Internal Rate of Return Method-Two Projects Munch N' Crunch Snack Company is considering two possible investments: a delivery truck or a bagging machine. The delivery truck would cost $65,652.6 and could be used to deliver an additional 56,000 bags of pretzels per year. Each bag of pretzels can be sold for a contribution margin of $0.38. The delivery truck operating expenses, excluding depreciation, are $0.52 per mile for 19,000 miles per year. The bagging machine would replace an old bagging machine, and its net investment cost would be $39,960. The new machine would require three fewer hours of direct labor per day. Direct labor is $10 per hour. There are 250 operating days in the year. Both the truck and the bagging machine are estimated to have nine- year lives. The minimum rate of return is 11%. However, Munch N' Crunch has funds to invest in only one of the projects. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1. 0.943 0.909 0.893 0.870 0.833 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.352 2.991 6 4.917 4.355 4.111 3.784 3.326 7 5.582 4.868 4.564 4.160 3.605 8. 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Compute the internal rate of return for each investment. Use the above table of present value of an annuity of $1. If required, round your present value factor answers to three decimal places and internal rate of return to the nearest percent.

Internal Rate of Return Method-Two Projects Munch N' Crunch Snack Company is considering two possible investments: a delivery truck or a bagging machine. The delivery truck would cost $65,652.6 and could be used to deliver an additional 56,000 bags of pretzels per year. Each bag of pretzels can be sold for a contribution margin of $0.38. The delivery truck operating expenses, excluding depreciation, are $0.52 per mile for 19,000 miles per year. The bagging machine would replace an old bagging machine, and its net investment cost would be $39,960. The new machine would require three fewer hours of direct labor per day. Direct labor is $10 per hour. There are 250 operating days in the year. Both the truck and the bagging machine are estimated to have nine- year lives. The minimum rate of return is 11%. However, Munch N' Crunch has funds to invest in only one of the projects. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1. 0.943 0.909 0.893 0.870 0.833 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.352 2.991 6 4.917 4.355 4.111 3.784 3.326 7 5.582 4.868 4.564 4.160 3.605 8. 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Compute the internal rate of return for each investment. Use the above table of present value of an annuity of $1. If required, round your present value factor answers to three decimal places and internal rate of return to the nearest percent.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 18E

Related questions

Question

How would I solve this? Thanks!

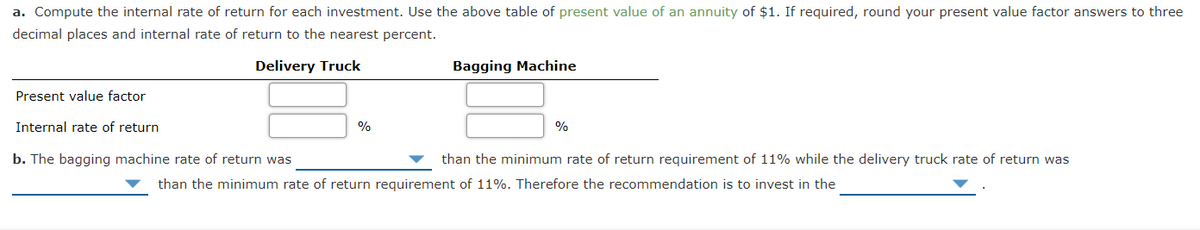

Transcribed Image Text:a. Compute the internal rate of return for each investment. Use the above table of present value of an annuity of $1. If required, round your present value factor answers to three

decimal places and internal rate of return to the nearest percent.

Delivery Truck

Bagging Machine

Present value factor

Internal rate of return

%

%

b. The bagging machine rate of return was

than the minimum rate of return requirement of 11% while the delivery truck rate of return was

than the minimum rate of return requirement of 11%. Therefore the recommendation is to invest in the

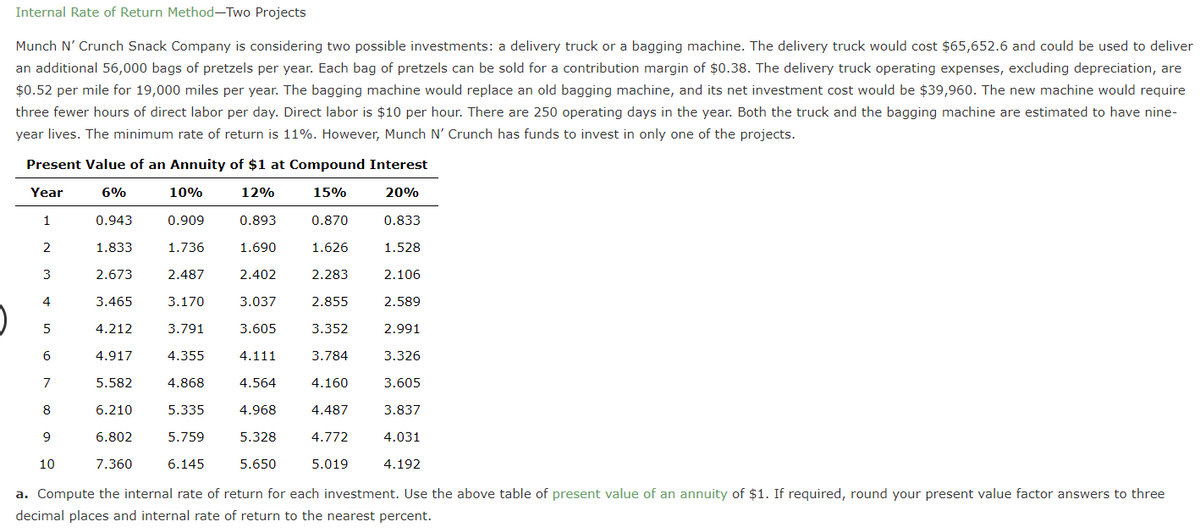

Transcribed Image Text:Internal Rate of Return Method-Two Projects

Munch N' Crunch Snack Company is considering two possible investments: a delivery truck or a bagging machine. The delivery truck would cost $65,652.6 and could be used to deliver

an additional 56,000 bags of pretzels per year. Each bag of pretzels can be sold for a contribution margin of $0.38. The delivery truck operating expenses, excluding depreciation, are

$0.52 per mile for 19,000 miles per year. The bagging machine would replace an old bagging machine, and its net investment cost would be $39,960. The new machine would require

three fewer hours of direct labor per day. Direct labor is $10 per hour. There are 250 operating days in the year. Both the truck and the bagging machine are estimated to have nine-

year lives. The minimum rate of return is 11%. However, Munch N' Crunch has funds to invest in only one of the projects.

Present Value of an Annuity of $1 at Compound Interest

Year

6%

10%

12%

15%

20%

1

0.943

0.909

0.893

0.870

0.833

2

1.833

1.736

1.690

1.626

1.528

3

2.673

2.487

2.402

2.283

2.106

4

3.465

3.170

3.037

2.855

2.589

5

4.212

3.791

3.605

3.352

2.991

6.

4.917

4.355

4.111

3.784

3.326

7

5.582

4.868

4.564

4.160

3.605

8

6.210

5.335

4.968

4.487

3.837

6.802

5.759

5.328

4.772

4.031

10

7.360

6.145

5.650

5.019

4.192

a. Compute the internal rate of return for each investment. Use the above table of present value of an annuity of $1. If required, round your present value factor answers to three

decimal places and internal rate of return to the nearest percent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,