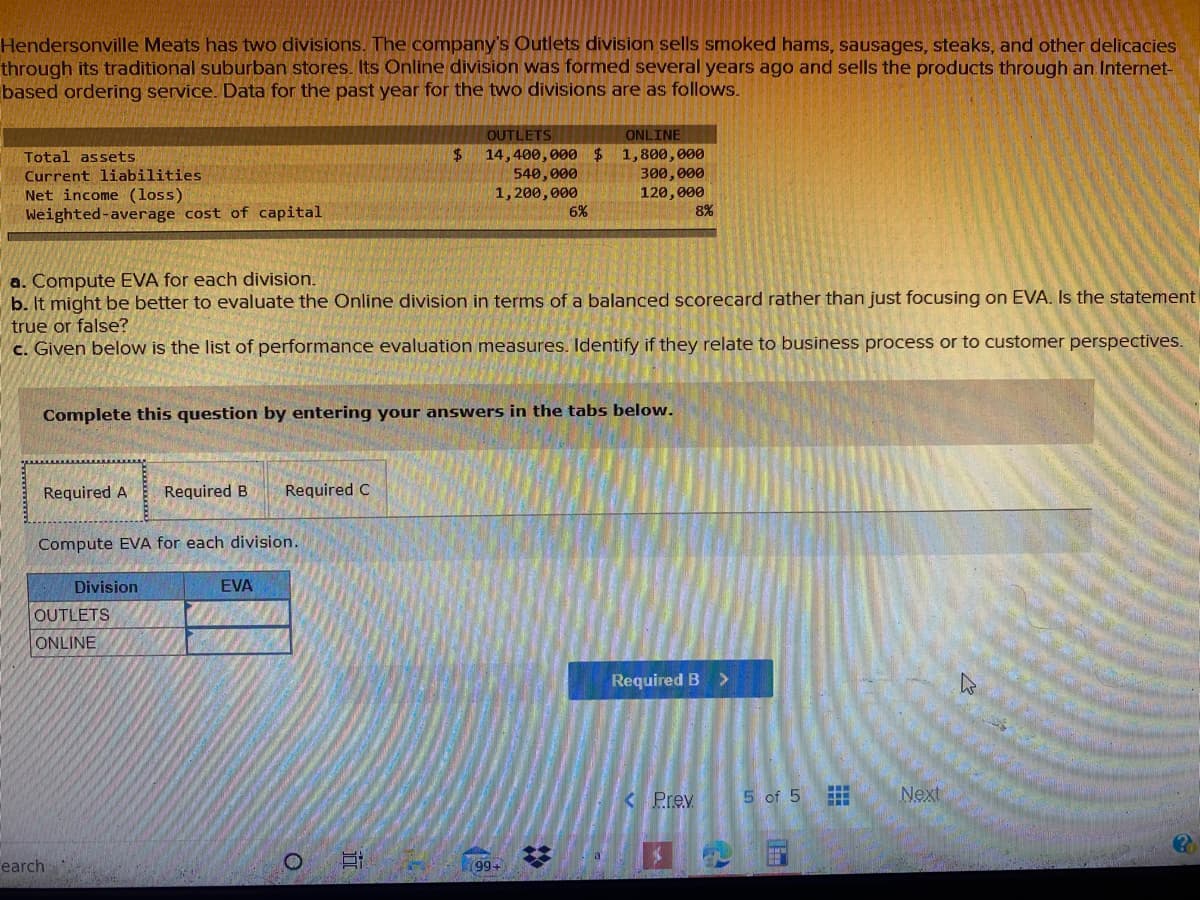

Hendersonville Meats has two divisions. The company's Outlets division sells smoked hams, sausages, steaks, and other delicacies through its traditional suburban stores. Its Online division was formed several years ago and sells the products through an Internet- based ordering service. Data for the past year for the two divisions are as follows. OUTLETS ONLINE 14,400,000 $ 1,800,000 300,000 120,000 8% Total assets 24 Current liabilities Net income (loss) Weighted-average cost of capital 540,000 1,200,000 6% a. Compute EVA for each division. b. It might be better to evaluate the Online division in terms of a balanced scorecard rather than just focusing on EVA. Is the statement true or false? c. Given below is the list of performance evaluation measures. Identify if they relate to business process or to customer perspectives. Complete this question by entering your answers in the tabs below.

Hendersonville Meats has two divisions. The company's Outlets division sells smoked hams, sausages, steaks, and other delicacies through its traditional suburban stores. Its Online division was formed several years ago and sells the products through an Internet- based ordering service. Data for the past year for the two divisions are as follows. OUTLETS ONLINE 14,400,000 $ 1,800,000 300,000 120,000 8% Total assets 24 Current liabilities Net income (loss) Weighted-average cost of capital 540,000 1,200,000 6% a. Compute EVA for each division. b. It might be better to evaluate the Online division in terms of a balanced scorecard rather than just focusing on EVA. Is the statement true or false? c. Given below is the list of performance evaluation measures. Identify if they relate to business process or to customer perspectives. Complete this question by entering your answers in the tabs below.

College Accounting (Book Only): A Career Approach

12th Edition

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cathy J. Scott

Chapter12: Financial Statements, Closing Entries, And Reversing Entries

Section: Chapter Questions

Problem 1A: Costco is the largest chain of membership warehouse clubs in the world based on sales volume, and it...

Related questions

Question

100%

Comparing

Transcribed Image Text:Hendersonville Meats has two divisions. The company's Outlets division sells smoked hams, sausages, steaks, and other delicacies

through its traditional suburban stores. Its Online division was formed several years ago and sells the products through an Internet-

based ordering service. Data for the past year for the two divisions are as follows.

OUTLETS

ONLINE

Total assets.

2$

Current liabilities

Net income (loss)

Weighted-average cost of capital

14,400,000

540,000

1, 200,000

6%

1,800,000

300,000

120,000

8%

a. Compute EVA for each division.

b. It might be better to evaluate the Online division in terms of a balanced scorecard rather than just focusing on EVA. Is the statement

true or false?

c. Given below is the list of performance evaluation measures. Identify if they relate to business process or to customer perspectives.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Required C

Compute EVA for each division.

Division

EVA

OUTLETS

ONLINE

Required B >

< Prev

5 of 5

Next

earch

994

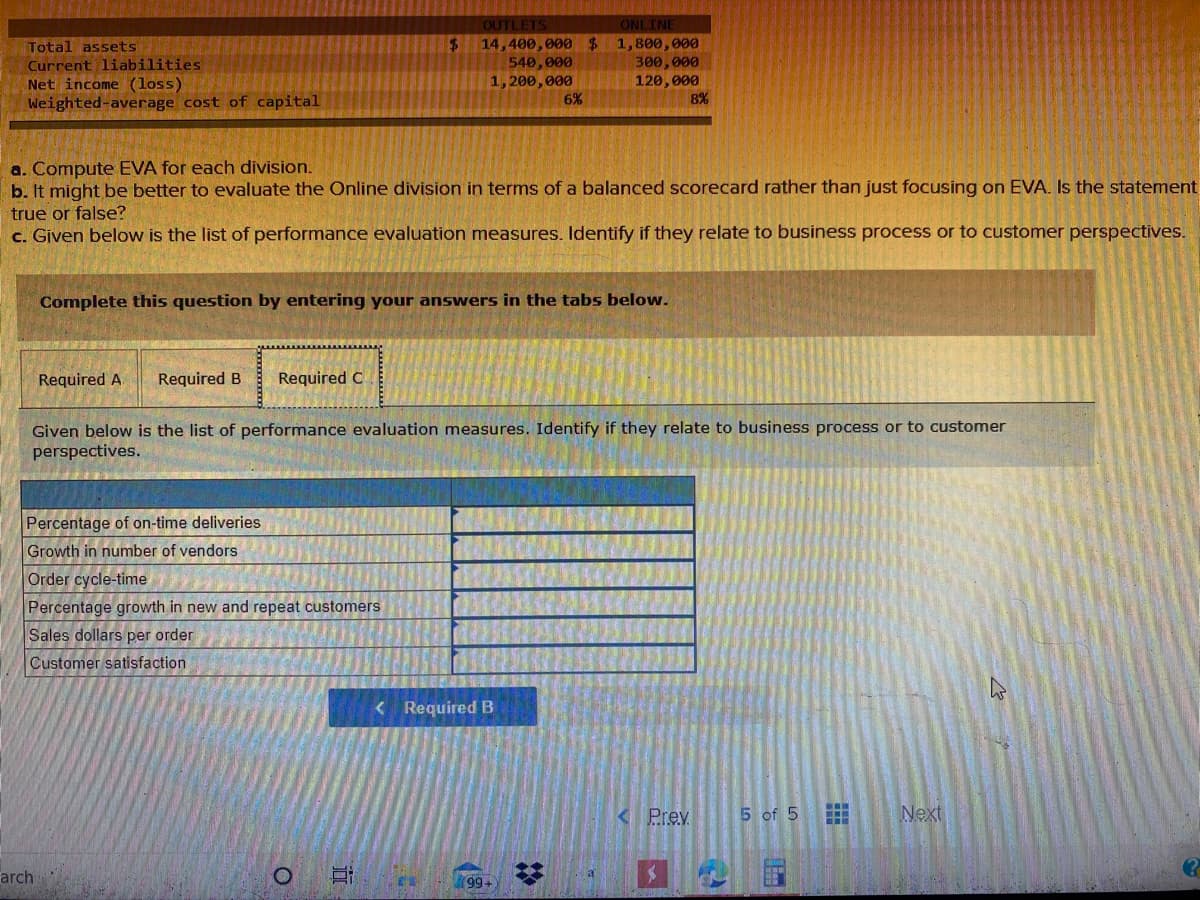

Transcribed Image Text:OUTLETS

ONLINE

14,400,000

540,000

1, 200,000

6%

$.

Total assets

Current liabilities

Net income (loss)

Weighted-average cost of capital

1,800,000

300,000

120,000

8%

a. Compute EVA for each division.

b. It might be better to evaluate the Online division in terms of a balanced scorecard rather than just focusing on EVA. Is the statement

true or false?

c. Given below is the list of performance evaluation measures. Identify if they relate to business process or to customer perspectives.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Required C

Given below is the list of performance evaluation measures. Identify if they relate to business process or to customer

perspectives.

Percentage of on-time deliveries

Growth in number of vendors

Order cycle-time

Percentage growth in new and repeat customers

Sales dollars per order

Customer satisfaction

< Required B

< Prev

5 of 5

Next

arch

99+

%2:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning