In 2021, the company successfully defends the patent in extended litigation at a cost of $47,200, thereby extending the patent life to December 31, 2028. What is the proper way to account for this cost? Also, record patent amortization (full year) in 2021. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit (To record legal cost of successfully defending patent) (To record one year's amortization)

In 2021, the company successfully defends the patent in extended litigation at a cost of $47,200, thereby extending the patent life to December 31, 2028. What is the proper way to account for this cost? Also, record patent amortization (full year) in 2021. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit (To record legal cost of successfully defending patent) (To record one year's amortization)

Chapter7: Deductions And Losses: Certain Business Expenses And Losses

Section: Chapter Questions

Problem 40P

Related questions

Question

100%

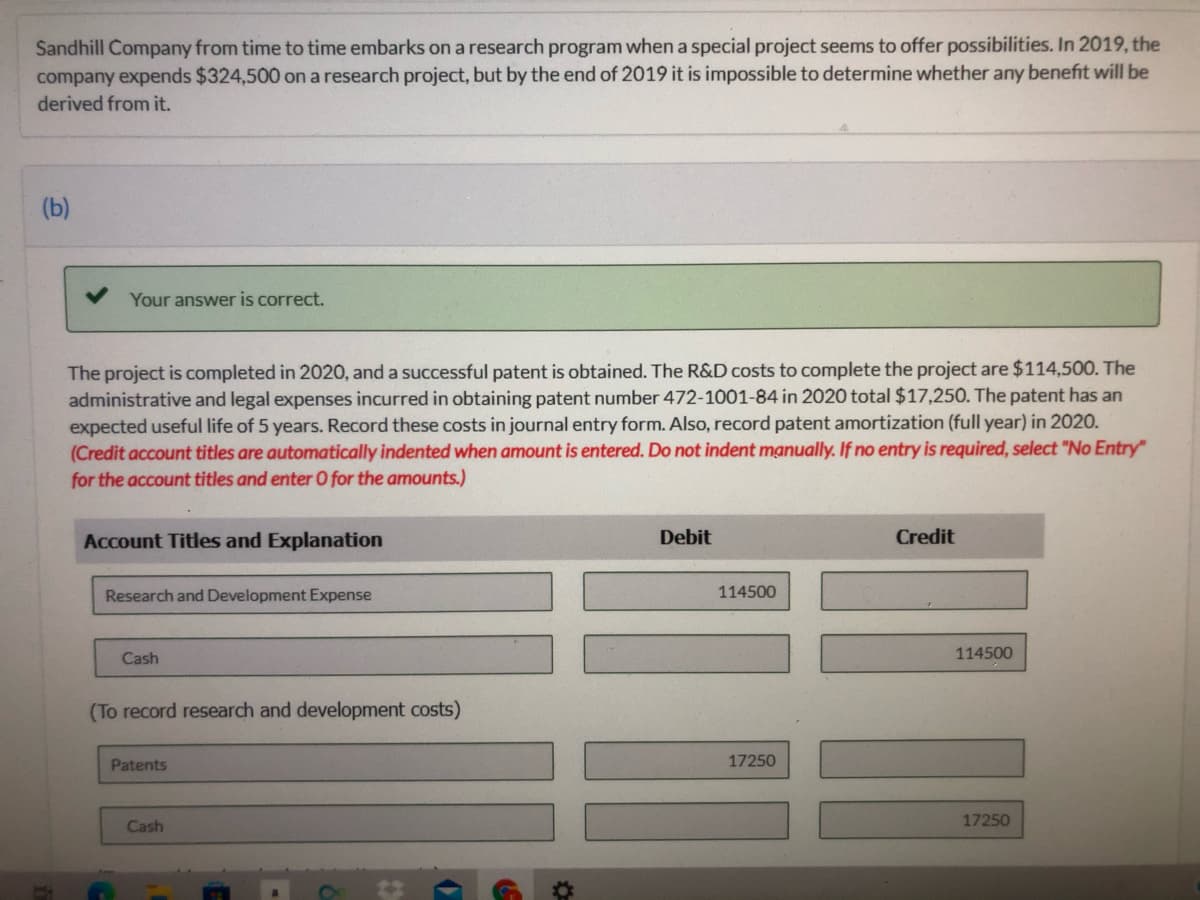

Transcribed Image Text:Sandhill Company from time to time embarks on a research program when a special project seems to offer possibilities. In 2019, the

company expends $324,500 on a research project, but by the end of 2019 it is impossible to determine whether any benefit will be

derived from it.

(b)

Your answer is correct.

The project is completed in 2020, and a successful patent is obtained. The R&D costs to complete the project are $114,500. The

administrative and legal expenses incurred in obtaining patent number 472-1001-84 in 2020 total $17,250. The patent has an

expected useful life of 5 years. Record these costs in journal entry form. Also, record patent amortization (full year) in 2020.

(Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry"

for the account titles and enter O for the amounts.)

Account Titles and Explanation

Debit

Credit

Research and Development Expense

114500

Cash

114500

(To record research and development costs)

Patents

17250

Cash

17250

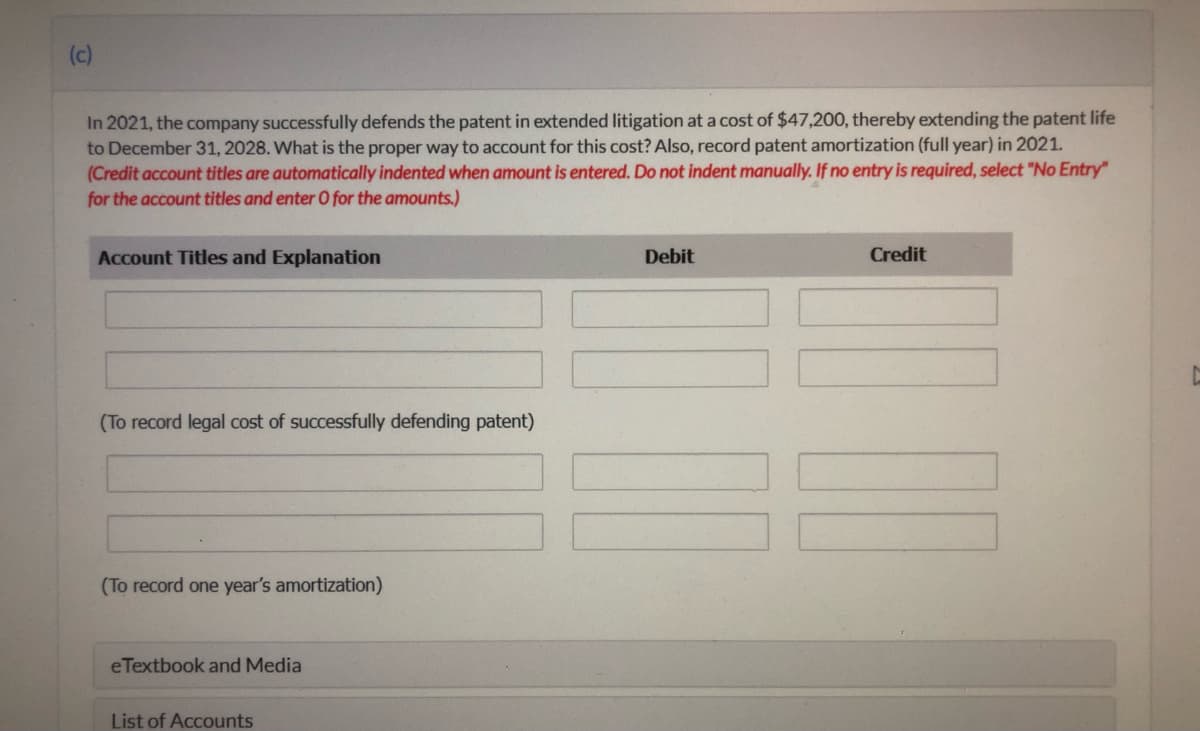

Transcribed Image Text:(c)

In 2021, the company successfully defends the patent in extended litigation at a cost of $47,200, thereby extending the patent life

to December 31, 2028. What is the proper way to account for this cost? Also, record patent amortization (full year) in 2021.

(Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry"

for the account titles and enter O for the amounts.)

Account Titles and Explanation

Debit

Credit

(To record legal cost of successfully defending patent)

(To record one year's amortization)

eTextbook and Media

List of Accounts

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College