Concept explainers

T accounts,

The unadjusted

| Epicenter Laundry Unadjusted Trial Balance June 30, 2016 |

||

| Debit Balances | Credit Balances | |

| Cash............................................................. | 11,000 | |

| Laundry Supplies................................................. | 21,500 | |

| Prepaid Insurance................................................. | 9,600 | |

| Laundry Equipment............................................... | 232,600 | |

| 125,400 | ||

| Accounts Payable................................................. | 11,800 | |

| Common Stock................................................... | 40,000 | |

| 65,600 | ||

| Dividends....................................................... | 10,000 | |

| Laundry Revenue................................................. | 232,200 | |

| Wages Expense................................................... | 125,200 | |

| Rent Expense..................................................... | 40,000 | |

| Utilities Expense.................................................. | 19,700 | |

| Miscellaneous Expense............................................ | 5,400 | |

| 475,000 | 475,000 | |

The data needed to determine year-end adjustments are as follows:

- a. Laundry supplies on hand at June 30 are $3,600.

- b. Insurance premiums expired during the year are $5,700.

- c. Depreciation of laundry equipment during the year is $6,500.

- d. Wages accrued but not paid at June 30 are $1,100.

Instructions

- 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as “June 30 Bal." In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, Insurance Expense, and Income Summary.

- 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed.

- 3. Journalize and post the adjusting entries. Identify the adjustments by "Adj." and the new balances as “Adj. BAL.”

- 4. Prepare an adjusted trial balance.

- 5. Prepare an income statement, a retained earnings statement, and a balance sheet.

- 6. Journalize and

post the closing entries. Identify the closing entries by “Clos." - 7. Prepare a post-closing trial balance.

1, 3, and 6:

Journal:

Journal is the book of original entry. Journal consists of the day-to-day financial transactions in a chronological order. The journal has two aspects; they are debit aspect and the credit aspect.

T-Accounts:

T-accounts are referred as T-account because its format represents the letter “T”. The T-accounts consists of the following:

- The title of accounts.

- The debit side (Dr) and,

- The credit side (Cr).

Adjusted trial balance:

The unadjusted trial balance is the summary of all the ledger accounts that appears on the ledger accounts before making adjusting journal entries.

Adjusting entries:

An adjusting entry is prepared when the trial balance is not up-to-date, and complete, and they are usually prepared at the end of the accounting period. This adjusting entry is essential for preparing the financial statements of the business.

Spreadsheet:

A spreadsheet is a worksheet. It is used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Retained Earnings Statement:

It is one of the financial statements, which shows the amount of the net income retained by a company at a particular point of time for reinvestment and pay its debts and obligations. It shows the amount of retained earnings that is not paid as dividends to the shareholders.

Income statement:

An income statement is one of the financial statements which shows the revenues, and expenses of the company. The income statement is prepared to ascertain the net income/loss of the company, by deducting the expenses from the revenues.

Balance sheet:

A balance sheet is a financial statement consists of the assets, liabilities, and the stockholder’s equity of the company. The balance of the assets account must be equal to that of the liabilities and the stockholder’s equity account.

Closing entries:

Closing entries are recorded in order to close the temporary accounts such as incomes and expenses by transferring them to the permanent accounts. It is passed at the end of the accounting period, to transfer the final balance.

Post-Closing Trial Balance:

After passing all the journal entries and the closing entries of the permanent accounts and then further posting them to each of the respective accounts, a post-closing trial balance is prepared which consists of a list of all the permanent accounts. A post-closing trial balance serves as an evidence to prove that the balance of the permanent accounts is equal.

To prepare: The T-accounts.

Explanation of Solution

Record the transactions directly in their respective T-accounts, and determine their balances.

| Cash | |||||||||||

| June 30 | Balance | 11,000 | |||||||||

| Laundry Supplies | |||||||||||

| June 30 | Balance | 21,500 | June 30 | Adjusted | 17,900 | ||||||

| June 30 | Adjusted balance | 3,600 | |||||||||

| Prepaid Insurance | |||||||||||

| June 30 | Balance | 9,600 | June 30 | Adjusted | 5,700 | ||||||

| Adjusted balance | 3,900 | ||||||||||

| Laundry Equipment | |||||||||||

| June 30 | Balance | 232,600 | |||||||||

| Accumulated Depreciation | |||||||||||

| June 30 | Balance | 125,400 | |||||||||

| June 30 | Adjusted | 6,500 | |||||||||

| June 30 | Adjusted balance | 131,900 | |||||||||

| Accounts Payable | |||||||||||

| June 30 | Balance | 11,800 | |||||||||

| Wages Payable | |||||||||||

| June 30 | Adjusted | 1,100 | |||||||||

| Retained Earnings | |||||||||||

| June 30 | Closing | 10,000 | June 30 | Balance | 65,600 | ||||||

| June 30 | Closing | 10,700 | |||||||||

| June 30 | Balance | 66,300 | |||||||||

| Dividends | |||||||||||

| June 30 | Balance | 10,000 | June 30 | Closing | 10,000 | ||||||

| Laundry Revenue | |||||||||||

| June 30 | Closing | 232,200 | June 30 | Balance | 232,200 | ||||||

| Wages Expense | |||||||||||

| June 30 | Balance | 125,200 | June 30 | Closing | 126,300 | ||||||

| June 30 | Adjusted | 1,100 | |||||||||

| June 30 | Adjusted balance | 126,300 | |||||||||

| Rent Expense | |||||||||||

| June 30 | Balance | 40,000 | June 30 | Closing | 40,000 | ||||||

| Utilities Expense | |||||||||||

| June 30 | Balance | 19,700 | June 30 | Closing | 19,700 | ||||||

| Depreciation Expense | |||||||||||

| June 30 | Adjusted | 6,500 | June 30 | Closing | 6,500 | ||||||

| Laundry Supplies Expense | |||||||||||

| June 30 | Adjusted | 17,900 | June 30 | Closing | 17,900 | ||||||

| Insurance Expense | |||||||||||

| June 30 | Adjusted | 5,700 | June 30 | Closing | 5,700 | ||||||

| Miscellaneous Expense | |||||||||||

| June 30 | Balance | 5,400 | June 30 | Closing | 5,400 | ||||||

| Common Stock | |||||

| June 30 | Closing | 40,000 | |||

| Income Summary | |||||

| June 30 | Closing | 221,500 | June 30 | Closing | 232,200 |

| Closing | 10,700 | ||||

Table (1)

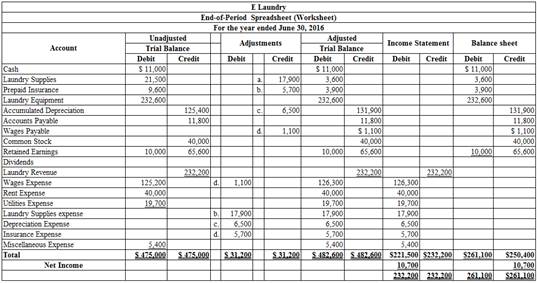

2.

To enter: The unadjusted trial balances on an end-of-period spreadsheet, and complete the spreadsheet.

Explanation of Solution

The unadjusted trial balance on an end-of-period spreadsheet is prepared as follows:

Table (2)

Hence, the unadjusted trial balance on an end-of-period spreadsheet is prepared and completed.

3.

To Journalize and post: The adjusting entries.

Explanation of Solution

The adjusting entries are journalized as follows:

| Date | Description | Debit ($) | Credit ($) | |

| 2016 | Wages expense | 1,100 | ||

| June | 30 | Wages payable | 1,100 | |

| (To record the wages accrued) | ||||

Table (3)

- Wages expense is an expense account, and it is increased. Hence, debit the wages expense account by $1,100.

- Wages payable is a liability account, and it is increased. Hence, credit the wages payable account by $1,100.

| Date | Description | Debit ($) | Credit ($) | |

| 2016 | Depreciation expense | 6,500 | ||

| June | 30 | Accumulated depreciation | 6,500 | |

| (To record the equipment depreciation) | ||||

Table (4)

- Depreciation expense is an expense account, and it is increased. Hence, debit the wages expense account by $6,500.

- Accumulated depreciation is a contra asset account, and it is increased. Hence, credit the accumulated depreciation account by $6,500.

| Date | Description | Debit ($) | Credit ($) | |

| 2016 | Laundry supplies expense | 17,900 | ||

| June | 30 | Laundry supplies

|

17,900 | |

| (To record the supplies expense) | ||||

Table (5)

- Laundry supplies expense is an expense account, and it is increased. Hence, debit the laundry supplies expense account by $17,900.

- Laundry supplies are the asset account, and it is increased. Hence, credit the laundry supplies account by $17,900.

| Date | Description | Debit ($) | Credit ($) | |

| 2016 | Insurance expense | 5,700 | ||

| August | 31 | Prepaid insurance | 5,700 | |

| (To record the insurance expense) | ||||

Table (6)

- Insurance expense is an expense account, and it is increased. Hence, debit the insurance expense account by $5,700.

- Prepaid insurance is an asset account, and it is decreased. Hence, credit the prepaid insurance account by $5,700.

4.

To prepare: An adjusted trial balance for Laundry E, as of June 30, 2016.

Explanation of Solution

Prepare an adjusted trial balance for Laundry E, as of June 30, 2016.

| Laundry E | ||

| Adjusted Trial Balance | ||

| June 30, 2016 | ||

| Accounts | Debit Balances | Credit Balances |

| Cash | 11,000 | |

| Laundry Supplies | 3,600 | |

| Prepaid Insurance | 3,900 | |

| Laundry Equipment | 232,600 | |

| Accumulated depreciation | 131,900 | |

| Accounts payable | 11,800 | |

| Wages Payable | 1,100 | |

| Common Stock | 40,000 | |

| Retained earnings | 65,600 | |

| Dividends | 10,000 | |

| Laundry revenue | 232,200 | |

| Wages expense | 126,300 | |

| Rent expense | 40,000 | |

| Utilities Expense | 19,700 | |

| Depreciation Expense | 17,900 | |

| Laundry supplies expense | 6,500 | |

| Insurance Expense | 5,700 | |

| Miscellaneous Expense | 5,400 | |

| 482,600 | 482,600 | |

Table (7)

The debit column and credit column of the unadjusted trial balance are agreed, both having balance of $482,600.

5.

Explanation of Solution

The net income of Laundry E for the month of June is $10,700.

| E Laundry | ||

| Income Statement | ||

| For the year ended June 30, 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenue: | ||

| Laundry revenue | $248,000 | |

| Expenses: | ||

| Wages Expense | $126,300 | |

| Rent Expense | 40,000 | |

| Utilities Expense | 19,700 | |

| Depreciation Expense | 17,900 | |

| Laundry supplies Expense | 6,500 | |

| Insurance Expense | 5,700 | |

| Miscellaneous Expense | 5,400 | |

| Total Expenses | 221,500 | |

| Net Income | $10,700 | |

Table (8)

Hence, the net income of Laundry E for the year ended June 30, 2016 is $10,700.

6.

To Journalize: The closing entries for E Laundry.

Explanation of Solution

Closing entry for revenue and expense accounts:

| Date | Accounts title and Explanation | Post Ref. | Debit ($) |

Credit ($) |

| June 30, 2016 | Laundry Revenue | 232,200 | ||

| Income Summary | 232,200 | |||

| (To record the closure of revenues account ) | ||||

| June 30 | Income Summary | 221,500 | ||

| Wages Expense | 126,300 | |||

| Rent Expense | 40,000 | |||

| Utilities Expense | 19,700 | |||

| Depreciation Expense | 6,500 | |||

| Laundry supplies Expense | 17,900 | |||

| Insurance Expense | 5,700 | |||

| Miscellaneous Expense | 5,400 | |||

| (To close the revenues and expenses account. Then the balance amount are transferred to income summary account) | ||||

| June 30 | Income Summary | 10,700 | ||

| Retained earnings | 10,700 | |||

| (To record the closure of net income from income summary to retained earnings) | ||||

| Retained earnings | 10,000 | |||

| Dividends | 10,000 | |||

| (To record the closure of dividend to retained earnings) | ||||

Table (11)

Laundry revenue account has a normal credit balance of $232,200 in total, now to close this account, the laundry revenue account must be debited with $232,200 and, income summary account must be credited with $232,200.

- In this closing entry, the laundry revenue account balance is being transferred to the income summary account, to bring the revenues account balance to zero.

- Thereby, the income summary account balance gets increased by $232,200 and, the revenue account balance gets decreased by $232,200.

All expenses accounts have a normal debit balance, the total of expenses are $221,500 have to be closed by transferring these account balances to the income summary account. All expenses account must be credited, and the income summary account must be debited with $ 221,500.

- In this closing entry, all the expenses account balances are transferred to the income summary account, to bring the expenses account balances to zero.

- Thereby, both the income summary account, and the expenses account balances get decreased by $221,500.

Determined amount balance of income summary is $10,700, which has to be closed by debiting the income summary account with $10,700, and crediting the retained earnings account with $10,700.

- In this closing entry, the income summary account balance is being transferred to the retained earnings account, to bring the income summary account balance to zero.

- Thereby, the income summary account gets decreased, and the retained earnings account balance gets increased by $10,700.

Dividends account has a normal debit balance of $10,000, now to close this account, retained earnings account must be debited with $10,000 and, dividend account must be credited with $10,000.

- In this closing entry, the dividend account balance is being transferred to the retained earnings account, to bring the dividend account balance to zero.

- Thereby, the retained earnings account balance gets increased by $10,000 and, the dividend account balance gets decreased by $10,000.

7.

To prepare: The post–closing trial balance of E Laundry for the month ended June 30, 2016.

Explanation of Solution

Prepare a post–closing trial balance of E Laundry for the month ended June 30, 2016 as follows:

Laundry E Post-closing Trial Balance June 30, 2016 |

||

| Particulars | Debit $ | Credit $ |

| Cash | 11,000 | |

| Laundry Supplies | 3,600 | |

| Prepaid insurance | 3,900 | |

| Laundry Equipment | 232,600 | |

| Accumulated depreciation | 131,900 | |

| Accounts payable | 11,800 | |

| Wages payable | 1,100 | |

| Common stock | 40,000 | |

| Retained earnings | 66,300 | |

| Total | $251,100 | $251,100 |

Table (12)

The debit column and credit column of the post–closing trial balance are agreed, both having balance of $251,100.

Want to see more full solutions like this?

Chapter 4 Solutions

Financial & Managerial Accounting

- The unadjusted trial balance of PS Music as of July 31, 2018, along with the adjustment data for the two months ended July 31, 2018, are shown in Chapter 3. Based upon the adjustment data, the following adjusted trial balance was prepared: PS Music Adjusted Trial Balance July 31, 2018 Account No. Debit Balances Credit Balances Cash................................................. 11 9,945 Accounts Receivable................................... 12 4,150 Supplies.............................................. 14 275 Prepaid Insurance..................................... 15 2,475 Office Equipment..................................... 17 7,500 Accumulated DepreciationOffice Equipment.......... 18 50 Accounts Payable..................................... 21 8,350 Wages Payable........................................ 22 140 Unearned Revenue.................................... 23 3,600 Common Stock....................................... 31 9,000 Dividends............................................ 33 1,750 Fees Earned........................................... 41 21,200 Music Expense........................................ 54 3,610 Wages Expense....................................... 50 2,940 Office Rent Expense................................... 51 2,550 Advertising Expense................................... 55 1,500 Equipment Rent Expense.............................. 52 1,375 Utilities Expense...................................... 53 1,215 Supplies Expense...................................... 56 925 Insurance Expense.................................... 57 225 Depreciation Expense................................. 58 50 Miscellaneous Expense................................ 59 1,855 42,340 42,340 Instructions 1. (Optional) Using the data from Chapter 3, prepare an end-of-period spreadsheet. 2. Prepare an income statement, a retained earnings statement, and a balance sheet. 3. Journalize and post the closing entries. The retained earnings account is #33 and the income summary account is #34 in the ledger of PS Music. Indicate closed accounts by inserting a line in both Balance columns opposite the closing entry. 4. Prepare a post-dosing trial balance.arrow_forwardPrepare journal entries to record the following transactions. Create a T-account for Unearned Revenue, post any entries that affect the account, tally ending balance for the account (assume Unearned Revenue beginning balance of $12,500). A. May 1, collected an advance payment from client, $15,000 B. December 31, remaining unearned advances, $7,500arrow_forwardPrepare journal entries to record the following transactions. Create a T-account for Accounts Payable, post any entries that affect the account, and tally ending balance for the account. Assume an Accounts Payable beginning balance of $5,000. A. February 2, purchased an asset, merchandise inventory, on account, $30,000 B. March 10, paid creditor for part of February purchase, $12,000arrow_forward

- The unadjusted trial balance that you prepared for PS Music at the end of Chapter 2 should appear as follows: Unadjusted Trial Balance July 31. 2016 Debit Balances Credit Balances Cash 9,945 Accounts Receivable 2,750 Supplies 1,020 Prepaid Insurance 2,700 Office Equipment 7,500 Accounts Payable 8,350 Unearned Revenue 7,200 Common Stock 9,000 Dividends 1,750 Fees Earned 16,200 Music Expense 3,610 Wages Expense 2.800 Office Rent Expense 2.SS0 Advertising Expense 1,500 Equipment Rent Expense 1,375 Utilities Expense 1,215 Supplies Expense 180 Miscellaneous Expense 1,855 40,750 40,750 The data needed to determine adjustments are as follows: a. During July. PS Music provided guest disc jockeys for KXMD for a total of 115 hours, for information on the amount of the accrued revenue to be billed to KXMD, see the contract described in the July 3, 2016, transaction at the end of Chapter 2. b. Supplies on hand at July 31, 275. c. The balance of the prepaid insurance account relates to the July 1. 2016, transaction at the end of Chapter 2. d. Depreciation of the office equipment is 50. e. The balance of the unearned revenue account relates to the contract between PS Music and KXMD, described in the July 3, 2016, transaction at the end of Chapter 2. f. Accrued wages as of July 31, 2016, were 140. Instructions 1. Prepare adjusting journal entries. You will need the following additional accounts: 18 Accumulated DepreciationOffice Equipment 22. Wages Payable 57. Insurance Expense 58. Depreciation Expense 2. Post the adjusting entries, inserting balances in the accounts affected. 3. Prepare an adjusted trial balance.arrow_forwardT accounts, adjusting entries, financial statements, and closing entries; optional end-of-period spreadsheet The unadjusted trial balance of Epicenter Laundry at June 30, 20Y6, the end of the fiscal year, follows: The data needed to determine year-end adjustments are as follows: (a) Laundry supplies on hand at June 30 are 8,600. (b) Insurance premiums expired during the year are 5,700. (c) Depreciation of laundry equipment during the year is 6,500. (d) Wages accrued but not paid at June 30 are 1,100. Instructions 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as June 30 Bal. In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, and Insurance Expense. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed. 3. Journalize and post the adjusting entries. Identify the adjustments by Adj. and the new balances as Adj. Bal. 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of stockholders equity, and a balance sheet. During the year ended June 30, 20Y6, additional common stock of 7,500 was issued. 6. Journalize and post the closing entries. Identify the closing entries by Clos. 7. Prepare a post-closing trial balance.arrow_forwardExercise 2-53 Preparing a Trial Balance Preparation The fo1lowing accounts and account balances are available for Badger Auto Parts at December 31, 2019: Required: Prepare a trial balance. Assume that all accounts have normal balances.arrow_forward

- Elite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on March 31, 2016, follows: The following business transactions were completed by Elite Realty during April 2016: Instructions 1. Record the April 1, 2016, balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for April in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of April 30, 2016. 5. Assume that the April 30 transaction for salaries and commissions should have been 19,100. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?arrow_forwardExercise 3-54 Recreating Adjusting Entries Selected balance sheet accounts for Gardner Company are presented below. Required: Analyze each account and recreate the journal entries that are made. For deferrals, be sure to include the original journal entry as well as the adjusting journal entry. Month end is May 31, 2019.arrow_forwardCornerstone Exercise 3-17 Accrued Revenue Adjusting Entries Powers Rental Service had the following items that require adjustment at year end. Earned $9,880 of revenue from the rental of equipment for which the customer had not yet paid. Interest of S650 on a note receivable has been earned but not yet received. Required: Prepare the adjusting entries needed at December 31. What is the effect on the financial statements if these adjusting entries are not made?arrow_forward

- T accounts, adjusting entries, financial statements, and closing entries; optional end-of-period spreadsheet The unadjusted trial balance of La Mesa Laundry at August 31, 20Y5, the end of the fiscal year, follows: The data needed to determine year-end adjustments are as follows: (a) Wages accrued but not paid at August 31 are 2,200. (b) Depreciation of equipment during the year is 8,150. (c) Laundry supplies on hand at August 31 are 2,000. (d) Insurance premiums expired during the year are 5,300. Instructions 1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as Aug. 31 Bal. In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, and Insurance Expense. 2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. Add the accounts listed in part (1) as needed. 3. Journalize and post the adjusting entries. Identify the adjustments by Adj. and the new balances as Adj. Bal. 4. Prepare an adjusted trial balance. 5. Prepare an income statement, a statement of stockholders equity, and a balance sheet. During the year ended August 31, 20Y5, common stock of 3,000 was issued. 6. Journalize and post the closing entries. Identify the closing entries by Clos. 7. Prepare a post-closing trial balance.arrow_forwardPOSTING ADJUSTING ENTRIES Two adjusting entries are in the following general journal. Post these adjusting entries to the four general ledger accounts. The following account numbers were taken from the chart of accounts: 141, Supplies; 219, Wages Payable; 511, Wages Expense; and 523, Supplies Expense. If you are not using the working papers that accompany this text, enter the following balances before posting the entries: Supplies, 200 Debit; and Wages Expense, 1,200 Debit.arrow_forwardFor each of the following accounts, identify whether it would be closed at year-end (yes or no) and on which financial statement the account would be reported (Balance Sheet, Income Statement, or Retained Earnings Statement). A. Accounts Payable B. Accounts Receivable C. Cash D. Dividends E. Fees Earned Revenue F. Insurance Expense G. Prepaid Insurance H. Suppliesarrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,