I am trying to calculate NNEP based on this - not sure how to calculate NNE Dec. 31, 2018 Dec. 31, 2017 Operating Assets 31,922 32,463 Operating liabilities 7,244 7,687 Net operating assets (NOA) 24,678 24,776 NNO $ 14,830.00 $ 13,154.00 Equity $ 9,848 $ 11,622 NOA= NNO + Equity $ 24,678 $ 24,776

I am trying to calculate NNEP based on this - not sure how to calculate NNE Dec. 31, 2018 Dec. 31, 2017 Operating Assets 31,922 32,463 Operating liabilities 7,244 7,687 Net operating assets (NOA) 24,678 24,776 NNO $ 14,830.00 $ 13,154.00 Equity $ 9,848 $ 11,622 NOA= NNO + Equity $ 24,678 $ 24,776

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter2: Financial Statements And The Annual Report

Section: Chapter Questions

Problem 2.13MCE

Related questions

Question

Hello,

I am trying to calculate NNEP based on this - not sure how to calculate NNE

| Dec. 31, 2018 | Dec. 31, 2017 | |

| Operating Assets | 31,922 | 32,463 |

| Operating liabilities | 7,244 | 7,687 |

| Net operating assets (NOA) | 24,678 | 24,776 |

| NNO | $ 14,830.00 | $ 13,154.00 |

| Equity | $ 9,848 | $ 11,622 |

| NOA= NNO + Equity | $ 24,678 | $ 24,776 |

Transcribed Image Text:Compte NOPAT using the formuls NOPAT Net inco NNE

A Compute NOPAT wsing the formmula NOPAT NOPRT

OPAT sing the formuta NPAT Net in

NNE

NOPRT

Tax on operating profit

Problems

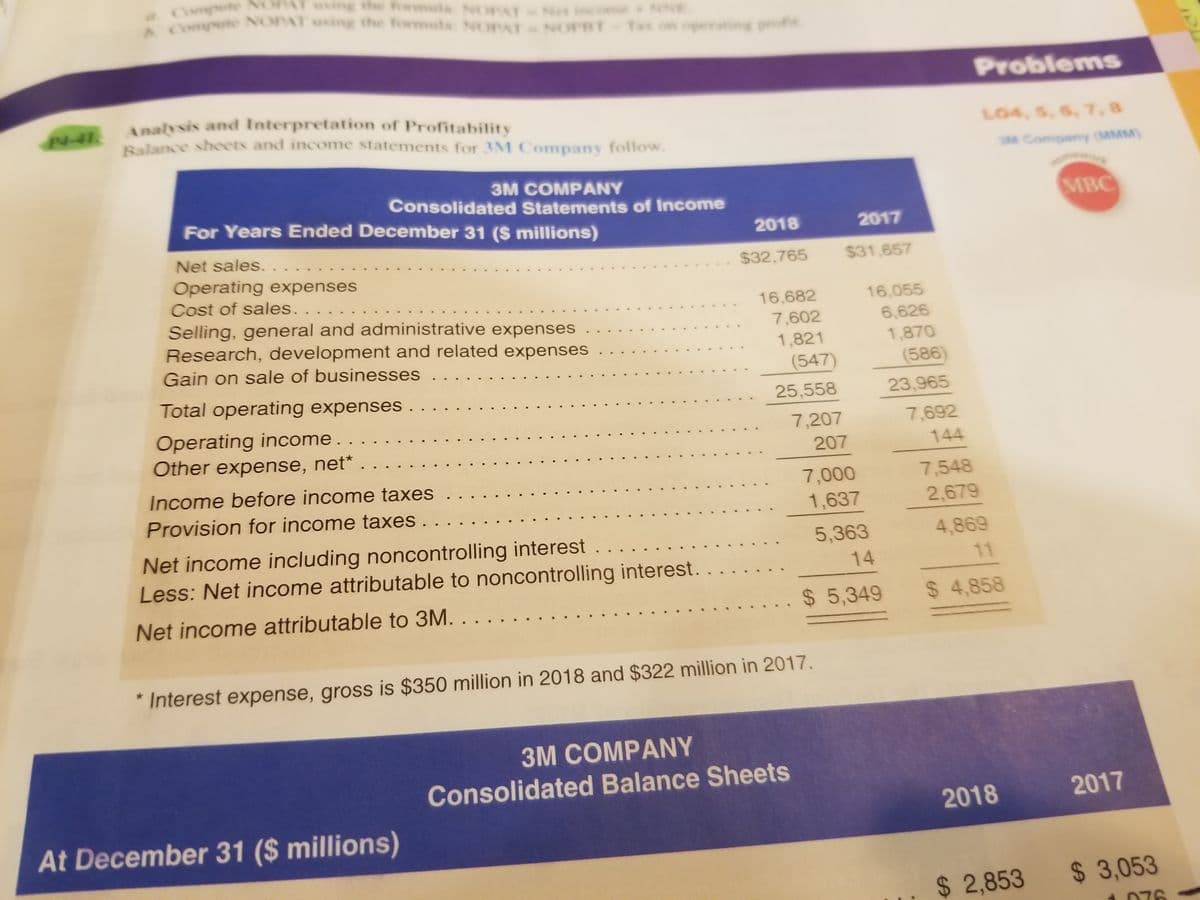

Analysis and Interpretation of Profitability

Balance sheets and income statements for 3M Company follow.

P4-412

LO4, 5, 6, 7, 8

3M Company (MMM)

3M COMPANY

Consolidated Statements of Income

MBC

For Years Ended December 31 ($ millions)

2018

2017

Net sales. . . . ..

$32,765

$31,657

Operating expenses

Cost of sales..

Selling, general and administrative expenses

Research, development and related expenses

16,682

16,055

7,602

6,626

1,821

1,870

Gain on sale of businesses

(547)

(586)

Total operating expenses .

25,558

23,965

Operating income.

Other expense, net*

7,207

7,692

207

144

Income before income taxes

7,000

7,548

Provision for income taxes.

1,637

2,679

4,869

Net income including noncontrolling interest

Less: Net income attributable to noncontrolling interest.

5,363

14

11

Net income attributable to 3M. .

$ 5,349

$ 4,858

Interest expense, gross is $350 million in 2018 and $322 million in 2017.

3M COMPANY

Consolidated Balance Sheets

2018

2017

At December 31 ($ millions)

$ 2,853

$ 3,053

076

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning