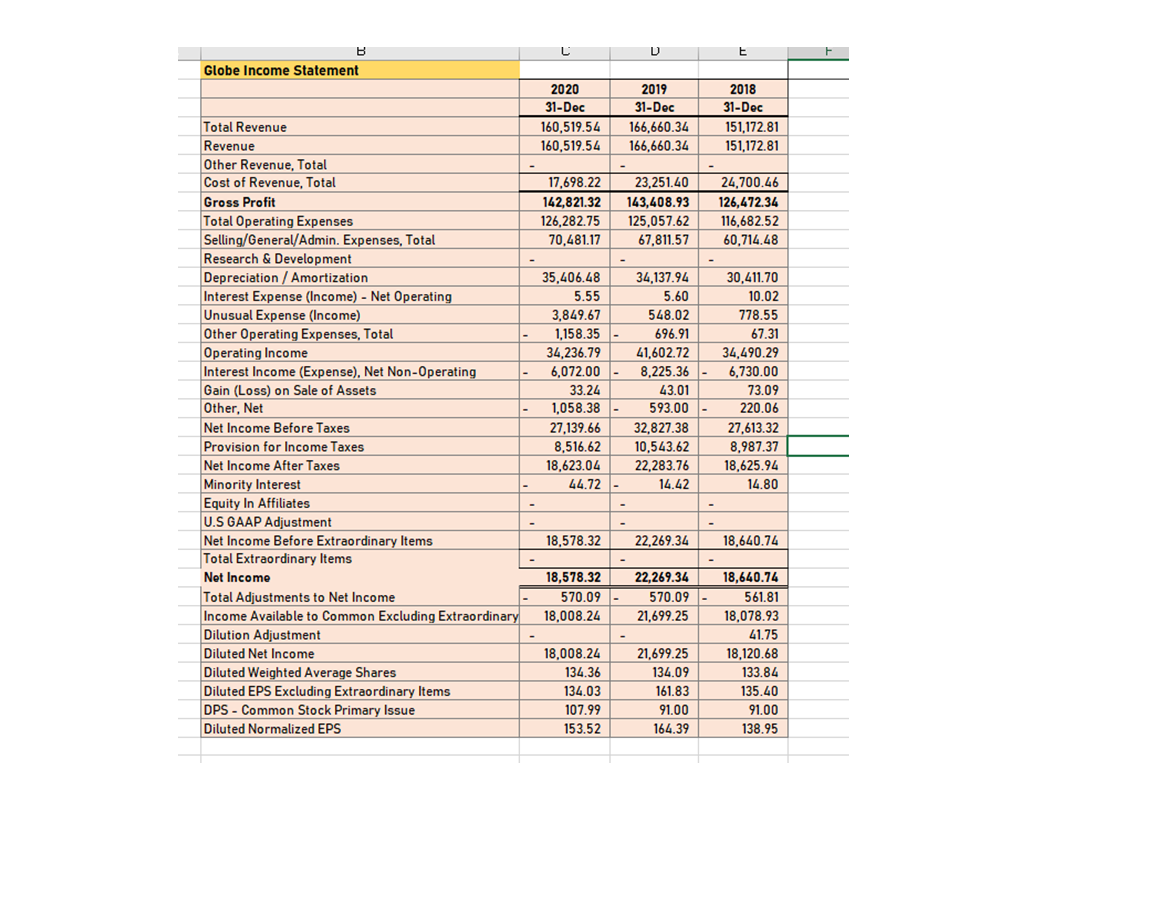

Transcribed Image Text:Globe Income Statement

2020

2019

2018

31-Doc

31-Doc

31-Dec

Total Revenue

Revenue

160,519.54

166,660.34

151,172.81

160,519.54

166,660.34

151,172.81

Other Revenue, Total

Cost of Revenue, Total

17,698.22

23,251.40

24,700,46

Gross Profit

142,821.32

143,408.93

126,472.34

Total Operating Expenses

Selling/General/Admin. Expenses, Total

Research & Development

Depreciation / Amortization

Interest Expense (Income) - Net Operating

Unusual Expense (Income)

Other Operating Expenses, Total

Operating Income

Interest Income (Expense), Net Non-Operating

126,282.75

125,057.62

116,682.52

70,481.17

67,811.57

60,714.48

35,406.48

34,137.94

30,411.70

5.55

5.60

10.02

3.849.67

548.02

778.55

1,158.35

696.91

67.31

41,602.72

34,490.29

34,236.79

6,072.00

8.225.36

6,730.00

Gain (Loss) on Sale of Assets

Other, Net

Net Income Before Taxes

43.01

593.00

33.24

73.09

1,058.38

220.06

27,139.66

8,516.62

18,623.04

32.827,38

27,613.32

Provision for Income Taxes

10,543.62

8,987.37

Net Income After Taxes

Minority Interest

Equity In Affiliates

U.S GAAP Adjustment

Net Income Before Extraordinary Items

Total Extraordinary Items

22.283.76

18,625.94

44.72

14.42

14.80

18,578.32

22,269.34

18,640.74

22,269.34

570.09

Net Income

18,578.32

18,640.74

570.09

Total Adjustments to Net Income

Income Available to Common Excluding Extraordinary

Dilution Adjustment

Diluted Net Income

561.81

18,008.24

21,699.25

18,078.93

41,75

18,008.24

21,699.25

18,120.68

Diluted Weighted Average Shares

Diluted EPS Excluding Extraordinary Items

DPS - Common Stock Primary Issue

134.36

134.09

133.84

134.03

161.83

135.40

107.99

91.00

91.00

Diluted Normalized EPS

153,52

164.39

138,95

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education