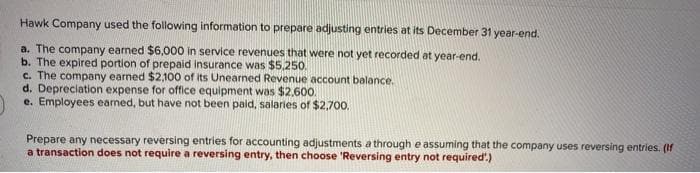

Hawk Company used the following information to prepare adjusting entries at its December 31 year-end. a. The company earned $6,000 in service revenues that were not yet recorded at year-end. b. The expired portion of prepaid insurance was $5,250. c. The company earned $2100 of its Unearned Revenue account balance. d. Depreciation expense for office equipment was $2,600. e. Employees earned, but have not been paid, salaries of $2,700. Prepare any necessary reversing entries for accounting adjustments a through e assuming that the company uses reversing entries. (1f a transaction does not require a reversing entry, then choose 'Reversing entry not required')

Hawk Company used the following information to prepare adjusting entries at its December 31 year-end. a. The company earned $6,000 in service revenues that were not yet recorded at year-end. b. The expired portion of prepaid insurance was $5,250. c. The company earned $2100 of its Unearned Revenue account balance. d. Depreciation expense for office equipment was $2,600. e. Employees earned, but have not been paid, salaries of $2,700. Prepare any necessary reversing entries for accounting adjustments a through e assuming that the company uses reversing entries. (1f a transaction does not require a reversing entry, then choose 'Reversing entry not required')

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter2: Service Company Worksheet (f1work)

Section: Chapter Questions

Problem 5R: The trial balance of Wikki Cleaners at December 31, 2012, the end of the current fiscal year, is as...

Related questions

Question

give me reverse entries please

Transcribed Image Text:Hawk Company used the following information to prepare adjusting entries at its December 31 year-end.

a. The company earned $6,000 in service revenues that were not yet recorded at year-end.

b. The expired portion of prepaid insurance was $5,250.

c. The company earned $2,100 of its Unearned Revenue account balance.

d. Depreciation expense for office equipment was $2,600.

e. Employees earned, but have not been pald, salaries of $2,700.

Prepare any necessary reversing entries for accounting adjustments a through e assuming that the company uses reversing entries. (If

a transaction does not require a reversing entry, then choose 'Reversing entry not required'.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub