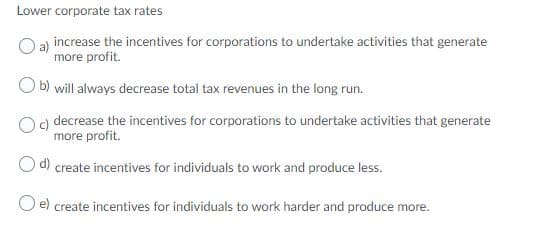

Lower corporate tax rates Oa) increase the incentives for corporations to undertake activities that generate more profit. O b) will always decrease total tax revenues in the long run. Og decrease the incentives for corporations to undertake activities that generate more profit. Od) create incentives for individuals to work and produce less. e) create incentives for individuals to work harder and produce more.

Lower corporate tax rates Oa) increase the incentives for corporations to undertake activities that generate more profit. O b) will always decrease total tax revenues in the long run. Og decrease the incentives for corporations to undertake activities that generate more profit. Od) create incentives for individuals to work and produce less. e) create incentives for individuals to work harder and produce more.

Microeconomics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter8: Costs And The Supply Of Goods

Section: Chapter Questions

Problem 11CQ

Related questions

Question

18

Transcribed Image Text:Lower corporate tax rates

O a) increase the incentives for corporations to undertake activities that generate

more profit.

O b) will always decrease total tax revenues in the long run.

decrease the incentives for corporations to undertake activities that generate

more profit.

Od create incentives for individuals to work and produce less.

create incentives for individuals to work harder and produce more.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax