he inventories of SS Corp. and PP Corp. has a fair value of P400,000 and P550,000 , respectively. The Equipment SS Corp. Is understated by P100,000. Compute the Consolidated Equity.

he inventories of SS Corp. and PP Corp. has a fair value of P400,000 and P550,000 , respectively. The Equipment SS Corp. Is understated by P100,000. Compute the Consolidated Equity.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 19E

Related questions

Question

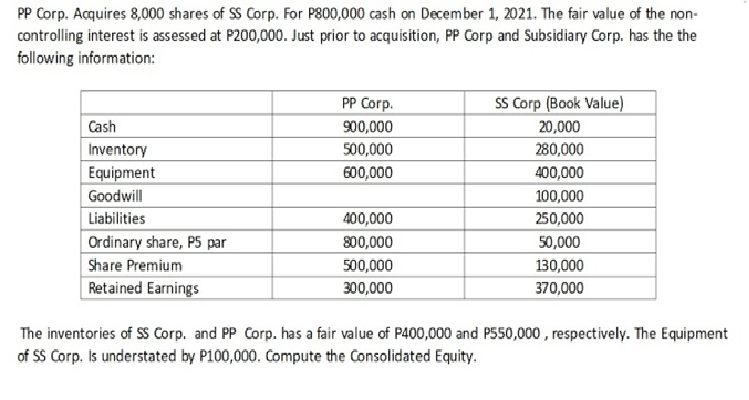

Transcribed Image Text:PP Corp. Acquires 8,000 shares of SS Corp. For P800,000 cash on December 1, 2021. The fair value of the non-

controlling interest is assessed at P200,000. Just prior to acquisition, PP Corp and Subsidiary Corp. has the the

following information:

PP Corp.

SS Corp (Book Value)

Cash

900,000

20,000

500,000

280,000

Inventory

Equipment

600,000

400,000

Goodwill

100,000

Liabilities

400,000

250,000

Ordinary share, P5 par

Share Premium

Retained Earnings

800,000

50,000

500,000

130,000

300,000

370,000

The inventories of SS Corp. and PP Corp. has a fair value of P400,000 and P550,000 , respectively. The Equipment

of SS Corp. Is understated by P100,000. Compute the Consolidated Equity.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning