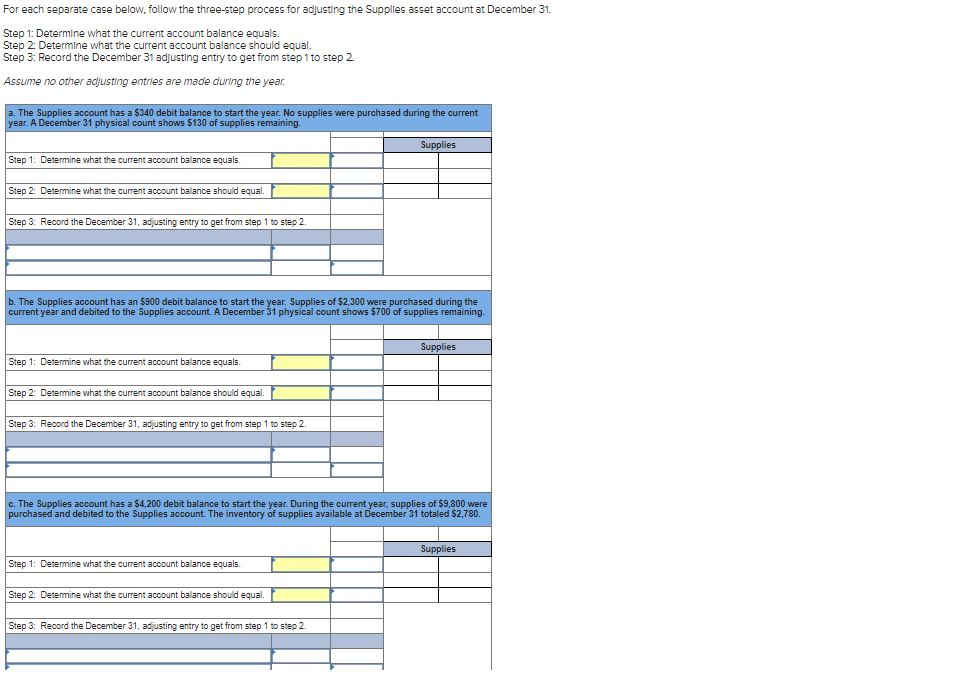

For each separate case below, follow the three-step process for adjusting the Supplies asset account at December 31. Step 1: Determine what the current account balance equals. Step 2 Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2 Assume no other adjusting entries are made during the year. a. The Supplies account has a $340 debit balance to start the year. No supplies were purchased during the current year. A December 31 physical count shows $130 of supplies remaining. Supplies Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31, adjusting entry to get from step 1 to step 2. b. The Supplies account has an $900 debit balance to start the year. Supplies of $2,300 were purchased during the current year and debited to the Supplies account. A December 31 physical count shows $700 of supplies remaining. Supplies Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31, adjusting entry to get from step 1 to step 2. c. The Supplies account has a $4,200 debit balance to start the year. During the current year, supplies of $9,800 were purchased and debited to the Supplies account. The inventory of supplies available at December 31 totaled $2,780. Supplies Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31, adjusting entry to get from step 1 to step 2.

For each separate case below, follow the three-step process for adjusting the Supplies asset account at December 31. Step 1: Determine what the current account balance equals. Step 2 Determine what the current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2 Assume no other adjusting entries are made during the year. a. The Supplies account has a $340 debit balance to start the year. No supplies were purchased during the current year. A December 31 physical count shows $130 of supplies remaining. Supplies Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31, adjusting entry to get from step 1 to step 2. b. The Supplies account has an $900 debit balance to start the year. Supplies of $2,300 were purchased during the current year and debited to the Supplies account. A December 31 physical count shows $700 of supplies remaining. Supplies Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31, adjusting entry to get from step 1 to step 2. c. The Supplies account has a $4,200 debit balance to start the year. During the current year, supplies of $9,800 were purchased and debited to the Supplies account. The inventory of supplies available at December 31 totaled $2,780. Supplies Step 1: Determine what the current account balance equals. Step 2: Determine what the current account balance should equal. Step 3: Record the December 31, adjusting entry to get from step 1 to step 2.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter2: Service Company Worksheet (f1work)

Section: Chapter Questions

Problem 4R: The trial balance of Wikki Cleaners at December 31, 2012, the end of the current fiscal year, is as...

Related questions

Question

100%

Transcribed Image Text:For each separate case below, follow the three-step process for adjusting the Supplies asset account at December 31.

Step 1: Determine what the current account balance equals.

Step 2: Determine what the current account balance should equal.

Step 3: Record the December 31 adjusting entry to get from step 1 to step 2.

Assume no other adjusting entries are made during the year.

a. The Supplies account has a $340 debit balance to start the year. No supplies were purchased during the current

year. A December 31 physical count shows $130 of supplies remaining.

Supplies

Step 1: Determine what the current account balance equals.

Step 2: Determine what the current account balance should equal.

Step 3: Record the December 31, adjusting entry to get from step 1 to step 2.

b. The Supplies account has an $900 debit balance to start the year. Supplies of $2,300 were purchased during the

current year and debited to the Supplies account. A December 31 physical count shows $700 of supplies remaining.

Supplies

Step 1: Determine what the current account balance equals.

Step 2: Determine what the current account balance should equal.

Step 3: Record the December 31, adjusting entry to get from step 1 to step 2.

c. The Supplies account has a $4,200 debit balance to start the year. During the current year, supplies of $9,800 were

purchased and debited to the Supplies account. The inventory of supplies available at December 31 totaled $2,780.

Supplies

Step 1: Determine what the current account balance equals.

Step 2: Determine what the current account balance should equal.

Step 3: Record the December 31, adjusting entry to get from step 1 to step 2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning