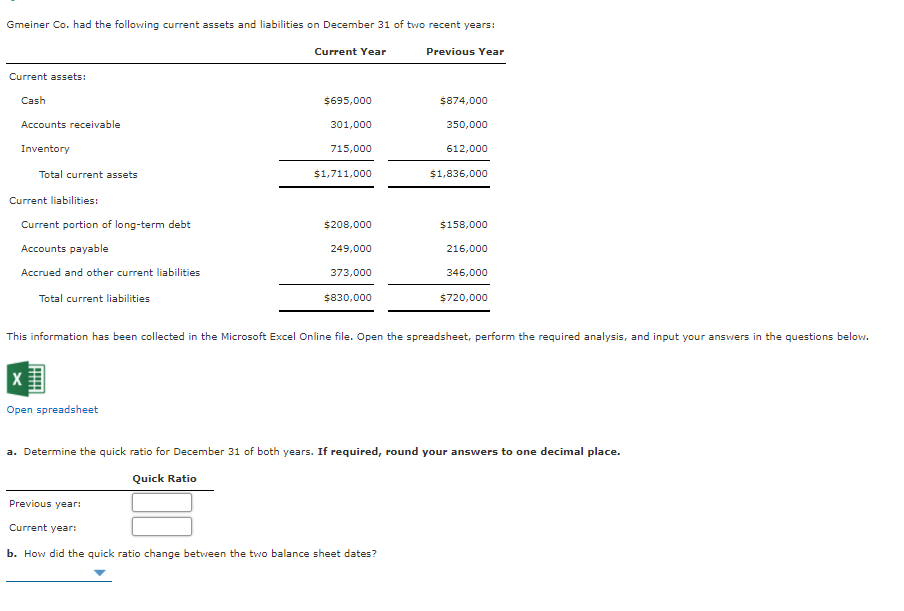

Gmeiner Co. had the following current assets and liabilities on December 31 of two recent years: Current Year Previous Year Current assets: Cash $695,000 $874,000 Accounts receivable 301,000 350,000 Inventory 715,000 612,000 Total current assets $1,711,000 $1,836,000 Current liabilities: Current portion of long-term debt $208,000 $158,000 Accounts payable 249,000 216,000 Accrued and other current liabilities 373,000 346,000 Total current liabilities $830,000 $720,000 This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet a. Determine the quick ratio for December 31 of both years. If required, round your answers to one decimal place. Quick Ratio Previous year: Current year: b. How did the quick ratio change between the two balance sheet dates?

Gmeiner Co. had the following current assets and liabilities on December 31 of two recent years: Current Year Previous Year Current assets: Cash $695,000 $874,000 Accounts receivable 301,000 350,000 Inventory 715,000 612,000 Total current assets $1,711,000 $1,836,000 Current liabilities: Current portion of long-term debt $208,000 $158,000 Accounts payable 249,000 216,000 Accrued and other current liabilities 373,000 346,000 Total current liabilities $830,000 $720,000 This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet a. Determine the quick ratio for December 31 of both years. If required, round your answers to one decimal place. Quick Ratio Previous year: Current year: b. How did the quick ratio change between the two balance sheet dates?

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter2: Financial Statements And The Annual Report

Section: Chapter Questions

Problem 2.5E: Classification of Assets and Liabilities Indicate the appropriate classification of each of the...

Related questions

Question

Practice Pack

.

Transcribed Image Text:Gmeiner Co. had the following current assets and liabilities on December 31 of two recent years:

Current Year

Previous Year

Current assets:

Cash

$695,000

$874,000

Accounts receivable

301,000

350,000

Inventory

715,000

612,000

Total current assets

$1,711,000

$1,836,000

Current liabilities:

Current portion of long-term debt

$208,000

$158,000

Accounts payable

249,000

216,000

Accrued and other current liabilities

373,000

346,000

Total current liabilities

$830,000

$720,000

This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below.

Open spreadsheet

a. Determine the quick ratio for December 31 of both years. If required, round your answers to one decimal place.

Quick Ratio

Previous year:

Current year:

b. How did the quick ratio change between the two balance sheet dates?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT