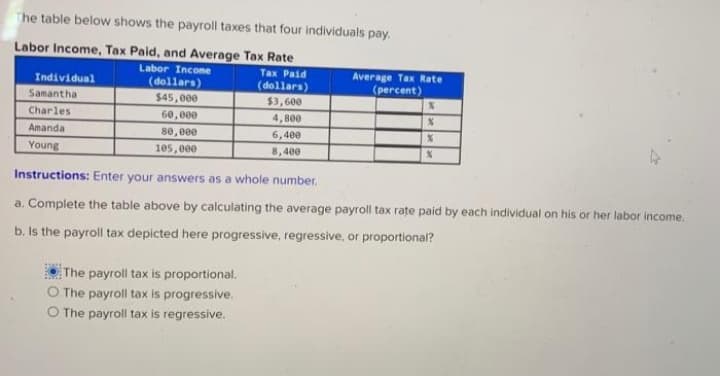

he table below shows the payroll taxes that four individuals pay. Labor Income, Tax Paid, and Average Tax Rate Labor Income Tax Paid Average Tax Rate (percent) Individual (dellars) (dollars) Samantha $45,000 $3,600 Charles 60,000 4,800 Amanda 80,000 6,400 Young 105,000 8,400 Instructions: Enter your answers as a whole number. a. Complete the table above by calculating the average payroll tax rate paid by each individual on his or her labor income. b. Is the payroll tax depicted here progressive, regressive, or proportional?

he table below shows the payroll taxes that four individuals pay. Labor Income, Tax Paid, and Average Tax Rate Labor Income Tax Paid Average Tax Rate (percent) Individual (dellars) (dollars) Samantha $45,000 $3,600 Charles 60,000 4,800 Amanda 80,000 6,400 Young 105,000 8,400 Instructions: Enter your answers as a whole number. a. Complete the table above by calculating the average payroll tax rate paid by each individual on his or her labor income. b. Is the payroll tax depicted here progressive, regressive, or proportional?

Economics Today and Tomorrow, Student Edition

1st Edition

ISBN:9780078747663

Author:McGraw-Hill

Publisher:McGraw-Hill

Chapter16: Government Spends, Collects, And Owes

Section: Chapter Questions

Problem 20AA

Related questions

Question

E2

Transcribed Image Text:The table below shows the payroll taxes that four individuals pay.

Labor Income, Tax Paid, and Average Tax Rate

Labor Income

Tax Paid

Average Tax Rate

(percent)

Individual

(dollars)

(dollars)

Samantha

$45,000

$3,600

Charles

60, e00

4,800

Amanda

80, eee

6,400

Young

105,000

8,400

Instructions: Enter your answers as a whole number,

a. Complete the table above by calculating the average payroll tax rate paid by each individual on his or her labor income.

b. Is the payroll tax depicted here progressive, regressive, or proportional?

The payroll tax is proportional.

O The payroll tax is progressive.

O The payroll tax is regressive.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics Today and Tomorrow, Student Edition

Economics

ISBN:

9780078747663

Author:

McGraw-Hill

Publisher:

Glencoe/McGraw-Hill School Pub Co

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Economics Today and Tomorrow, Student Edition

Economics

ISBN:

9780078747663

Author:

McGraw-Hill

Publisher:

Glencoe/McGraw-Hill School Pub Co

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning