Using the financial statements of Sultan Center in 2018, calculate the following ratios and interpret your results: current ratio calculations ........................ interpretation of results ....................... return on equity ratio calculations ....................... interpretation of results ...................... profit margin calculations ......................... interpretation of results ........................... debt to equity ratio calculations ............................ interpretation of results ............................ (financial statements listed below and also company website for more information)

Using the financial statements of Sultan Center in 2018, calculate the following ratios and interpret your results: current ratio calculations ........................ interpretation of results ....................... return on equity ratio calculations ....................... interpretation of results ...................... profit margin calculations ......................... interpretation of results ........................... debt to equity ratio calculations ............................ interpretation of results ............................ (financial statements listed below and also company website for more information)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 52PSA

Related questions

Question

Using the financial statements of Sultan Center in 2018, calculate the following ratios and interpret your results:

current ratio

calculations

........................

interpretation of results

.......................

- return on equity ratio

calculations

.......................

interpretation of results

......................

- profit margin

calculations

.........................

interpretation of results

...........................

- debt to equity ratio

calculations

............................

interpretation of results

............................

(financial statements listed below and also company website for more information)

https://cis.boursakuwait.com.kw/Portal/FData/610_BL_2019_9_E_293202094434260.pdf

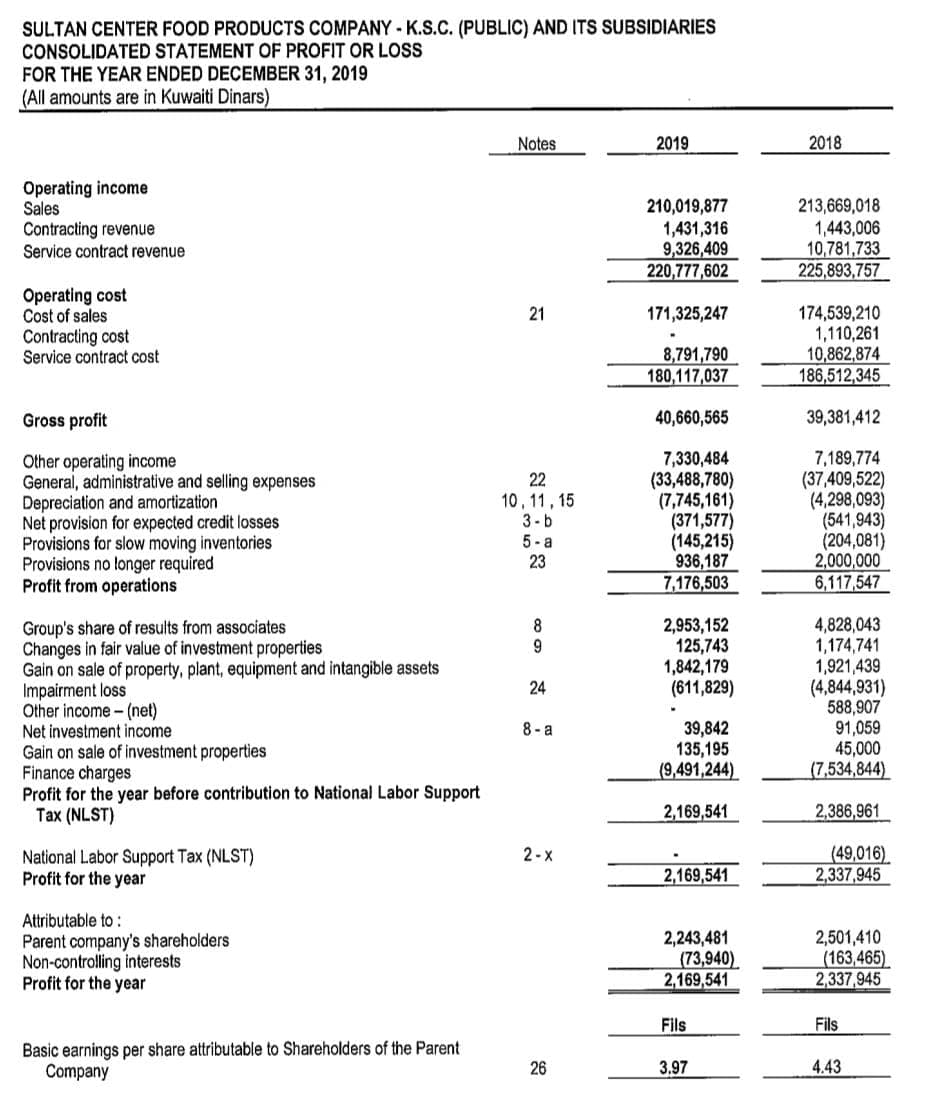

Transcribed Image Text:SULTAN CENTER FOOD PRODUCTS COMPANY - K.S.C. (PUBLIC) AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENT OF PROFIT OR LOSS

FOR THE YEAR ENDED DECEMBER 31, 2019

(All amounts are in Kuwaiti Dinars)

Notes

2019

2018

Operating income

Sales

210,019,877

1,431,316

9,326,409

220,777,602

213,669,018

1,443,006

10,781,733

225,893,757

Contracting revenue

Service contract revenue

Operating cost

Cost of sales

174,539,210

1,110,261

10,862,874

186,512,345

21

171,325,247

Contracting cost

Service contract cost

8,791,790

180,117,037

Gross profit

40,660,565

39,381,412

Other operating income

General, administrative and selling expenses

Depreciation and amortization

Net provision for expected credit losses

Provisions for slow moving inventories

Provisions no longer required

Profit from operations

22

10, 11, 15

3-b

5- a

23

7,330,484

(33,488,780)

(7,745,161)

(371,577)

(145,215)

936,187

7,176,503

7,189,774

(37,409,522)

(4,298,093)

(541,943)

(204,081)

2,000,000

6,117,547

Group's share of results from associates

Changes in fair value of investment properties

Gain on sale of property, plant, equipment and intangible assets

Impairment loss

Other income - (net)

Net investment income

Gain on sale of investment properties

Finance charges

Profit for the year before contribution to National Labor Support

Tax (NLST)

4,828,043

1,174,741

1,921,439

(4,844,931)

588,907

91,059

45,000

(7,534,844)

8

2,953,152

125,743

1,842,179

(611,829)

9.

24

8 -a

39,842

135,195

(9,491,244)

2,169,541

2,386,961

National Labor Support Tax (NLST)

Profit for the year

(49,016)

2,337,945

2-x

2,169,541

Attributable to :

Parent company's shareholders

Non-controlling interests

Profit for the year

2,243,481

(73,940)

2,169,541

2,501,410

(163,465)

2,337,945

Fils

Fils

Basic earnings per share attributable to Shareholders of the Parent

Company

26

3,97

4.43

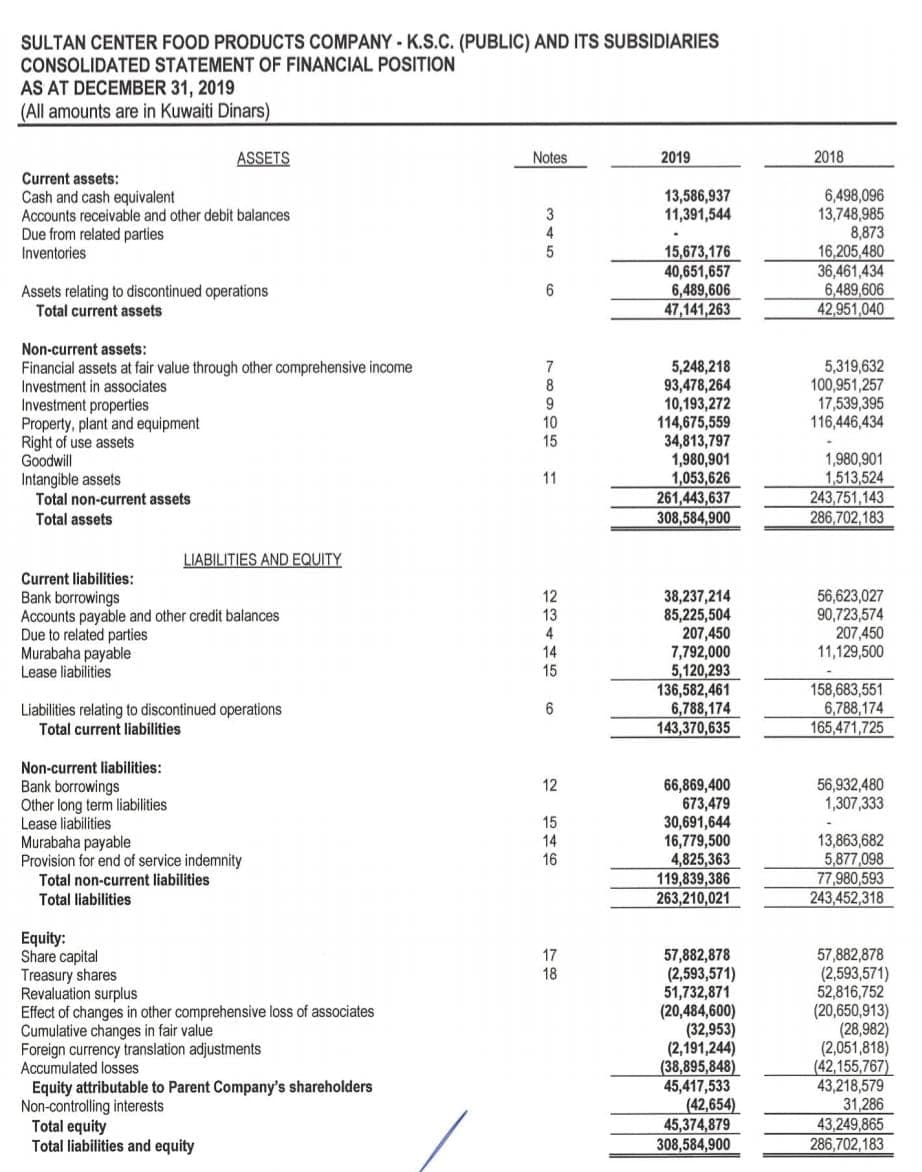

Transcribed Image Text:SULTAN CENTER FOOD PRODUCTS COMPANY - K.S.C. (PUBLIC) AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT DECEMBER 31, 2019

(All amounts are in Kuwaiti Dinars)

ASSETS

Notes

2019

2018

Current assets:

Cash and cash equivalent

Accounts receivable and other debit balances

Due from related parties

Inventories

6,498,096

13,748,985

8,873

16,205,480

36,461,434

6,489,606

42,951,040

13,586,937

11,391,544

3

4

15,673,176

40,651,657

6,489,606

47,141,263

Assets relating to discontinued operations

Total current assets

Non-current assets:

5,248,218

93,478,264

10,193,272

114,675,559

34,813,797

1,980,901

1,053,626

261,443,637

308,584,900

5,319,632

100,951,257

17,539,395

116,446,434

7

Financial assets at fair value through other comprehensive income

Investment in associates

Investment properties

Property, plant and equipment

Right of use assets

Goodwill

Intangible assets

Total non-current assets

Total assets

9

10

15

1,980,901

1,513,524

243,751,143

286,702,183

11

LIABILITIES AND EQUITY

Current liabilities:

Bank borrowings

Accounts payable and other credit balances

Due to related parties

Murabaha payable

Lease liabilities

38,237,214

85,225,504

207,450

7,792,000

5,120,293

136,582,461

6,788,174

143,370,635

56,623,027

90,723,574

207,450

11,129,500

12

13

4

14

15

Liabilities relating to discontinued operations

Total current liabilities

158,683,551

6,788,174

165,471,725

Non-current liabilities:

Bank borrowings

Other long term liabilities

Lease liabilities

Murabaha payable

Provision for end of service indemnity

Total non-current liabilities

Total liabilities

66,869,400

673,479

30,691,644

16,779,500

4,825,363

119,839,386

263,210,021

56,932,480

1,307,333

12

15

13,863,682

5,877,098

77,980,593

243,452,318

14

16

Equity:

Share capital

Treasury shares

Revaluation surplus

Effect of changes in other comprehensive loss of associates

Cumulative changes in fair value

Foreign currency translation adjustments

Accumulated losses

57,882,878

(2,593,571)

52,816,752

(20,650,913)

(28,982)

(2,051,818)

(42,155,767)

43,218,579

31,286

43,249,865

286,702,183

17

18

57,882,878

(2,593,571)

51,732,871

(20,484,600)

(32,953)

(2,191,244)

(38,895,848)

45,417,533

(42,654)

45,374,879

308,584,900

Equity attributable to Parent Company's shareholders

Non-controlling interests

Total equity

Total liabilities and equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning