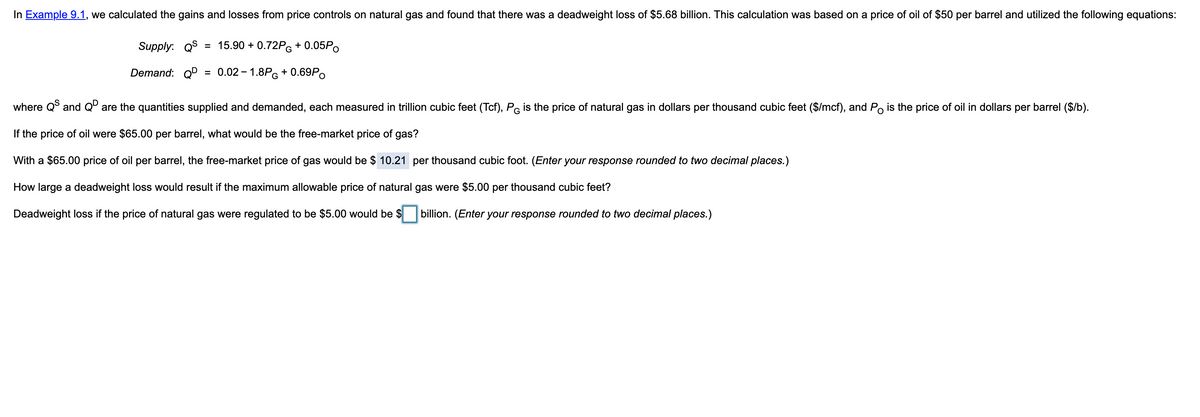

In Example 9.1. we calculated the gains and losses from price controls on natural gas and found that there was a deadweight loss of $5.68 billion. This calculation was based on a price of oil of $50 per barrel and utilized the following equations: Supply. Q$ = 15.90 + 0.72PG + 0.05P. Demand: OP = 0.02 - 1.8PG + 0.69P. where Q and Q are the quantities supplied and demanded, each measured in trillion cubic feet (Tcf), Pe is the price of natural gas in dollars per thousand cubic feet (S/mcf), and Po is the price of oil in dollars per barrel (S/b). If the price of oil were $65.00 per barrel, what would be the free-market price of gas? With a $65.00 price of oil per barrel, the free-market price of gas would be $ 10.21 per thousand cubic foot. (Enter your response rounded to two decimal places.) How large a deadweight loss would result if the maximum allowable price of natural gas were $5.00 per thousand cubic feet? Deadweight loss if the price of natural gas were regulated to be $5.00 would be $ billion. (Enter your response rounded to two decimal places.)

In Example 9.1. we calculated the gains and losses from price controls on natural gas and found that there was a deadweight loss of $5.68 billion. This calculation was based on a price of oil of $50 per barrel and utilized the following equations: Supply. Q$ = 15.90 + 0.72PG + 0.05P. Demand: OP = 0.02 - 1.8PG + 0.69P. where Q and Q are the quantities supplied and demanded, each measured in trillion cubic feet (Tcf), Pe is the price of natural gas in dollars per thousand cubic feet (S/mcf), and Po is the price of oil in dollars per barrel (S/b). If the price of oil were $65.00 per barrel, what would be the free-market price of gas? With a $65.00 price of oil per barrel, the free-market price of gas would be $ 10.21 per thousand cubic foot. (Enter your response rounded to two decimal places.) How large a deadweight loss would result if the maximum allowable price of natural gas were $5.00 per thousand cubic feet? Deadweight loss if the price of natural gas were regulated to be $5.00 would be $ billion. (Enter your response rounded to two decimal places.)

Chapter4: Markets In Action

Section: Chapter Questions

Problem 19SQ

Related questions

Question

N4

Transcribed Image Text:In Example 9.1, we calculated the gains and losses from price controls on natural gas and found that there was a deadweight loss of $5.68 billion. This calculation was based on a price of oil of $50 per barrel and utilized the following equations:

Supply: QS

= 15.90 + 0.72PG + 0.05P.

Demand: QD

0.02 – 1.8PG + 0.69P.

%3D

where Q and Qº are the quantities supplied and demanded, each measured in trillion cubic feet (Tcf), PG is the price of natural gas in dollars per thousand cubic feet ($/mcf), and Po is the price of oil in dollars per barrel ($/b).

If the price of oil were $65.00 per barrel, what would be the free-market price of gas?

With a $65.00 price of oil per barrel, the free-market price of gas would be $ 10.21 per thousand cubic foot. (Enter your response rounded to two decimal places.)

How large a deadweight loss would result if the maximum allowable price of natural gas were $5.00 per thousand cubic feet?

Deadweight loss if the price of natural gas were regulated to be $5.00 would be $

billion. (Enter your response rounded to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you