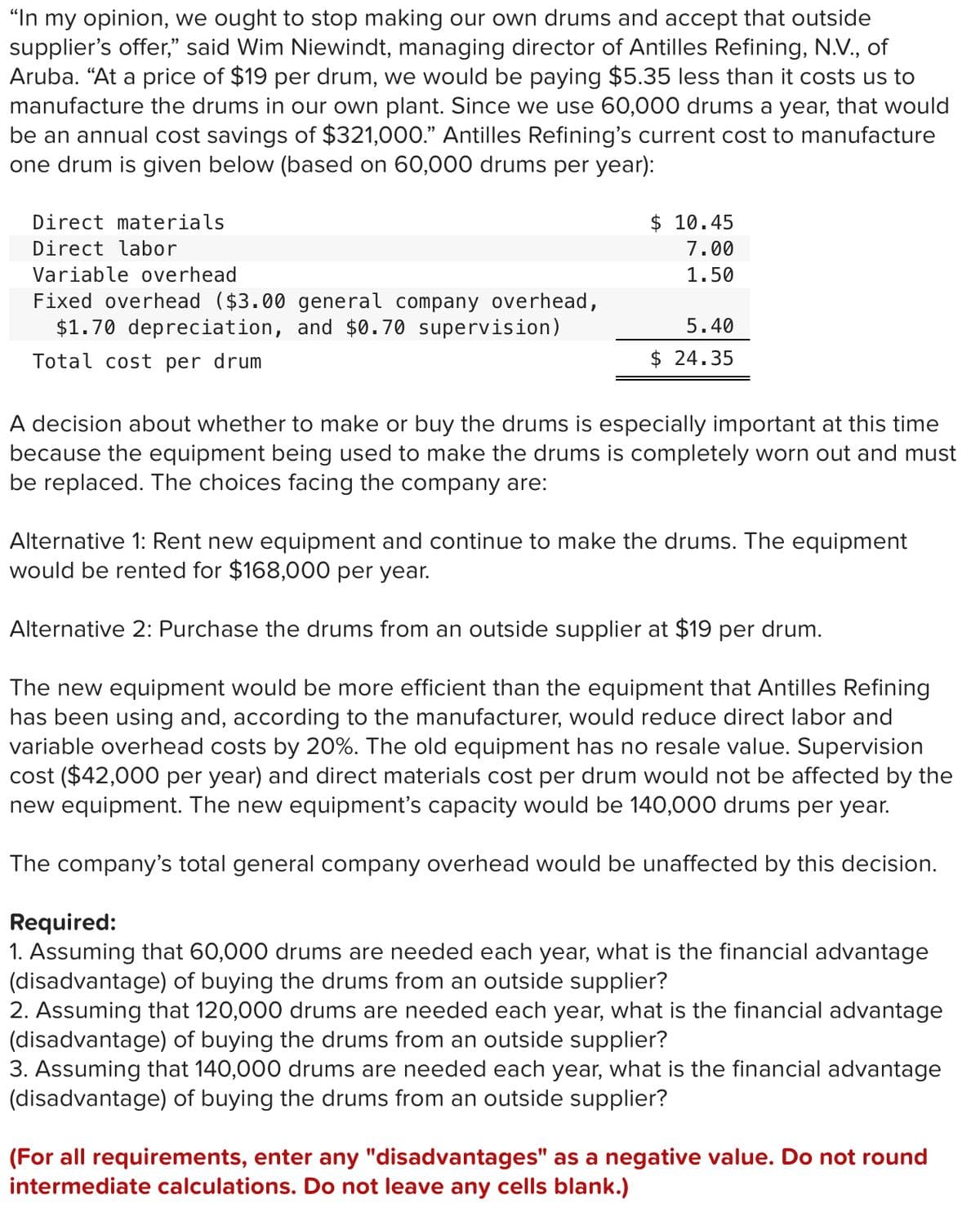

"In my opinion, we ought to stop making our own drums and accept that outside supplier's offer," said Wim Niewindt, managing director of Antilles Refining, N.V., of Aruba. “At a price of $19 per drum, we would be paying $5.35 less than it costs us to manufacture the drums in our own plant. Since we use 60,000 drums a year, that would be an annual cost savings of $321,000." Antilles Refining's current cost to manufacture one drum is given below (based on 60,000 drums per year): Direct materials $ 10.45 Direct labor 7.00 Variable overhead 1.50 Fixed overhead ($3.00 general company overhead, $1.70 depreciation, and $0.70 supervision) 5.40 Total cost per drum $ 24.35 A decision about whether to make or buy the drums is especially important at this time because the equipment being used to make the drums is completely worn out and must be replaced. The choices facing the company are: Alternative 1: Rent new equipment and continue to make the drums. The equipment would be rented for $168,000 per year. Alternative 2: Purchase the drums from an outside supplier at $19 per drum. The new equipment would be more efficient than the equipment that Antilles Refining has been using and, according to the manufacturer, would reduce direct labor and variable overhead costs by 20%. The old equipment has no resale value. Supervision cost ($42,000 per year) and direct materials cost per drum would not be affected by the new equipment. The new equipment's capacity would be 140,000 drums per year. The company's total general company overhead would be unaffected by this decision. Required: 1. Assuming that 60,000 drums are needed each year, what is the financial advantage (disadvantage) of buying the drums from an outside supplier? 2. Assuming that 120,000 drums are needed each year, what is the financial advantage (disadvantage) of buying the drums from an outside supplier? 3. Assuming that 140,000 drums are needed each year, what is the financial advantage (disadvantage) of buying the drums from an outside supplier?

"In my opinion, we ought to stop making our own drums and accept that outside supplier's offer," said Wim Niewindt, managing director of Antilles Refining, N.V., of Aruba. “At a price of $19 per drum, we would be paying $5.35 less than it costs us to manufacture the drums in our own plant. Since we use 60,000 drums a year, that would be an annual cost savings of $321,000." Antilles Refining's current cost to manufacture one drum is given below (based on 60,000 drums per year): Direct materials $ 10.45 Direct labor 7.00 Variable overhead 1.50 Fixed overhead ($3.00 general company overhead, $1.70 depreciation, and $0.70 supervision) 5.40 Total cost per drum $ 24.35 A decision about whether to make or buy the drums is especially important at this time because the equipment being used to make the drums is completely worn out and must be replaced. The choices facing the company are: Alternative 1: Rent new equipment and continue to make the drums. The equipment would be rented for $168,000 per year. Alternative 2: Purchase the drums from an outside supplier at $19 per drum. The new equipment would be more efficient than the equipment that Antilles Refining has been using and, according to the manufacturer, would reduce direct labor and variable overhead costs by 20%. The old equipment has no resale value. Supervision cost ($42,000 per year) and direct materials cost per drum would not be affected by the new equipment. The new equipment's capacity would be 140,000 drums per year. The company's total general company overhead would be unaffected by this decision. Required: 1. Assuming that 60,000 drums are needed each year, what is the financial advantage (disadvantage) of buying the drums from an outside supplier? 2. Assuming that 120,000 drums are needed each year, what is the financial advantage (disadvantage) of buying the drums from an outside supplier? 3. Assuming that 140,000 drums are needed each year, what is the financial advantage (disadvantage) of buying the drums from an outside supplier?

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter15: Decision Analysis

Section: Chapter Questions

Problem 5P: Hudson Corporation is considering three options for managing its data warehouse: continuing with its...

Related questions

Question

Transcribed Image Text:"In my opinion, we ought to stop making our own drums and accept that outside

supplier's offer," said Wim Niewindt, managing director of Antilles Refining, N.V., of

Aruba. “At a price of $19 per drum, we would be paying $5.35 less than it costs us to

manufacture the drums in our own plant. Since we use 60,000 drums a year, that would

be an annual cost savings of $321,000." Antilles Refining's current cost to manufacture

one drum is given below (based on 60,000 drums per year):

Direct materials

$ 10.45

Direct labor

7.00

Variable overhead

1.50

Fixed overhead ($3.00 general company overhead,

$1.70 depreciation, and $0.70 supervision)

5.40

Total cost per drum

$ 24.35

A decision about whether to make or buy the drums is especially important at this time

because the equipment being used to make the drums is completely worn out and must

be replaced. The choices facing the company are:

Alternative 1: Rent new equipment and continue to make the drums. The equipment

would be rented for $168,000 per year.

Alternative 2: Purchase the drums from an outside supplier at $19 per drum.

The new equipment would be more efficient than the equipment that Antilles Refining

has been using and, according to the manufacturer, would reduce direct labor and

variable overhead costs by 20%. The old equipment has no resale value. Supervision

cost ($42,000 per year) and direct materials cost per drum would not be affected by the

new equipment. The new equipment's capacity would be 140,000 drums per year.

The company's total general company overhead would be unaffected by this decision.

Required:

1. Assuming that 60,000 drums are needed each year, what is the financial advantage

(disadvantage) of buying the drums from an outside supplier?

2. Assuming that 120,000 drums are needed each year, what is the financial advantage

(disadvantage) of buying the drums from an outside supplier?

3. Assuming that 140,000 drums are needed each year, what is the financial advantage

(disadvantage) of buying the drums from an outside supplier?

(For all requirements, enter any "disadvantages" as a negative value. Do not round

intermediate calculations. Do not leave any cells blank.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT