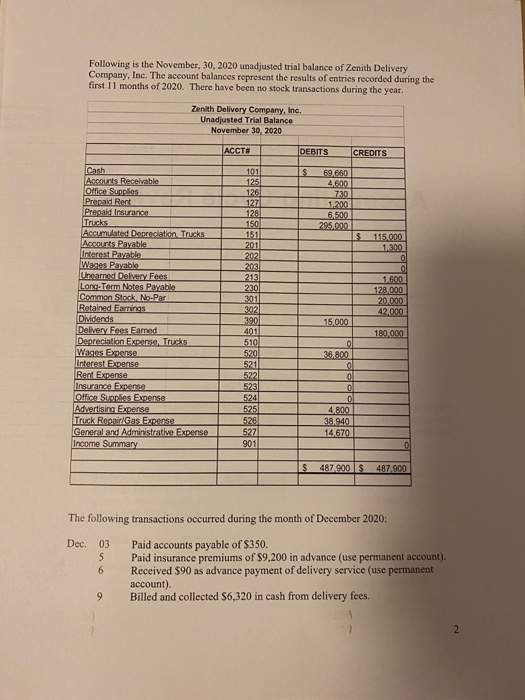

Following is the November, 30, 2020 unadjusted trial balance of Zenith Delivery Company, Inc. The account balances represent the results of entries recorded during the first 11 months of 2020. There have been no stock transactions during the year. Zenith Delivery Company, Inc. Unadjusted Trial Balance November 30, 2020 ACCT# DEBITS CREDITS Cash Accourts Receivable LOffice Sucples Precaid Rert Prepaid Insurance 101 125 126 69.660 4.600 730 1.200 6.500 295.000 127 126 150 151 201 202 203 213 Accumlated Decreciation Trucks Accourts Payatle Interest Pavable Wanes Paable Unearned Delvey Fees Long-Term Notes Payable Common Stock No-Par Retained Earmings Dividends Delivery Fees Earned Depreciation Expense. Trucks Wages Expense Interest Expense Rert Expense Insurance Evpese Office Supples Expense Advertising Expense Truck RecairiGas Expense General and Administrative Experse Income Summary 115.000 1.300 1.600 230 301 202 390 401 510 520 521 5221 128.000 20.000 42.000 15.000 180.000 36.800 523 524 525 4.800 526 527 901 38.940 14.670 487.900 S 487.900 The following transactions occurred during the month of December 2020: Dec. 03 Paid accounts payable of $350. Paid insurance premiums of $9,200 in advance (use permanent account). Received $90 as advance payment of delivery service (use permanent account). Billed and collected $6,320 in cash from delivery fees. 5 9.

Following is the November, 30, 2020 unadjusted trial balance of Zenith Delivery Company, Inc. The account balances represent the results of entries recorded during the first 11 months of 2020. There have been no stock transactions during the year. Zenith Delivery Company, Inc. Unadjusted Trial Balance November 30, 2020 ACCT# DEBITS CREDITS Cash Accourts Receivable LOffice Sucples Precaid Rert Prepaid Insurance 101 125 126 69.660 4.600 730 1.200 6.500 295.000 127 126 150 151 201 202 203 213 Accumlated Decreciation Trucks Accourts Payatle Interest Pavable Wanes Paable Unearned Delvey Fees Long-Term Notes Payable Common Stock No-Par Retained Earmings Dividends Delivery Fees Earned Depreciation Expense. Trucks Wages Expense Interest Expense Rert Expense Insurance Evpese Office Supples Expense Advertising Expense Truck RecairiGas Expense General and Administrative Experse Income Summary 115.000 1.300 1.600 230 301 202 390 401 510 520 521 5221 128.000 20.000 42.000 15.000 180.000 36.800 523 524 525 4.800 526 527 901 38.940 14.670 487.900 S 487.900 The following transactions occurred during the month of December 2020: Dec. 03 Paid accounts payable of $350. Paid insurance premiums of $9,200 in advance (use permanent account). Received $90 as advance payment of delivery service (use permanent account). Billed and collected $6,320 in cash from delivery fees. 5 9.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 5SEQ: The balance in the unearned rent account for Jones Co. as of December 31 is $1 ,20(). If Jones Co....

Related questions

Question

100%

Answer asap.

Transcribed Image Text:Following is the November, 30, 2020 unadjusted trial balance of Zenith Delivery

Company, Inc. The account balances represent the results of entries recorded during the

first 11 months of 2020. There have been no stock transactions during the year.

Zenith Delivery Company, Inc.

Unadjusted Trial Balance

November 30, 2020

ACCT#

DEBITS

CREDITS

Cash

Accourts Receivable

LOffice Sucples

Precaid Rert

Prepaid Insurance

101

125

126

69.660

4.600

730

1.200

6.500

295.000

127

126

150

151

201

202

203

213

Accumlated Decreciation Trucks

Accourts Payatle

Interest Pavable

Wanes Paable

Unearned Delvey Fees

Long-Term Notes Payable

Common Stock No-Par

Retained Earmings

Dividends

Delivery Fees Earned

Depreciation Expense. Trucks

Wages Expense

Interest Expense

Rert Expense

Insurance Evpese

Office Supples Expense

Advertising Expense

Truck RecairiGas Expense

General and Administrative Experse

Income Summary

115.000

1.300

1.600

230

301

202

390

401

510

520

521

5221

128.000

20.000

42.000

15.000

180.000

36.800

523

524

525

4.800

526

527

901

38.940

14.670

487.900 S

487.900

The following transactions occurred during the month of December 2020:

Dec.

03

Paid accounts payable of $350.

Paid insurance premiums of $9,200 in advance (use permanent account).

Received $90 as advance payment of delivery service (use permanent

account).

Billed and collected $6,320 in cash from delivery fees.

5

9.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 14 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College