Required: Compute the ratios (according to the listed ratios as above) for 2019 and 2020. Analyse the ratios as the above between these 2 years. b. From (a), analyse the ratios as the above between 2020 and the industry. a. Comment the performance of the fim in terms of liquidity, efficiency, debt and profitability of the firm as a whole. d. Give THREE (3) suggestions on how to improve on the profitability. C.

Required: Compute the ratios (according to the listed ratios as above) for 2019 and 2020. Analyse the ratios as the above between these 2 years. b. From (a), analyse the ratios as the above between 2020 and the industry. a. Comment the performance of the fim in terms of liquidity, efficiency, debt and profitability of the firm as a whole. d. Give THREE (3) suggestions on how to improve on the profitability. C.

Chapter7: Accounting Information Systems

Section: Chapter Questions

Problem 26MC: An enterprise resource planning (ERP) system ________. A. is software to help you prepare your tax...

Related questions

Question

Transcribed Image Text:udejee

d you may be a victim of software counterfeiting. Avoid interruption and keep your files safe with genuine Office today.

Styles

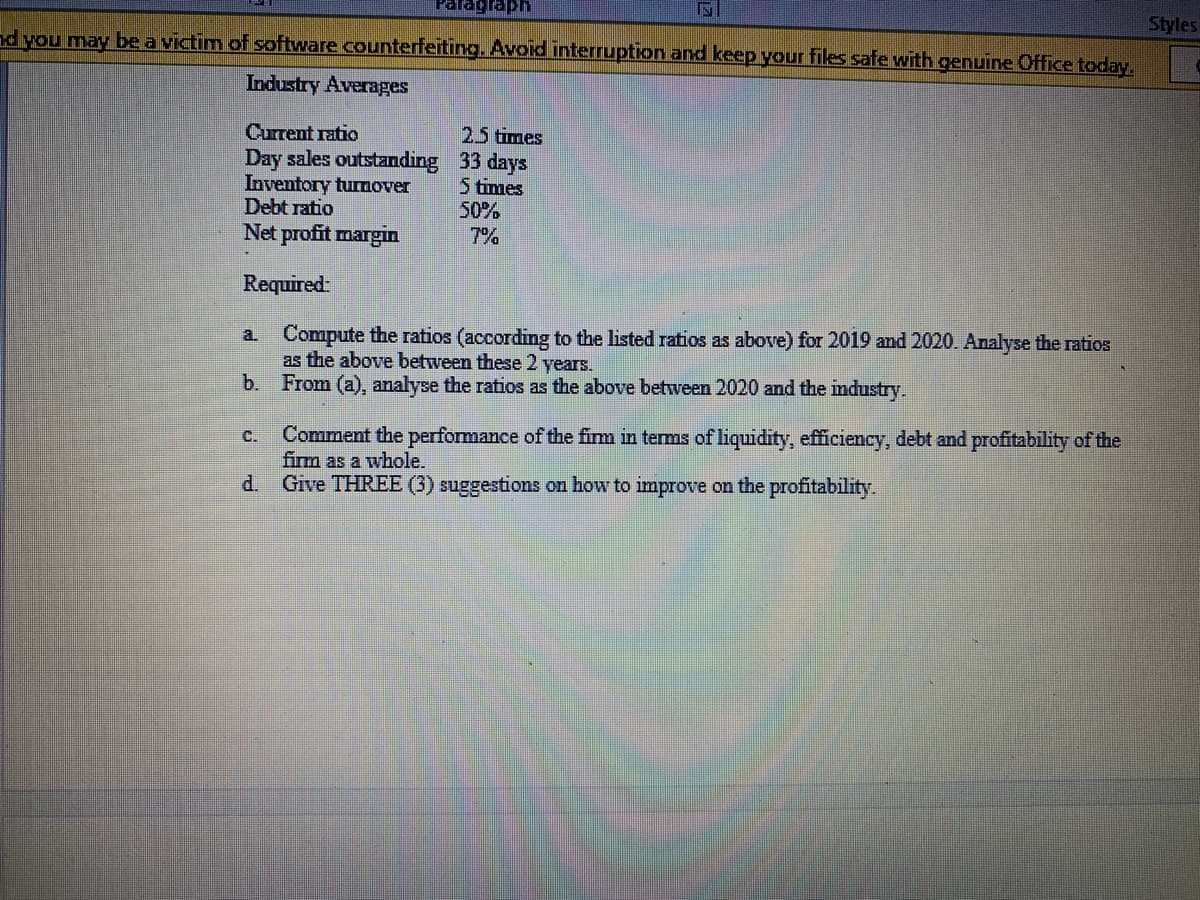

Industry Averages

Current ratio

Inventory turnover

Debt ratio

Net profit margın

25 times

Day sales outstanding 33 days

5 times

50%

7%

Required

Compute the ratios (according to the listed ratios as above) for 2019 and 2020. Analyse the ratios

as the above between these 2 years.

b.

a.

From (a), analyse the ratios as the above between 2020 and the imdustry.

Comment the performance of the fim in terms of liquidity, efficiency, debt and profitability of the

firm as a whole.

d. Give THREE (3) suggestions on how to improve on the profitability.

C.

Transcribed Image Text:Font

Spac. Heading 1

Heading 2

Title

Subtit

Paragraph

- isn't genuine, and you may be a victim of software counterfeitīng. Avoid interruption and keep your files safe with genuine Office today.

Styles

Get genuine Office

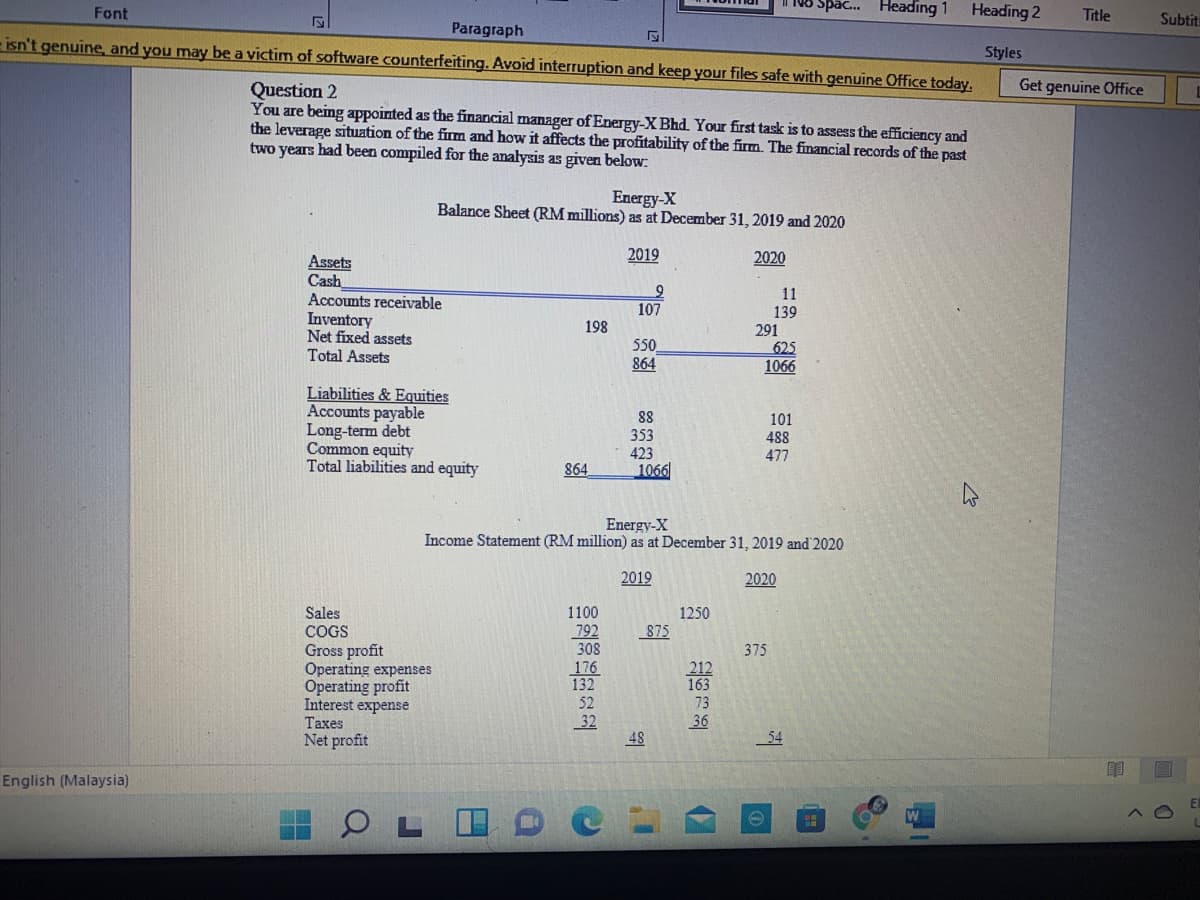

Question 2

You are being appointed as the financial manager of Energy-X Bhd Your first task is to assess the efficiency and

the leverage situation of the firm and how it affects the profitability of the firm. The financial records of the past

two years had been compiled for the analysis as given below:

Energy-X

Balance Sheet (RM millions) as at December 31, 2019 and 2020

2019

2020

Assets

Cash

Accounts receivable

Inventory

Net fixed assets

Total Assets

11

139

291

625

107

198

550

864

1066

Liabilities & Equities

Accounts payable

Long-term debt

Common equity

Total liabilities and equity

88

353

423

1066

101

488

477

864

Energy-X

Income Statement (RM million) as at December 31, 2019 and 2020

2019

2020

Sales

COGS

1100

792

308

1250

875

Gross profit

Operating expenses

Operating profit

Interest expense

Тахes

Net profit

375

176

132

52

32

36

48

_ 54

English (Malaysia)

器”

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College