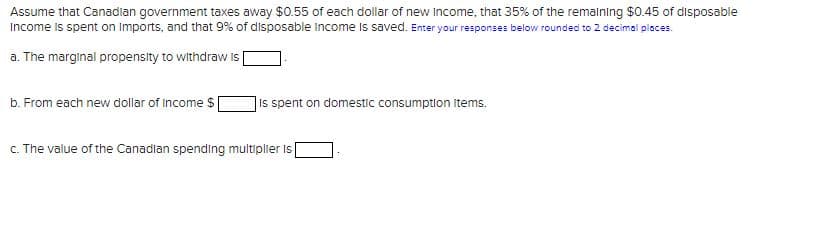

Income is spent on Imports, and that 9% of disposable income is saved. Enter your responses below rounded to 2 decimal places. a. The marginal propensity to withdraw is b. From each new dollar of income $ is spent on domestic consumption Items. c. The value of the Canadian spending multiplier is

Q: Who should pay the tax? The following graph gives the labor market for laboratory aides in the…

A: Demand-supply equilibrium in economics is the point at which the quantity of goods or services that…

Q: Which of the following is least like monopoly? Sony Corporation A natural gas utility company A…

A: Monopoly: Under a monopoly, a single seller faces the entire market demand on his own. Here, the…

Q: The range of probability is O any value between -1 to 1 O any value between minus infinity to plus…

A: Probability is the possibility of an event to occur or the event to not occur.

Q: Suppose that the current (first) generation consists of 1 million people, half of whom are women.…

A: Economics Economics provides solutions to problems of choice in the political, market, health,…

Q: In each of the following cases, calculate the values of MPC, MPW, and the spending multiplier. Enter…

A: MPC measures the change in consumption due to a change in income. MPC stands for marginal…

Q: Finally, type the following problem and then show all work in answering the problem's questions: 1.…

A: To determine the inflation rate, we have to find the consumer price index for each year and find the…

Q: Individual industries will use energy as efficiently as it is economical to do so, and there are…

A: IRR stands for Internal Rate of Return, which is a financial metric used to evaluate the potential…

Q: Consider a budget constraint model with two goods X and Y. Suppose X is an inferior good, and the…

A: The substitution effect is the change in quantity demanded of a product that results from a change…

Q: Implementation of a taxation is necessary in economy. Explain

A: Taxation is the term used to describe the imposition of obligatory taxes or fees by a government on…

Q: How do trade policies affect the global economy?

A: The global economy refers to the interconnected network of economic activity that takes place…

Q: The following graph shows the weekly market for craft beer in some hypothetical economy. Suppose the…

A: The government collects taxes from individuals and businesses, or it includes them in the price of a…

Q: Consider an economy with two goods, consumption c and leisure 1, and a representative consumer. The…

A: Considering an economy with two goods consumption and leisure A consumer's daily leisure hours l =…

Q: he inverse demand curve a monopoly faces is p=130-2Q. The firm's cost curve is C(Q)=10+6Q. What…

A: In monopoly market structure, There exists a single seller. The monopolist maximize uts profit by…

Q: Initial Construction Cost (P) 3" Asphalt overlay @ Yr 7 & Yr 22 New Asphalt Pavement @ Yr 15…

A: The present worth of a cashflow refers to its value at present in accordance with its value in the…

Q: Tapas are savory Spanish small meals or appetizers. If tapas are normal goods and consumers' incomes…

A: Demand curve is the downward sloping curve. Supply curve is the upward sloping curve. The price…

Q: Nominal GDP for this simple economy in year 1 equals

A: GDP is the value of all final goods and services produced in an economy in a given period of time.…

Q: Quantity What is the amount of producer surplus after the governa

A: Equilibrium in the market occurs at the intersection of market demand and market supply curve. The…

Q: If you are a marketing specialist working for the cell phone company, refer to your answers from…

A: Price elasticity of demand measures the responsiveness of change in quantity demand to change in…

Q: Q.1) State whether the following statements are true or false. Shortly explain your answer in 1-2…

A: In a perfectly competitive market, there are many buyers and sellers, and no single firm has enough…

Q: The variable that connect the market of money and the market of goods via investment spending is: a…

A: Aggregate demand is the sum of Consumption, Investment, government spending and net export. The MPC…

Q: The mixed strategy n.e. to the following game is Prove it mathematically:

A: Here the probability with which player 1 plays L is ‘p’ and the probability with which the player 1…

Q: 4.1) Using the substitution method, solve the following simultaneous equation:

A: The method of substitution involves finding the value of x in terms of y from the first equation…

Q: Assume that the following asset values (in millions of dollars) exist in Ironmania: Federal Reserve…

A: The money supply is the total amount of money in circulation within a particular economy. This is…

Q: Please no written by hand solution Important I want a good solution to this question with good…

A: The transfer of money and other financial assets between nations is referred to as a capital flow.…

Q: What are the characteristics that set a good manager apart from an incompetent one?

A: Managerial economics involves the use of quantitative and qualitative analysis to perform…

Q: the answer provided is in order, however due to its overly spread, i would want a different version…

A: Governments provide cash help known as unemployment benefits to people who have lost their jobs and…

Q: Calculate the equilibrium quantity and equillibrum price given:- Demand equation:- P = 100Q-30…

A: Market equillibrum is referred to be as the point where the supply and the demand curve intersect…

Q: A new restaurant – Uovo – has just opened in West L.A. It is serving the upscale market, with truly…

A: Given information; A restaurant faces the following demand function: Q = 600 - 4P Where Q is the…

Q: Suppose that a worker in Freedonia can produce either 6 units of corn or 4 units of wheat per year,…

A: The theory of comparative advantage explains why trade between nations is advantageous. It asserts…

Q: Find the present value of an annuity‐due of $200 per quarter for 2 years, if interest is compounded…

A: Given: Interest rate (i) = 8% compounded monthly PMT = $200 per quarter Year (n) = 2 years Payment…

Q: if the current unemployment rate exceeds the natural rate the fed should increase the federal fund…

A: Natural rate of unemployment is that rate of unemployment which occurs when economy is operating at…

Q: State of development in Kenya. Explain

A: Development is a process of good change wherein people, communities, and nations gradually better…

Q: The figure illustrates the market for apples in which the government has imposed a price floor of…

A: Since you have posted multiple questions, we will provide the solution only to the first question as…

Q: Additional units of a variable input are added to a fixed input. Total output rises from 0 units to…

A: Increasing marginal return is when the increase in input lead to an increase in the output which is…

Q: Question Completion Status QUESTION 5 Refer to information in table 1. A cell phone company wants to…

A: Pricing: The market situation where a single seller faces the entire market demand all by himself is…

Q: Explain using examples why firms might take actions leading to reductions in employment when the…

A: One of the most crucial instruments of monetary policy is the interest rate that the central bank…

Q: We'll give new tax credits to businesses that hire and invest." g) Discuss the effects of tax…

A: Tax credits can have several effects on businesses that hire, including their employment levels, the…

Q: 7. Short-run and long-run effects of a shift in demand Suppose that the jackfruit industry is…

A: Given information: Suppose that the jackfruit industry is initially operating in long-run…

Q: Which cost curve(s) will be impacted if a firm swtiches from plastic cups to more expensive…

A: We know that:- Total cost = Variable cost + Fixed cost Variable cost are those cost that can be…

Q: Give typing answer with explanation and conclusion Would the proposed amendments to the income…

A: Income taxes paid disclosure is a financial statement disclosure that gives details on how much an…

Q: As part of Budget 2018, the Government of Canada introduced the Canada Workers Benefit (CWB) that…

A: As a part of budget 2018, the government of Canada introduced the Canada Workers Benefit (CWB). CWB…

Q: Suppose that the Central Bank has currently set the reserve requirements in the economy to be equal…

A: Given information: The reserve requirement is 10% The initial deposit is $400. Cash in circulation…

Q: Describe the national income and product accounts (NIPA).

A: GDP is an important indicator of a country's economic health, as it reflects the size of its economy…

Q: Suppose your bank raises its minimum-balance requirement for free checking on checking accounts by…

A: The M2 and M1 numbers are carefully watched as measures of the total money supply. M1 (cash and…

Q: An amusement park decides to apply two-part tariff rule to set price, given the demand equation…

A: Incase of monopoly, The profit is maximized where the marginal cost is equal to marginal revenue.…

Q: Describe the four fundamental principles of integrative negotiation.

A: Integrative negotiation is a strategy in economics that aims to create a "win-win" outcome for all…

Q: If demand and supply change in the same direction, we equilibrium quantity and we the direction of…

A: If there is technological advancements that cut the cost of producing computer then the supply curve…

Q: new keynesian models assume that the business cycle fluctuations are driven by the aggregate demand…

A: Keynesian economics is a macroeconomic theory that focuses on the role of aggregate demand in…

Q: Ali has two options after completion of his schooling. Either he can attend college or he can work…

A: Before getting on to the question, we first understand the concept of opportunity cost. In economics…

Q: if country A real gdp grows at 5% while country B real gdp grows at 3% then we can conclude that…

A: Gross domestic product (GDP) measures the money value of all final goods and services produced in an…

Step by step

Solved in 2 steps

- A country’s GDP is defined by the following equation: GDP = Consumer Spending + Investmentspending. The economy of this country is closed and there’s no government. Investment spendingis defined by the following equation: Investment Spending = Investment (planned) + Investment(unplanned). Investment (planned) is fixed at 350. Consumer spending is defined by thefollowing equation: Consumer spending = 200 + 0.55 (GDP). And for this country, PlannedExpenditure = Consumer Spending + Investment Planned. Based on this information, attempt thefollowing questions:a. “Investment (unplanned) will be negative if GDP is 900” – showing work, test theauthenticity of this statement. b. How do you think GDP (and production) will change if the income of this country is 1500?Explain by deriving Investment (unplanned) for an income of 1500. c. Derive the GDP for which Planned Expenditure = GDP. d. Supposed Investment (planned) was increased to 450. How will income-expenditureequilibrium change. e. Relate…Assume taxes are zero and an economy has a consumption function of C = 0.56 (Yd) + $777.68. By how much will GDP change if net exports change by -411.26? Round your answer to two digits after the decimal.What is the relative importance of consumption spending (C) in aggreagte demand and some factors that affect it? What is the relative importance of investment spending (I) in aggreagte demand and some factors that affect it? What is the relative importance of government spending (G) in aggreagte demand and some factors that affect it? What is the relative importance of Net Export (NX) (Net Export = spending on exports (X) - imports (M)) in aggreagte demand and some factors that affect it?

- Assume: Y= C + I + G + NX C = 400 + (0.8)YD Io = 200 G = 300 + (0.1)(Y* - Y) YD = Y - TA + TR NXo = - 40 TA = (0.25)Y TRo = 50 Assume the equation for net exports changes from NXo= - 40 to NX1 = - 40 - mY. How would this affect expenditure multiplier, if we assume that 0 < m < 1?Suppose that disposable income, consumptio, and saving in some country are $ 200 billion, $ 150 billion, and $ 50 billion respectively. Next, assume that disposobal income increase by $ 20 billion, consumption rises by $ 18 billion, and saving goes up by $ 2 billion. a) What is the economy's MPC? What is its MPS? Instructions: Round your answers to 1 decimal place. b) What was the APC before the increase in disposable income? Instructions: Round your answer to 2 decimal places. What was the APC after the increase. ( round your answer to 3 decimal places).Question:Given that the marginal propensity to consume in a fully employed closed economy is 0.75, an increase in government expenditure of $1,000 million will increase the national income by:a. $0b. $750c. $4,000d. $7,500e. $8,000

- Consider a 4-sector economy, the consumption spending is C = 500+0.75(Y-T), taxes are T = 10 + 0.2Y, and imports are M=0.2Y. Planned investment is Ip=300, government spending is G=250, and exports are X=10. What is the slope of the planned aggregate expenditure (PAE) line? a) 0.7 b) 0.5 c) 0.6 d) 0.3 e) 0.4Let's say the autonomous Investment = $5,000, autonomous consumption = $12000, autonomous government expenditures = $3,000, autonomous net exports = - $2,000, and the mpe = .6. Now there is a banking crisis, and Investment drops $2,500. What is equilibrium GDP? Question 8 options: $15,500 $33,500 $48,750 $38,750 2The economy of HOYA has a spending mulipilier of 4. Based only on this information, we know that in HOYAO. Every one point change in R will change spending by 4O. An $80 decrease in investment will reduce GDP by $20O. A $10 increase in not exports will lead to a $40 income equilibrium GDPO. $25 increase in goverment purchase will increase equilibrium consumption by $100

- Assume taxes are zero and an economy has a consumption function of C = 0.72 (Yd) + $587.32. By how much will savings change if disposable income in the economy changes by 123? Round your answer to two digits after the decimal and be sure to provide a negative sign if it decreases.Consider a closed economy in which total output equals $13,000. The economy also has the following information: Consumption totals $6500 Government spending totals $2500 Private savings totals $3800 Carefully following all numeric instructions, tell me this economy's net taxes (T). Carefully following all numeric instructions, tell me this economy's public savings. Carefully following all numeric instructions, tell me this economy's economic investment.Could you do C and D A country has an initial real output of $162 Billion. What would the final output be expected to be if:a. The government spends $15 billion on infrastructure and the MPC of the country is 0.35b. The government reduces taxes by $3.5 billion and the MPW of the country is 0.75c. The government makes no changes to taxes or spending.d. The government decreases spending nationwide by $9 billion in a country where people are likely to withdraw 60 cents on every new dollar of income.