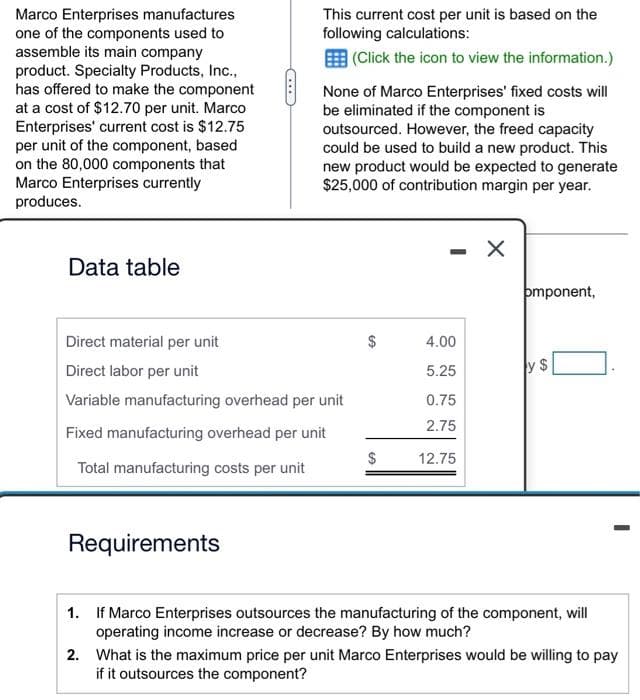

Marco Enterprises manufactures one of the components used to assemble its main company product. Specialty Products, Inc., has offered to make the component at a cost of $12.70 per unit. Marco Enterprises' current cost is $12.75 per unit of the component, based on the 80,000 components that Marco Enterprises currently produces. Data table This current cost per unit is based on the following calculations: (Click the icon to view the information.) Requirements None of Marco Enterprises' fixed costs will be eliminated if the component is outsourced. However, the freed capacity could be used to build a new product. This new product would be expected to generate $25,000 of contribution margin per year. Direct material per unit Direct labor per unit Variable manufacturing overhead per unit Fixed manufacturing overhead per unit Total manufacturing costs per unit $ $ 4.00 5.25 0.75 2.75 12.75 X pmponent, SA 1. If Marco Enterprises outsources the manufacturing of the component, will operating income increase or decrease? By how much? - 2. What is the maximum price per unit Marco Enterprises would be willing to pay if it outsources the component?

Marco Enterprises manufactures one of the components used to assemble its main company product. Specialty Products, Inc., has offered to make the component at a cost of $12.70 per unit. Marco Enterprises' current cost is $12.75 per unit of the component, based on the 80,000 components that Marco Enterprises currently produces. Data table This current cost per unit is based on the following calculations: (Click the icon to view the information.) Requirements None of Marco Enterprises' fixed costs will be eliminated if the component is outsourced. However, the freed capacity could be used to build a new product. This new product would be expected to generate $25,000 of contribution margin per year. Direct material per unit Direct labor per unit Variable manufacturing overhead per unit Fixed manufacturing overhead per unit Total manufacturing costs per unit $ $ 4.00 5.25 0.75 2.75 12.75 X pmponent, SA 1. If Marco Enterprises outsources the manufacturing of the component, will operating income increase or decrease? By how much? - 2. What is the maximum price per unit Marco Enterprises would be willing to pay if it outsources the component?

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter10: Evaluating Decentralized Operations

Section: Chapter Questions

Problem 17E: Materials used by the Instrument Division of Ziegler Inc. are currently purchased from outside...

Related questions

Question

please help me to solve this problem

Transcribed Image Text:Marco Enterprises manufactures

one of the components used to

assemble its main company

product. Specialty Products, Inc.,

has offered to make the component

at a cost of $12.70 per unit. Marco

Enterprises' current cost is $12.75

per unit of the component, based

on the 80,000 components that

Marco Enterprises currently

produces.

Data table

This current cost per unit is based on the

following calculations:

(Click the icon to view the information.)

Requirements

None of Marco Enterprises' fixed costs will

be eliminated if the component is

outsourced. However, the freed capacity

could be used to build a new product. This

new product would be expected to generate

$25,000 of contribution margin per year.

Direct material per unit

Direct labor per unit

Variable manufacturing overhead per unit

Fixed manufacturing overhead per unit

Total manufacturing costs per unit

$

$

4.00

5.25

0.75

2.75

12.75

X

pmponent,

SA

-

1.

If Marco Enterprises outsources the manufacturing of the component, will

operating income increase or decrease? By how much?

2.

What is the maximum price per unit Marco Enterprises would be willing to pay

if it outsources the component?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning