ice and output (P and Q) as a function of exogenous variables in 3). Using comparative statics, find how the equilibrium price and outpu 0 agegb aPegb apeqb P) and income () change (i.e. find- emand and supply are affected?) Are goods x and y complements or sut Terior good? exogenous variables are given as follows: Income ()= 520, Price of the librium price and output values. Calculate the price elasticity of demar aximized at the equilibrium price? If not, what would you do to incre asticity of demand at the equilibrium price and output found in part c. I price elasticity of demand forx with respect to price of y? Are the you consistent with part a? come (I) = 520, Price of the related product (P,) = 40. Suppose r it tax on sellers. Find the new equilibrium price and quantity after the ta en on buyers? Show the original no tax equilibrium (in part a) and the equ ate the burden on buyers and sellers. Find the relationship between the lemand and supply. %3D

ice and output (P and Q) as a function of exogenous variables in 3). Using comparative statics, find how the equilibrium price and outpu 0 agegb aPegb apeqb P) and income () change (i.e. find- emand and supply are affected?) Are goods x and y complements or sut Terior good? exogenous variables are given as follows: Income ()= 520, Price of the librium price and output values. Calculate the price elasticity of demar aximized at the equilibrium price? If not, what would you do to incre asticity of demand at the equilibrium price and output found in part c. I price elasticity of demand forx with respect to price of y? Are the you consistent with part a? come (I) = 520, Price of the related product (P,) = 40. Suppose r it tax on sellers. Find the new equilibrium price and quantity after the ta en on buyers? Show the original no tax equilibrium (in part a) and the equ ate the burden on buyers and sellers. Find the relationship between the lemand and supply. %3D

Chapter12: The Partial Equilibrium Competitive Model

Section: Chapter Questions

Problem 12.3P

Related questions

Question

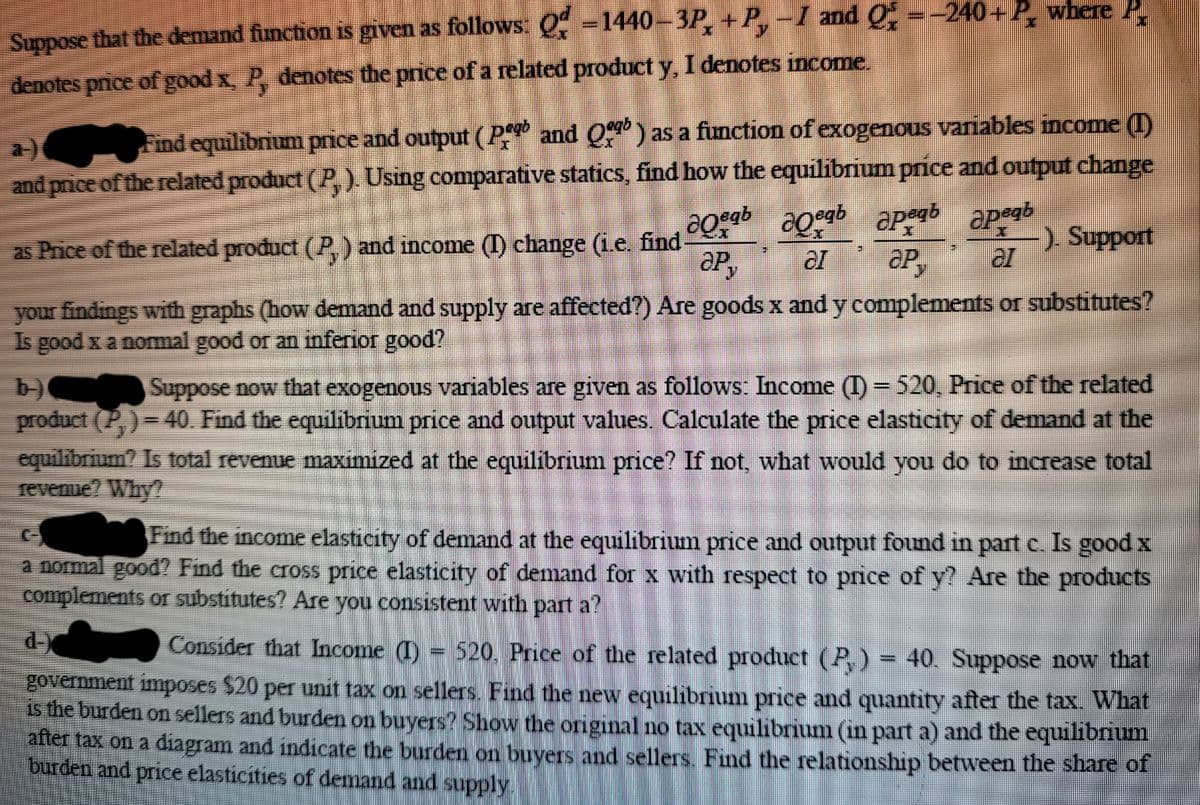

Transcribed Image Text:Suppose that the demand function is given as follows Q -1440-3P,+P,-I and Q =-240+ P, where P.

denotes pnice of good x, P, denotes the price of a related product y, I denotes income.

Find equilibrium price and output (P and O) as a function of exogenous variables income (I)

and price of the related product (P,). Using comparative statics, find how the equilibrium price and output change

a)

-) Support

as Price of the related product (P,) and income () change (i.e. find-

P,

your findings with graphs (how demand and supply are affected?) Are goods x and y complements or substitutes?

Is good x a nomal good or an inferior good?

b)

product (P,)= 40. Find the equilibrium price and output values. Calculate the price elasticity of demand at the

cquilibrium? Is total revenue maximized at the equilibrium price? If not, what would you do to increase total

revenue? Why?

Suppose now that exogenous variables are given as follows: Income (I) = 520, Price of the related

Find the income elasticity of demand at the equilibrium price and output found in part e. Is good x

a normal good? Find the cross price elasticity of demand for x with respect to price of y? Are the products

complements or substitutes? Are you consistent with part a?

d-

Consider that Income (I)

520. Price of the related product (P,) = 40. Suppose now that

government imposes $20 per unit tax on sellers. Find the new equilibrium price and quantity after the tax. What

is the burden on sellers and burden on buyers? Show the original no tax equilibrium (in part a) and the equilibrium

after tax on a diagram and indicate the burden on buyers and sellers. Find the relationship between the share of

burden and price elasticities of demand and supply

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you