Make the Statement of Financial Position by making the Statement of Income and Statement of Equity. Inlude the notes.

Make the Statement of Financial Position by making the Statement of Income and Statement of Equity. Inlude the notes.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 22E: Ellerson Company provided the following information for the last calendar year: During the year,...

Related questions

Question

Make the

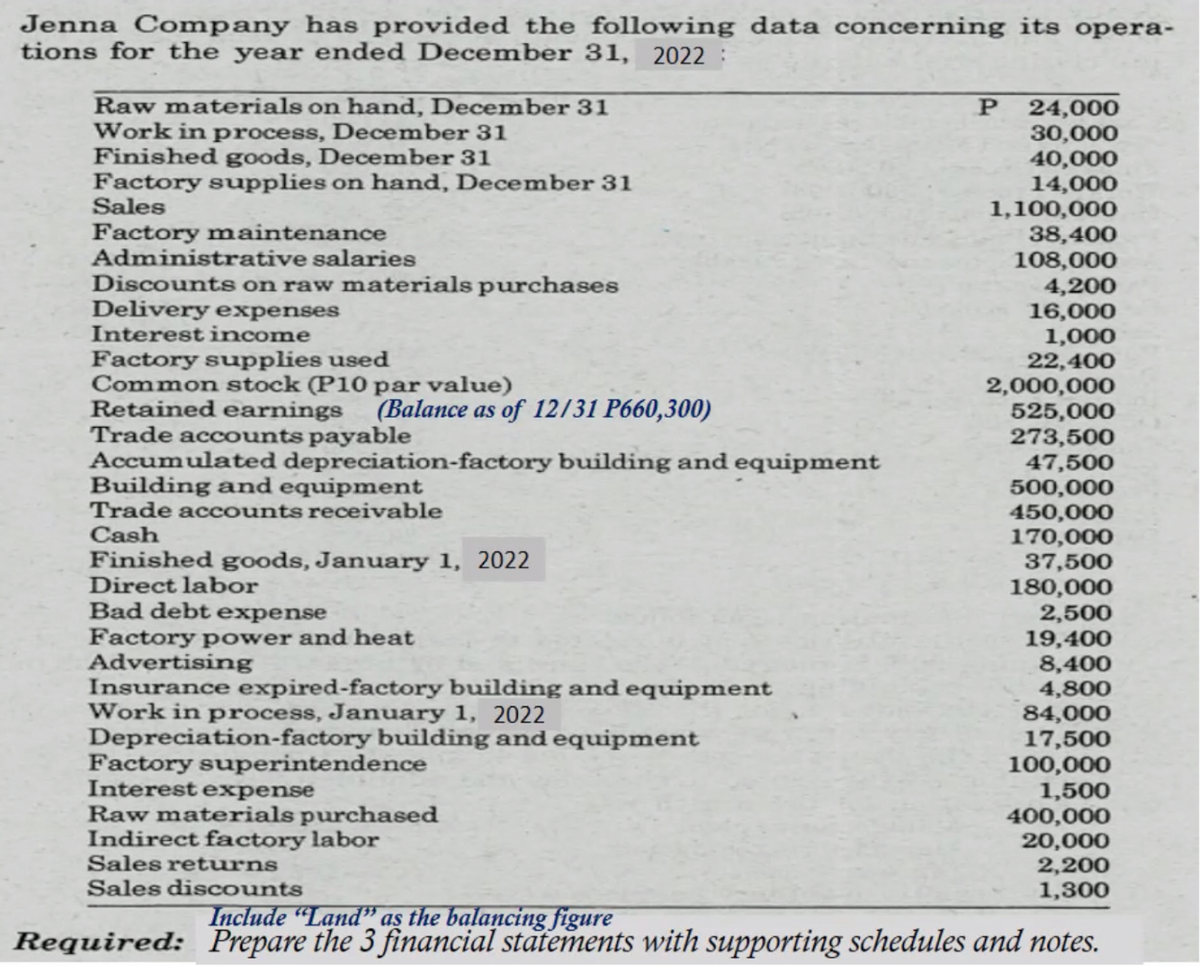

Transcribed Image Text:Jenna Company has provided the following data concerning its opera-

tions for the year ended December 31, 2022

Raw materials on hand, December 31

Work in process, December 31

Finished goods, December 31

Factory supplies on hand, December 31

Sales

Factory maintenance

Administrative salaries

Discounts on raw materials purchases

Delivery expenses

Interest income

Factory supplies used

Common stock (P10 par value)

Retained earnings

Trade accounts payable

(Balance as of 12/31 P660,300)

Accumulated depreciation-factory building and equipment

Building and equipment

Trade accounts receivable

Cash

Finished goods, January 1, 2022

Direct labor

Bad debt expense

Factory power and heat

Advertising

Insurance expired-factory building and equipment

Work in process, January 1, 2022

Depreciation-factory building and equipment

Factory superintendence

Interest expense

Raw materials purchased

Indirect factory labor

Sales returns

Sales discounts

P

24,000

30,000

40,000

14,000

1,100,000

38,400

108,000

4,200

16,000

1,000

22,400

2,000,000

525,000

273,500

47,500

500,000

450,000

170,000

37,500

180,000

2,500

19,400

8,400

4,800

84,000

17,500

100,000

1,500

400,000

20,000

2,200

1,300

Include "Land" as the balancing figure

Required: Prepare the 3 financial statements with supporting schedules and notes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub