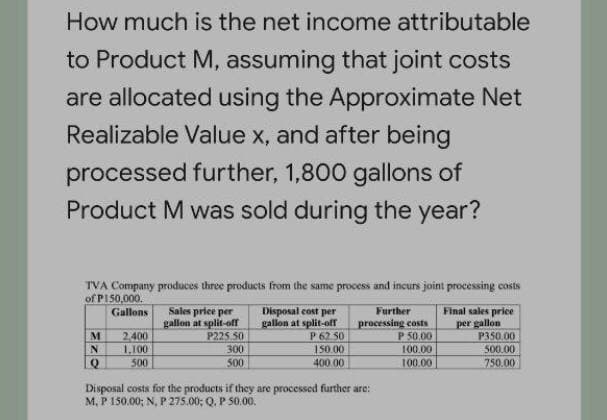

How much is the net income attributable to Product M, assuming that joint costs are allocated using the Approximate Net Realizable Value x, and after being processed further, 1,800 gallons of Product M was sold during the year? TVA Company produces three products from the same process and incurs joint processing costs of PI50,000. Gallons Sales price per gallon at split-off P225 50 300 Disposal cost per gallon at split-off P 62 50 150.00 400 00 Further processing costs P 50.00 Final sales price per gallon P350.00 2,400 1,100 M 100.00 500.00 500 500 100.00 750.00 Disposal costs for the products if they are processed further are: M, P 150.00; N, P 275.00; Q. P 50.00.

How much is the net income attributable to Product M, assuming that joint costs are allocated using the Approximate Net Realizable Value x, and after being processed further, 1,800 gallons of Product M was sold during the year? TVA Company produces three products from the same process and incurs joint processing costs of PI50,000. Gallons Sales price per gallon at split-off P225 50 300 Disposal cost per gallon at split-off P 62 50 150.00 400 00 Further processing costs P 50.00 Final sales price per gallon P350.00 2,400 1,100 M 100.00 500.00 500 500 100.00 750.00 Disposal costs for the products if they are processed further are: M, P 150.00; N, P 275.00; Q. P 50.00.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter25: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 4CMA: Oakes Inc. manufactured 40,000 gallons of Mononate and 60,000 gallons of Beracyl in a joint...

Related questions

Question

Please answer in good accounting form. Thank you! <3

Transcribed Image Text:How much is the net income attributable

to Product M, assuming that joint costs

are allocated using the Approximate Net

Realizable Value x, and after being

processed further, 1,800 gallons of

Product M was sold during the year?

TVA Company produces three products from the same process and incurs joint processing costs

of PI50,000.

Sales price per

gallon at split-off

P225.50

300

Disposal cost per

gallon at split-off

P 62 50

150.00

Final sales price

per gallon

P350.00

500.00

Gallons

Further

2.400

1,100

processing costs

P 50.00

100.00

500

500

400 00

100.00

750.00

Disposal costs for the products if they are processed further are:

M, P 150.00; N, P 275.00; Q. P S0.00.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning