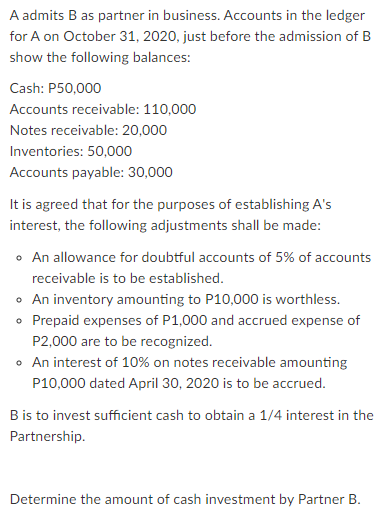

A admits B as partner in business. Accounts in the ledger for A on October 31, 2020, just before the admission of B show the following balances: Cash: P50,000 Accounts receivable: 110,000 Notes receivable: 20,000 Inventories: 50,000 Accounts payable: 30,000 It is agreed that for the purposes of establishing A's interest, the following adjustments shall be made: • An allowance for doubtful accounts of 5% of accounts receivable is to be established. • An inventory amounting to P10,000 is worthless. • Prepaid expenses of P1,000 and accrued expense of P2,000 are to be recognized. • An interest of 10% on notes receivable amounting P10,000 dated April 30, 2020 is to be accrued. Bis to invest sufficient cash to obtain a 1/4 interest in the Partnership. Determine the amount of cash investment by Partner B.

A admits B as partner in business. Accounts in the ledger for A on October 31, 2020, just before the admission of B show the following balances: Cash: P50,000 Accounts receivable: 110,000 Notes receivable: 20,000 Inventories: 50,000 Accounts payable: 30,000 It is agreed that for the purposes of establishing A's interest, the following adjustments shall be made: • An allowance for doubtful accounts of 5% of accounts receivable is to be established. • An inventory amounting to P10,000 is worthless. • Prepaid expenses of P1,000 and accrued expense of P2,000 are to be recognized. • An interest of 10% on notes receivable amounting P10,000 dated April 30, 2020 is to be accrued. Bis to invest sufficient cash to obtain a 1/4 interest in the Partnership. Determine the amount of cash investment by Partner B.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 4PB

Related questions

Question

100%

Transcribed Image Text:A admits B as partner in business. Accounts in the ledger

for A on October 31, 2020, just before the admission of B

show the following balances:

Cash: P50,000

Accounts receivable: 110,000

Notes receivable: 20,000

Inventories: 50,000

Accounts payable: 30,000

It is agreed that for the purposes of establishing A's

interest, the following adjustments shall be made:

• An allowance for doubtful accounts of 5% of accounts

receivable is to be established.

o An inventory amounting to P10,000 is worthless.

• Prepaid expenses of P1,000 and accrued expense of

P2,000 are to be recognized.

• An interest of 10% on notes receivable amounting

P10,000 dated April 30, 2020 is to be accrued.

B is to invest sufficient cash to obtain a 1/4 interest in the

Partnership.

Determine the amount of cash investment by Partner B.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,