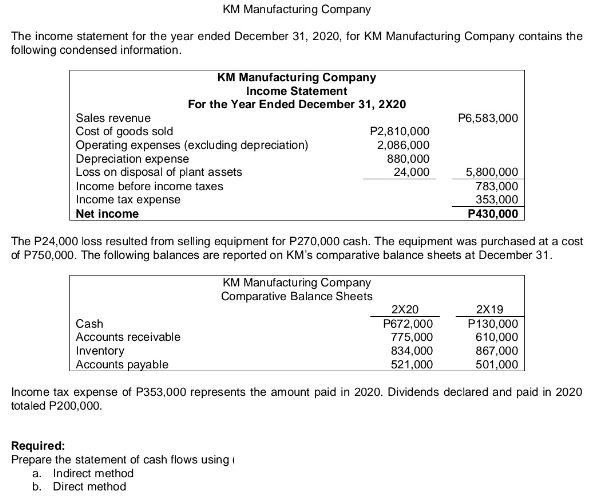

KM Manufacturing Company The income statement for the year ended December 31, 2020, for KM Manufacturing Company contains the following condensed information. KM Manufacturing Company Income Statement For the Year Ended December 31, 2X20 Sales revenue Cost of goods sold Operating expenses (excluding depreciation) Depreciation expense Loss on disposal of plant assets Income before income taxes P6,583,000 P2,810,000 2,086,000 880,000 24,000 5,800,000 783,000 353,000 P430,000 Income tax expense Net income The P24,000 loss resulted from selling equipment for P270,000 cash. The equipment was purchased at a cost of P750,000. The following balances are reported on KM's comparative balance sheets at December 31. KM Manufacturing Company Comparative Balance Sheets 2X20 2X19 Cash Accounts receivable Inventory Accounts payable P672,000 775,000 834,000 521,000 P130,000 610,000 867,000 501,000 Income tax expense of P353,000 represents the amount paid in 2020. Dividends declared and paid in 2020 totaled P200,000. Required: Prepare the statement of cash flows using i a. Indirect method b. Direct method

KM Manufacturing Company The income statement for the year ended December 31, 2020, for KM Manufacturing Company contains the following condensed information. KM Manufacturing Company Income Statement For the Year Ended December 31, 2X20 Sales revenue Cost of goods sold Operating expenses (excluding depreciation) Depreciation expense Loss on disposal of plant assets Income before income taxes P6,583,000 P2,810,000 2,086,000 880,000 24,000 5,800,000 783,000 353,000 P430,000 Income tax expense Net income The P24,000 loss resulted from selling equipment for P270,000 cash. The equipment was purchased at a cost of P750,000. The following balances are reported on KM's comparative balance sheets at December 31. KM Manufacturing Company Comparative Balance Sheets 2X20 2X19 Cash Accounts receivable Inventory Accounts payable P672,000 775,000 834,000 521,000 P130,000 610,000 867,000 501,000 Income tax expense of P353,000 represents the amount paid in 2020. Dividends declared and paid in 2020 totaled P200,000. Required: Prepare the statement of cash flows using i a. Indirect method b. Direct method

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 8E: Cost of Goods Sold, Income Statement. and Statement of Comprehensive Income Gaskin Company derives...

Related questions

Question

Transcribed Image Text:KM Manufacturing Company

The income statement for the year ended December 31, 2020, for KM Manufacturing Company contains the

following condensed information.

KM Manufacturing Company

Income Statement

For the Year Ended December 31, 2X20

Sales revenue

Cost of goods sold

Operating expenses (excluding depreciation)

Depreciation expense

Loss on disposal of plant assets

Income before income taxes

P6,583,000

P2,810,000

2,086,000

880,000

24,000

5,800,000

783,000

353,000

P430,000

Income tax expense

Net income

The P24,000 loss resulted from selling equipment for P270,000 cash. The equipment was purchased at a cost

of P750,000. The following balances are reported on KM's comparative balance sheets at December 31.

KM Manufacturing Company

Comparative Balance Sheets

2X20

2X19

Cash

Accounts receivable

Inventory

Accounts payable

P672,000

775,000

834,000

521,000

P130,000

610,000

867,000

501,000

Income tax expense of P353,000 represents the amount paid in 2020. Dividends declared and paid in 2020

totaled P200,000.

Required:

Prepare the statement of cash flows using i

a. Indirect method

b. Direct method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning