MIRR unequal lives. Grady Enterprises is looking at two project opportunities for a parcel of land the company currently owns. The first project is a restaurant, and the second project is a sports facility The projected cash flow of the restaurant is an initial cost of $1,600,000 with cash flows over the next six years of $250,000 (vear one), $240,000 (year two), $270,000 (years three through five), and S1,730,000 (year six), at which point Grady plans to sell the restaurant. The sports facility has the following cash flows: an initial cost of $2,440,000 with cash flows over the next four years of $360,000 (years one through three) and $3,420,000 (year four), at which point Grady plans to sell the facility. The appropriate discount rate for the restaurant is 10.5% and the appropriate discount rate for the sports facility is 11.5%. What are the MIRRS for the Grady Enterprises projects? What are the MIRRS when you adjust for the unequal lives? Do the MIRR adjusted for unequal lives change the decision based on the MIRRS? Hint Take all cash flows to the same ending period as the longest project If the appropriate reinvestment rate for the restaurant is 10.5%, what is the MIRR of the restaurant project? 13.89 % (Round to two decimal places.) If the appropriate reinvestment rate for the sports facility is 11.5%, what is the MIRR of the sports facility? % (Round to two decimal places.)

MIRR unequal lives. Grady Enterprises is looking at two project opportunities for a parcel of land the company currently owns. The first project is a restaurant, and the second project is a sports facility The projected cash flow of the restaurant is an initial cost of $1,600,000 with cash flows over the next six years of $250,000 (vear one), $240,000 (year two), $270,000 (years three through five), and S1,730,000 (year six), at which point Grady plans to sell the restaurant. The sports facility has the following cash flows: an initial cost of $2,440,000 with cash flows over the next four years of $360,000 (years one through three) and $3,420,000 (year four), at which point Grady plans to sell the facility. The appropriate discount rate for the restaurant is 10.5% and the appropriate discount rate for the sports facility is 11.5%. What are the MIRRS for the Grady Enterprises projects? What are the MIRRS when you adjust for the unequal lives? Do the MIRR adjusted for unequal lives change the decision based on the MIRRS? Hint Take all cash flows to the same ending period as the longest project If the appropriate reinvestment rate for the restaurant is 10.5%, what is the MIRR of the restaurant project? 13.89 % (Round to two decimal places.) If the appropriate reinvestment rate for the sports facility is 11.5%, what is the MIRR of the sports facility? % (Round to two decimal places.)

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 7E

Related questions

Question

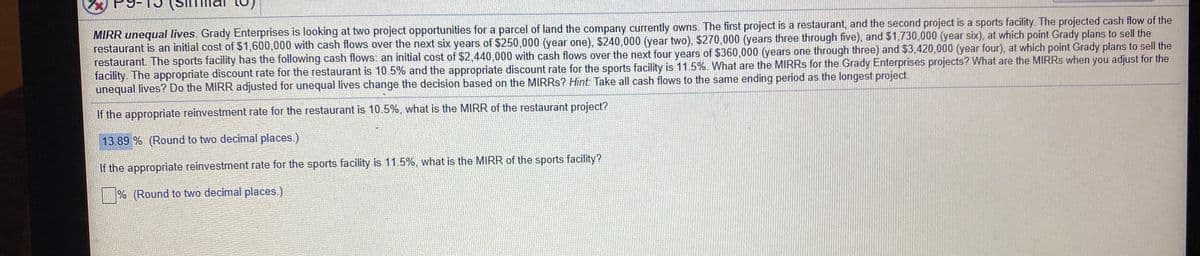

Transcribed Image Text:MIRR unequal lives. Grady Enterprises is looking at two project opportunities for a parcel of land the company currently owns. The first project is a restaurant, and the second project is a sports facility. The projected cash flow of the

restaurant is an initial cost of $1,600,000 with cash flows over the next six years of $250,000 (year one), $240,000 (year two), $270,000 (years three through five), and $1,730,000 (year six), at which point Grady plans to sell the

restaurant. The sports facility has the following cash flows: an initial cost of $2,440,000 with cash flows over the next four years of $360,000 (years one through three) and $3,420,000 (year four), at which point Grady plans to sell the

facility. The appropriate discount rate for the restaurant is 10.5% and the appropriate discount rate for the sports facility is 11.5%. What are the MIRRS for the Grady Enterprises projects? What are the MIRRS when you adjust for the

unequal lives? Do the MIRR adjusted for unequal lives change the decision based on the MIRRS? Hint: Take all cash flows to the same ending period as the longest project.

If the appropriate reinvestment rate for the restaurant is 10.5%, what is the MIRR of the restaurant project?

13.89 % (Round to two decimal places.)

If the appropriate reinvestment rate for the sports facility is 11.5%, what is the MIRR of the sports facility?

|% (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning