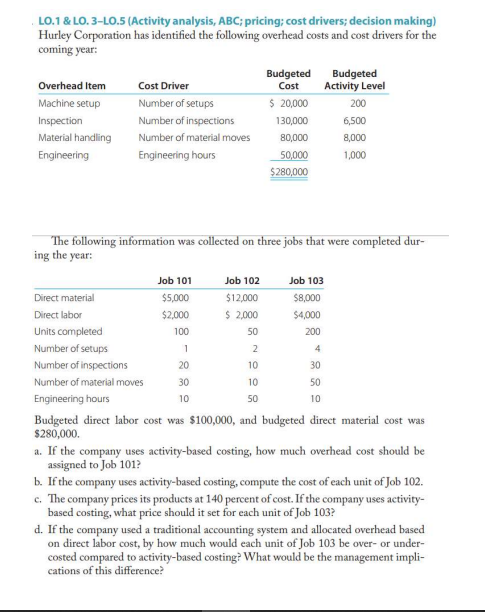

LO.1 & LO. 3-LO.5 (Activity analysis, ABC; pricing; cost drivers; decision making Hurley Corporation has identified the following overhead costs and cost drivers for th coming year: Budgeted Cost Budgeted Activity Level Overhead Item Cost Driver Machine setup Number of setups $ 20,000 200 Inspection Number of inspections 130,000 6,500 Material handling Number of material moves 80,000 8,000 Engineering Engineering hours 50,000 1,000 $280,000 The following information was collected on three jobs that were completed dur- ing the year: Job 101 Job 102 Job 103 Direct material $5,000 $12,000 $8,000 Direct labor $2,000 $ 2,000 $4,000 Units completed 100 50 200 Number of setups 1 2 4 Number of inspections 20 10 30 Number of material moves 30 10 50 Engineering hours 10 50 10

LO.1 & LO. 3-LO.5 (Activity analysis, ABC; pricing; cost drivers; decision making Hurley Corporation has identified the following overhead costs and cost drivers for th coming year: Budgeted Cost Budgeted Activity Level Overhead Item Cost Driver Machine setup Number of setups $ 20,000 200 Inspection Number of inspections 130,000 6,500 Material handling Number of material moves 80,000 8,000 Engineering Engineering hours 50,000 1,000 $280,000 The following information was collected on three jobs that were completed dur- ing the year: Job 101 Job 102 Job 103 Direct material $5,000 $12,000 $8,000 Direct labor $2,000 $ 2,000 $4,000 Units completed 100 50 200 Number of setups 1 2 4 Number of inspections 20 10 30 Number of material moves 30 10 50 Engineering hours 10 50 10

Principles of Cost Accounting

17th Edition

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Edward J. Vanderbeck, Maria R. Mitchell

Chapter7: The Master Budget And Flexible Budgeting

Section: Chapter Questions

Problem 8P: Preparing a performance report Use the flexible budget prepared in P7-6 for the 29,000-unit level of...

Related questions

Question

Transcribed Image Text:LO.1 & LO. 3-LO.5 (Activity analysis, ABC; pricing; cost drivers; decision making)

Hurley Corporation has identified the following overhead costs and cost drivers for the

coming year:

Budgeted

Budgeted

Activity Level

Overhead Item

Cost Driver

Cost

Machine setup

Number of setups

$ 20,000

200

Inspection

Number of inspections

130,000

6,500

Material handling

Number of material moves

80,000

8,000

Engineering

Engineering hours

50,000

1,000

$280,000

The following information was collected on three jobs that were completed dur-

ing the year:

Job 101

Job 102

Job 103

Direct material

$5,000

$12,000

$8,000

Direct labor

$2,000

$ 2,000

$4,000

Units completed

100

50

200

Number of setups

4

Number of inspections

20

10

30

Number of material moves

30

10

50

Engineering hours

10

50

10

Budgeted direct labor cost was $100,000, and budgeted direct material cost was

$280,000.

a. If the company uses activity-based costing, how much overhead cost should be

assigned to Job 101?

b. If the company uses activity-based costing, compute the cost of each unit of Job 102.

c. The company prices its products at 140 percent of cost. If the company uses activity-

based costing, what price should it set for each unit of Job 103?

d. If the company used a traditional accounting system and allocated overhead based

on direct labor cost, by how much would each unit of Job 103 be over- or under-

costed compared to activity-based costing? What would be the management impli-

cations of this difference?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning