Ratio Industry Ratios GnG Ratios 1. Current Ratio 5.3 2. Acid Test Ratio 5.1 3. Gross Profit Ratio 30%

Ratio Industry Ratios GnG Ratios 1. Current Ratio 5.3 2. Acid Test Ratio 5.1 3. Gross Profit Ratio 30%

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter3: Analysis Of Financial Statements

Section: Chapter Questions

Problem 14P: The Jimenez Corporation’s forecasted 2020 financial statements follow, along with some industry...

Related questions

Question

100%

|

Ratio |

Industry Ratios |

GnG Ratios |

|

1. |

5.3 |

|

|

2. Acid Test Ratio |

5.1 |

|

|

3. Gross Profit Ratio |

30% |

|

|

4. Net Income Margin |

7.5% |

|

|

5. Receivable Turnover Ratio |

9 |

|

|

6. Return on Asset Ratio |

12% |

|

|

7. Debt to Asset Ratio |

1:4 |

|

Interpretation and verbal analysis compared to industry ratios:

1. Liquidity

2. Profitability

3. Solvency

Computations:

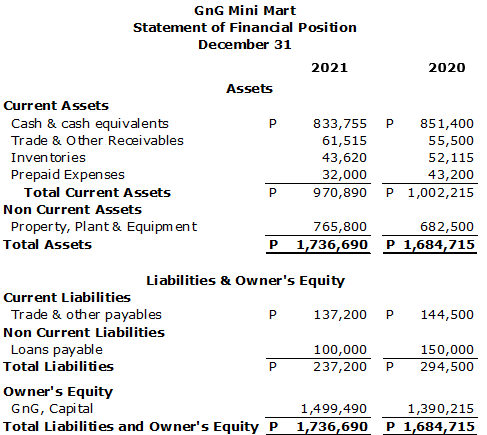

Transcribed Image Text:GnG Mini Mart

Statement of Finandial Position

December 31

2021

2020

Assets

Current Assets

Cash & cash equivalents

P

833,755

851,400

Trade & Other Receivables

61,515

55,500

Inventories

43,620

52,115

Prepaid Expenses

32,000

970,890

43,200

Total Current Assets

P 1,002,215

Non Current Assets

Property, Plant & Equipm ent

765,800

P 1,736,690 P 1,684,715

682,500

Total Assets

Liabilities & Owner's Equity

Current Liabilities

Trade & other payables

P

137,200

144,500

Non Current Liabilities

Loans payable

100,000

237,200

150,000

Total Liabilities

P

P

294,500

Owner's Equity

GnG, Capi tal

Total Liabilities and Owner's Equity P

1,499,490

1,390,215

1,736,690

P 1,684,715

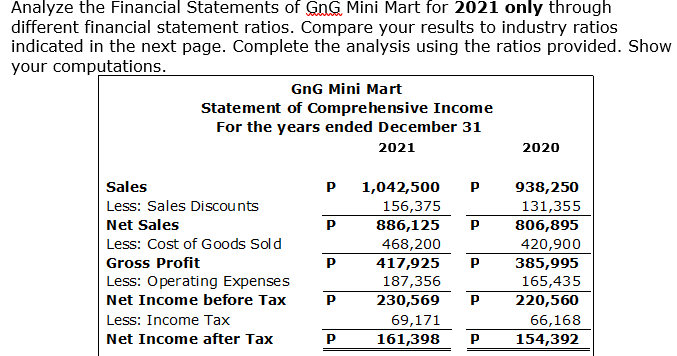

Transcribed Image Text:Analyze the Financial Statements of GnG Mini Mart for 2021 only through

different financial statement ratios. Compare your results to industry ratios

indicated in the next page. Complete the analysis using the ratios provided. Show

your computations.

GnG Mini Mart

Statement of Comprehensive Income

For the years ended December 31

2021

2020

P 938,250

131,355

806,895

Sales

P

1,042,500

Less: Sales Discounts

156,375

Net Sales

P

886,125

Less: Cost of Goods Sold

468,200

417,925

420,900

385,995

Gross Profit

Less: Operating Expenses

187,356

230,569

165,435

220,560

Net Income before Tax

Less: Income Tax

69,171

66,168

Net Income after Tax

P

161,398

154,392

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College