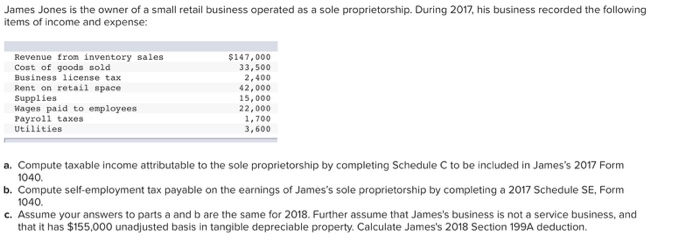

James Jones is the owner of a small retail business operated as a sole proprietorship. During 2017, his business recorded the following items of income and expense: Revenue from inventory sales Cost of goods sold Business lieense tax Rent on retail space Supplies Mages paid to employees Payroll taxes Utilities $147,000 33, 500 2,400 42,000 15,000 22,000 1,700 3,600 a. Compute taxable income attributable to the sole proprietorship by completing Schedule C to be included in James's 2017 Form 1040. b. Compute self-employment tax payable on the earnings of James's sole proprietorship by completing a 2017 Schedule SE, Form 1040.

James Jones is the owner of a small retail business operated as a sole proprietorship. During 2017, his business recorded the following items of income and expense: Revenue from inventory sales Cost of goods sold Business lieense tax Rent on retail space Supplies Mages paid to employees Payroll taxes Utilities $147,000 33, 500 2,400 42,000 15,000 22,000 1,700 3,600 a. Compute taxable income attributable to the sole proprietorship by completing Schedule C to be included in James's 2017 Form 1040. b. Compute self-employment tax payable on the earnings of James's sole proprietorship by completing a 2017 Schedule SE, Form 1040.

Chapter16: Accounting Periods And Methods

Section: Chapter Questions

Problem 33P

Related questions

Question

Transcribed Image Text:James Jones is the owner of a small retail business operated as a sole proprietorship. During 2017, his business recorded the following

items of income and expense:

Revenue from inventory sales

Cost of goods sold

Business license tax

$147,000

Rent on retail space

Supplies

Wages paid to employees

Payroll taxes

Utilities

33,500

2,400

42,000

15,000

22,000

1,700

3,600

a. Compute taxable income attributable to the sole proprietorship by completing Schedule C to be included in James's 2017 Form

1040.

b. Compute self-employment tax payable on the earnings of James's sole proprietorship by completing a 2017 Schedule SE, Form

1040.

c. Assume your answers to parts a and b are the same for 2018. Further assume that James's business is not a service business, and

that it has $155,000 unadjusted basis in tangible depreciable property. Calculate James's 2018 Section 199A deduction.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning