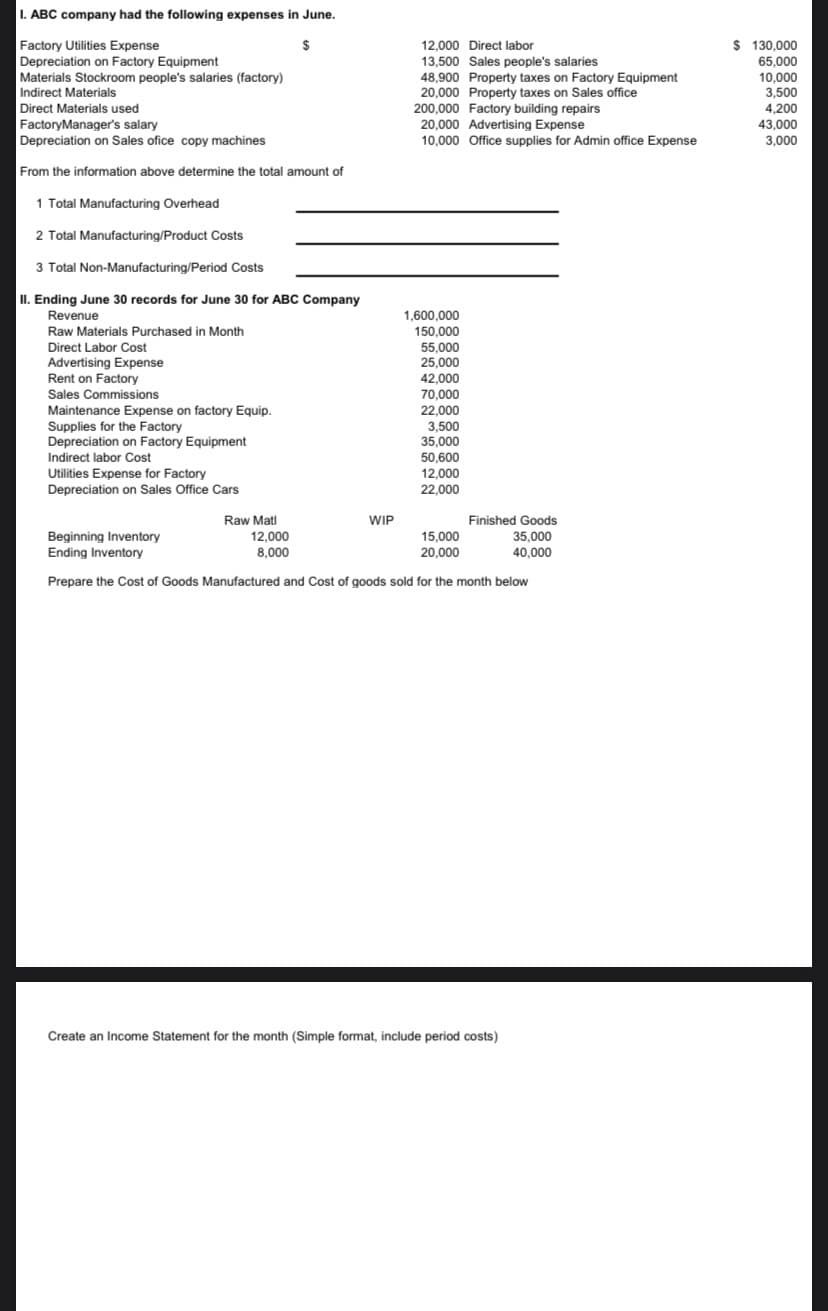

I. ABC company had the following expenses in June. $ 130,000 65,000 12,000 Direct labor Factory Utilities Expense Depreciation on Factory Equipment Materials Stockroom people's salaries (factory) Indirect Materials 13,500 Sales people's salaries 48,900 Property taxes on Factory Equipment 20,000 Property taxes on Sales office 200,000 Factory building repairs 20,000 Advertising Expense 10,000 Office supplies for Admin office Expense 10,000 3,500 4,200 43,000 3,000 Direct Materials used FactoryManager's salary Depreciation on Sales ofice copy machines From the information above determine the total amount of 1 Total Manufacturing Overhead 2 Total Manufacturing/Product Costs 3 Total Non-Manufacturing/Period Costs

I. ABC company had the following expenses in June. $ 130,000 65,000 12,000 Direct labor Factory Utilities Expense Depreciation on Factory Equipment Materials Stockroom people's salaries (factory) Indirect Materials 13,500 Sales people's salaries 48,900 Property taxes on Factory Equipment 20,000 Property taxes on Sales office 200,000 Factory building repairs 20,000 Advertising Expense 10,000 Office supplies for Admin office Expense 10,000 3,500 4,200 43,000 3,000 Direct Materials used FactoryManager's salary Depreciation on Sales ofice copy machines From the information above determine the total amount of 1 Total Manufacturing Overhead 2 Total Manufacturing/Product Costs 3 Total Non-Manufacturing/Period Costs

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 21E: Ellerson Company provided the following information for the last calendar year: During the year,...

Related questions

Question

Transcribed Image Text:L. ABC company had the following expenses in June.

$ 130.000

Factory Utilities Expense

Depreciation on Factory Equipment

Materials Stockroom people's salaries (factory)

Indirect Materials

$

12,000 Direct labor

13,500 Sales people's salaries

48,900 Property taxes on Factory Equipment

20,000 Property taxes on Sales office

200,000 Factory building repairs

65,000

10,000

3,500

Direct Materials used

4,200

FactoryManager's salary

Depreciation on Sales ofice copy machines

20,000 Advertising Expense

10,000 Office supplies for Admin office Expense

43,000

3,000

From the information above determine the total amount of

1 Total Manufacturing Overhead

2 Total Manufacturing/Product Costs

3 Total Non-Manufacturing/Period Costs

II. Ending June 30 records for June 30 for ABC Company

1,600,000

150.000

Revenue

Raw Materials Purchased in Month

Direct Labor Cost

Advertising Expense

Rent on Factory

Sales Commissions

Maintenance Expense on factory Equip.

55,000

25,000

42,000

70,000

22,000

3,500

35,000

Supplies for the Factory

Depreciation on Factory Equipment

Indirect labor Cost

50.600

Utilities Expense for Factory

Depreciation on Sales Office Cars

12,000

22,000

Raw Mati

12,000

8,000

Finished Goods

35,000

40,000

WIP

Beginning Inventory

Ending Inventory

15,000

20,000

Prepare the Cost of Goods Manufactured and Cost of goods sold for the month below

Create an Income Statement for the month (Simple format, include period costs)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning