Mr. and Mrs. L are calendar-year, cash-basis taxpayers. They have their own business, which they operate as a sole proprietorship. In addition, they own several investments including a 4-year-old rental property in whose operations they do not materially participate. Mr. and Mrs. L are not involved in a real property trade or business for purposes of Sec. 469. In the current year, the rental property produced a net loss of $40,000 including interest expense of $90,000. In addition, Mr. and Mrs. L paid the following amounts of interest expense: Interest on home mortgage Interest on business loan Interest on loan to purchase 10,000 shares of ABC Corporation stock $ 4,500 35,500 A. $37,500 B. $2,000 C. $9,000 D. $0 45,000 $85,000 Mr. and Mrs. L had no dividend or interest income in the current year. If they file a joint return, what is the total amount deductible as investment interest on their 1040 for the current year?

Mr. and Mrs. L are calendar-year, cash-basis taxpayers. They have their own business, which they operate as a sole proprietorship. In addition, they own several investments including a 4-year-old rental property in whose operations they do not materially participate. Mr. and Mrs. L are not involved in a real property trade or business for purposes of Sec. 469. In the current year, the rental property produced a net loss of $40,000 including interest expense of $90,000. In addition, Mr. and Mrs. L paid the following amounts of interest expense: Interest on home mortgage Interest on business loan Interest on loan to purchase 10,000 shares of ABC Corporation stock $ 4,500 35,500 A. $37,500 B. $2,000 C. $9,000 D. $0 45,000 $85,000 Mr. and Mrs. L had no dividend or interest income in the current year. If they file a joint return, what is the total amount deductible as investment interest on their 1040 for the current year?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter6: Losses And Loss Limitations

Section: Chapter Questions

Problem 14P

Related questions

Question

p2.

Subject :- Accounting

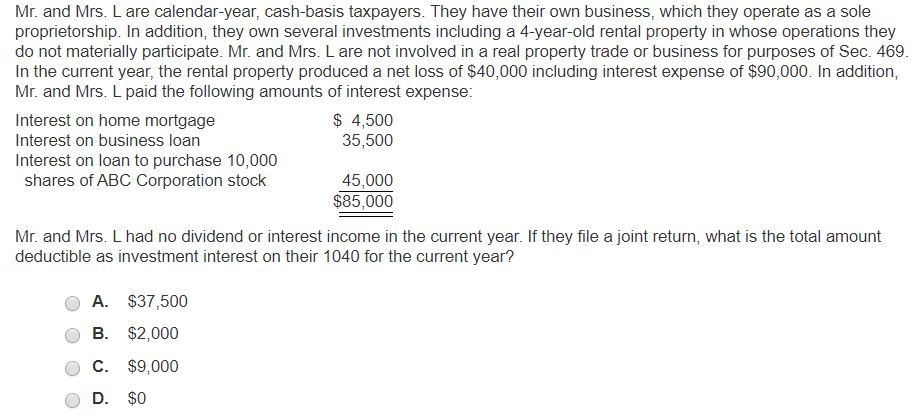

Transcribed Image Text:Mr. and Mrs. L are calendar-year, cash-basis taxpayers. They have their own business, which they operate as a sole

proprietorship. In addition, they own several investments including a 4-year-old rental property in whose operations they

do not materially participate. Mr. and Mrs. L are not involved in a real property trade or business for purposes of Sec. 469.

In the current year, the rental property produced a net loss of $40,000 including interest expense of $90,000. In addition,

Mr. and Mrs. L paid the following amounts of interest expense:

Interest on home mortgage

Interest on business loan

Interest on loan to purchase 10,000

shares of ABC Corporation stock

$ 4,500

35,500

A. $37,500

B. $2,000

C. $9,000

D. $0

45,000

$85,000

Mr. and Mrs. L had no dividend or interest income in the current year. If they file a joint return, what is the total amount

deductible as investment interest on their 1040 for the current year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you