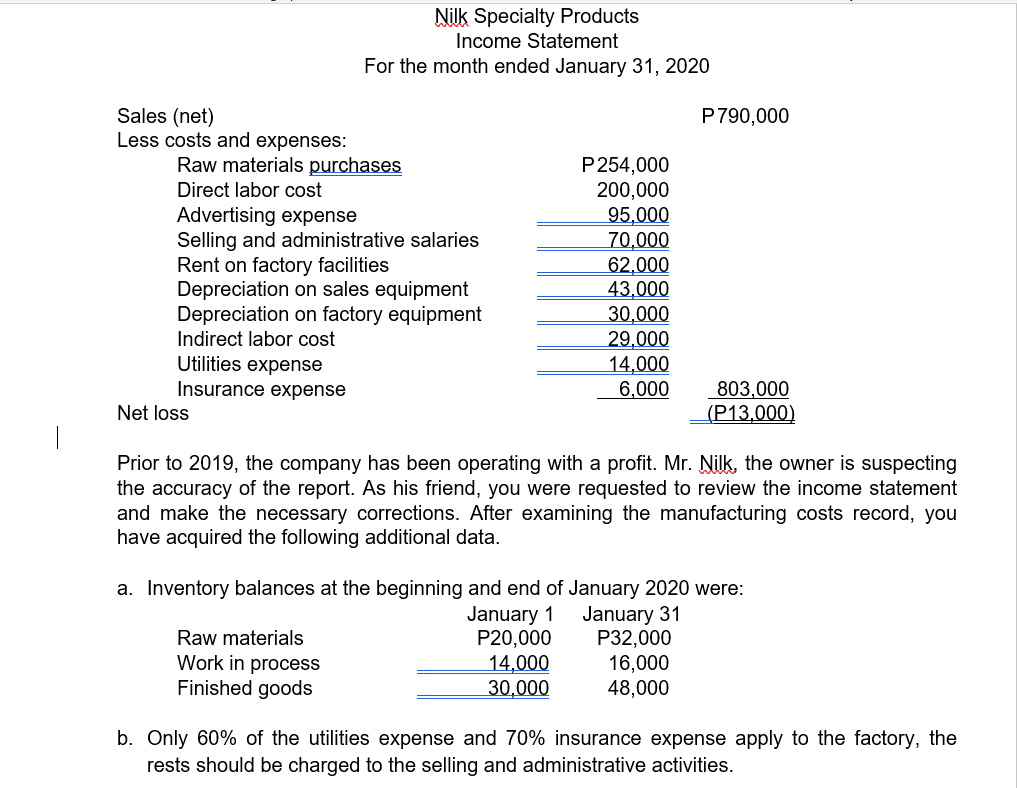

Nilk Specialty Products Income Statement For the month ended January 31, 2020 Sales (net) Less costs and expenses: P790,000 Raw materials purchases Direct labor cost Advertising expense Selling and administrative salaries Rent on factory facilities Depreciation on sales equipment Depreciation on factory equipment Indirect labor cost Utilities expense Insurance expense P254,000 200,000 95,000 70,000 62,000 43,000 30,000 29,000 14,000 6,000 803,000 (P13,000) Net loss | Prior to 2019, the company has been operating with a profit. Mr. Nilk, the owner is suspecting the accuracy of the report. As his friend, you were requested to review the income statement and make the necessary corrections. After examining the manufacturing costs record, you have acquired the following additional data. a. Inventory balances at the beginning and end of January 2020 were: Raw materials Work in process Finished goods January 1 P20,000 14,000 30,000 January 31 P32,000 16,000 48,000 b. Only 60% of the utilities expense and 70% insurance expense apply to the factory, the rests should be charged to the selling and administrative activities.

Nilk Specialty Products Income Statement For the month ended January 31, 2020 Sales (net) Less costs and expenses: P790,000 Raw materials purchases Direct labor cost Advertising expense Selling and administrative salaries Rent on factory facilities Depreciation on sales equipment Depreciation on factory equipment Indirect labor cost Utilities expense Insurance expense P254,000 200,000 95,000 70,000 62,000 43,000 30,000 29,000 14,000 6,000 803,000 (P13,000) Net loss | Prior to 2019, the company has been operating with a profit. Mr. Nilk, the owner is suspecting the accuracy of the report. As his friend, you were requested to review the income statement and make the necessary corrections. After examining the manufacturing costs record, you have acquired the following additional data. a. Inventory balances at the beginning and end of January 2020 were: Raw materials Work in process Finished goods January 1 P20,000 14,000 30,000 January 31 P32,000 16,000 48,000 b. Only 60% of the utilities expense and 70% insurance expense apply to the factory, the rests should be charged to the selling and administrative activities.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 2E: Cost of Goods Sold and Income Statement Schuch Company presents you with the following account...

Related questions

Question

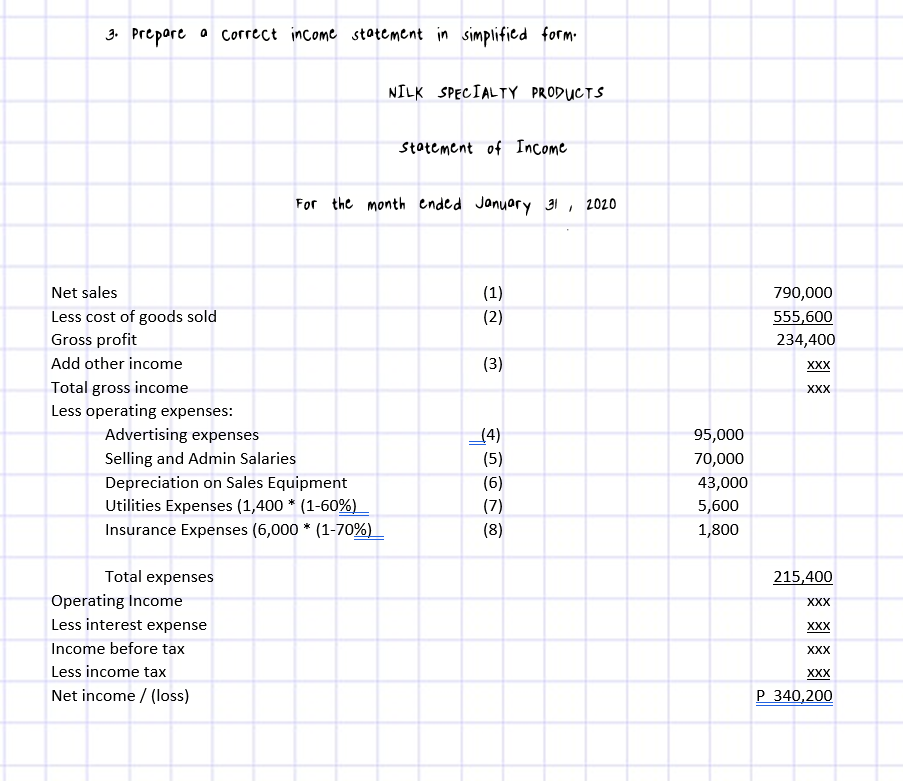

Check if my answer is correct.

Please put a solution with formula with the answers with numbers in the middle. numbers 1-8.

Transcribed Image Text:Nilk Specialty Products

Income Statement

For the month ended January 31, 2020

Sales (net)

Less costs and expenses:

Raw materials purchases

P790,000

P254,000

200,000

95,000

70,000

62,000

43,000

30.000

Direct labor cost

Advertising expense

Selling and administrative salaries

Rent on factory facilities

Depreciation on sales equipment

Depreciation on factory equipment

Indirect labor cost

Utilities expense

Insurance expense

29,000

14,000

6,000

803,000

(P13,000)

Net loss

Prior to 2019, the company has been operating with a profit. Mr. Nilk,

the accuracy of the report. As his friend, you were requested to review the income statement

and make the necessary corrections. After examining the manufacturing costs record, you

have acquired the following additional data.

owner

suspecting

a. Inventory balances at the beginning and end of January 2020 were:

January 1

P20,000

14,000

30,000

January 31

P32,000

16,000

48,000

Raw materials

Work in process

Finished goods

b. Only 60% of the utilities expense and 70% insurance expense apply to the factory, the

rests should be charged to the selling and administrative activities.

Transcribed Image Text:3. Prepore

a Correct income statement in simplificd form.

NILK SPECIALTY PRODUCTS

Statement of Income

For the month ended January 31 , 2020

Net sales

(1)

790,000

Less cost of goods sold

Gross profit

(2)

555,600

234,400

Add other income

(3)

XXX

Total gross income

Less operating expenses:

Advertising expenses

XXX

(4)

(5)

95,000

Selling and Admin Salaries

70,000

Depreciation on Sales Equipment

Utilities Expenses (1,400 * (1-60%)

Insurance Expenses (6,000 * (1-70%)

(6)

43,000

(7)

5,600

(8)

1,800

Total expenses

215,400

Operating Income

XXX

Less interest expense

XXX

Income before tax

XXX

Less income tax

XXX

Net income / (loss)

P 340,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning