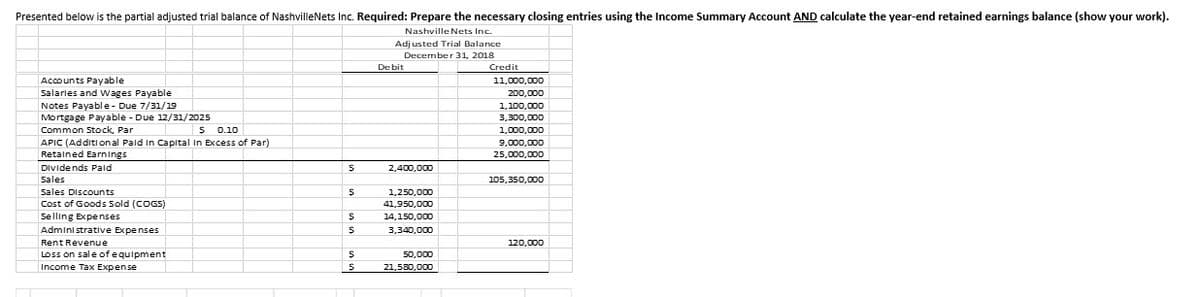

Presented below is the partial adjusted trial balance of NashvilleNets Inc. Required: Prepare the necessary closing entries using the Income Summary Account AND calculate the year-end retained earnings balance (show your work). Nashville Nets Inc. Adj usted Trial Balance December 31, 2018 Credit De bit Accounts Payable Salaries and wages Payable 11,000,000 200,000 Notes Payable- Due 7/31/19 Mortgage Payable - Due 12/31/2025 Common Stock, Par 1,100,000 3,300,000 1,000,000 0.10 APIC (Additi onal Paid in Capital in Excess of Par) Retained Earnings 9.000,000 25,000,000 Divide nds Paid Sales Sales Discounts 2,400,000 105,350,000 Cost of Goods Sold (COGS) Selling Expenses Admini strative Expenses 1,250,000 41,950,000 14,150,000 3,340,000 Rent Revenue 120,000 LOSS on sal e of e quipment Income Tax Expense 50,000 21,580,000

Presented below is the partial adjusted trial balance of NashvilleNets Inc. Required: Prepare the necessary closing entries using the Income Summary Account AND calculate the year-end retained earnings balance (show your work). Nashville Nets Inc. Adj usted Trial Balance December 31, 2018 Credit De bit Accounts Payable Salaries and wages Payable 11,000,000 200,000 Notes Payable- Due 7/31/19 Mortgage Payable - Due 12/31/2025 Common Stock, Par 1,100,000 3,300,000 1,000,000 0.10 APIC (Additi onal Paid in Capital in Excess of Par) Retained Earnings 9.000,000 25,000,000 Divide nds Paid Sales Sales Discounts 2,400,000 105,350,000 Cost of Goods Sold (COGS) Selling Expenses Admini strative Expenses 1,250,000 41,950,000 14,150,000 3,340,000 Rent Revenue 120,000 LOSS on sal e of e quipment Income Tax Expense 50,000 21,580,000

Chapter4: The Adjustment Process

Section: Chapter Questions

Problem 13PA: Prepare adjusting journal entries, as needed, considering the account balances excerpted from the...

Related questions

Question

Transcribed Image Text:Presented below is the partial adjusted trial balance of NashvilleNets Inc. Required: Prepare the necessary closing entries using the Income Summary Account AND calculate the year-end retained earnings balance (show your work).

Nashville Nets Inc.

Adjusted Trial Balance

December 31, 2018

De bit

Credit

Accounts Payable

Salaries and Wages Payable

Notes Payable- Due 7/31/19

Mortgage Payable - Due 12/31/2025

Common Stock, Par

11,000,000

200,000

1,100,000

3,300,000

םנ.סS

0.10

1,000,000

APIC (Additi on al Pald in Capital in Excess of Par)

Retained Earnings

9,000,000

25,000,000

Dividends Paid

2,400,000

Sales

105,350,000

Sales Discounts

1,250,000

Cost of Goods Sold (COGS)

41,950,000

Selling Expenses

14,150,000

Admini strative Expenses

3,340,000

Rent Revenue

120,000

Loss on sal e of equipment

Income Tax Expense

50,000

21,580,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning