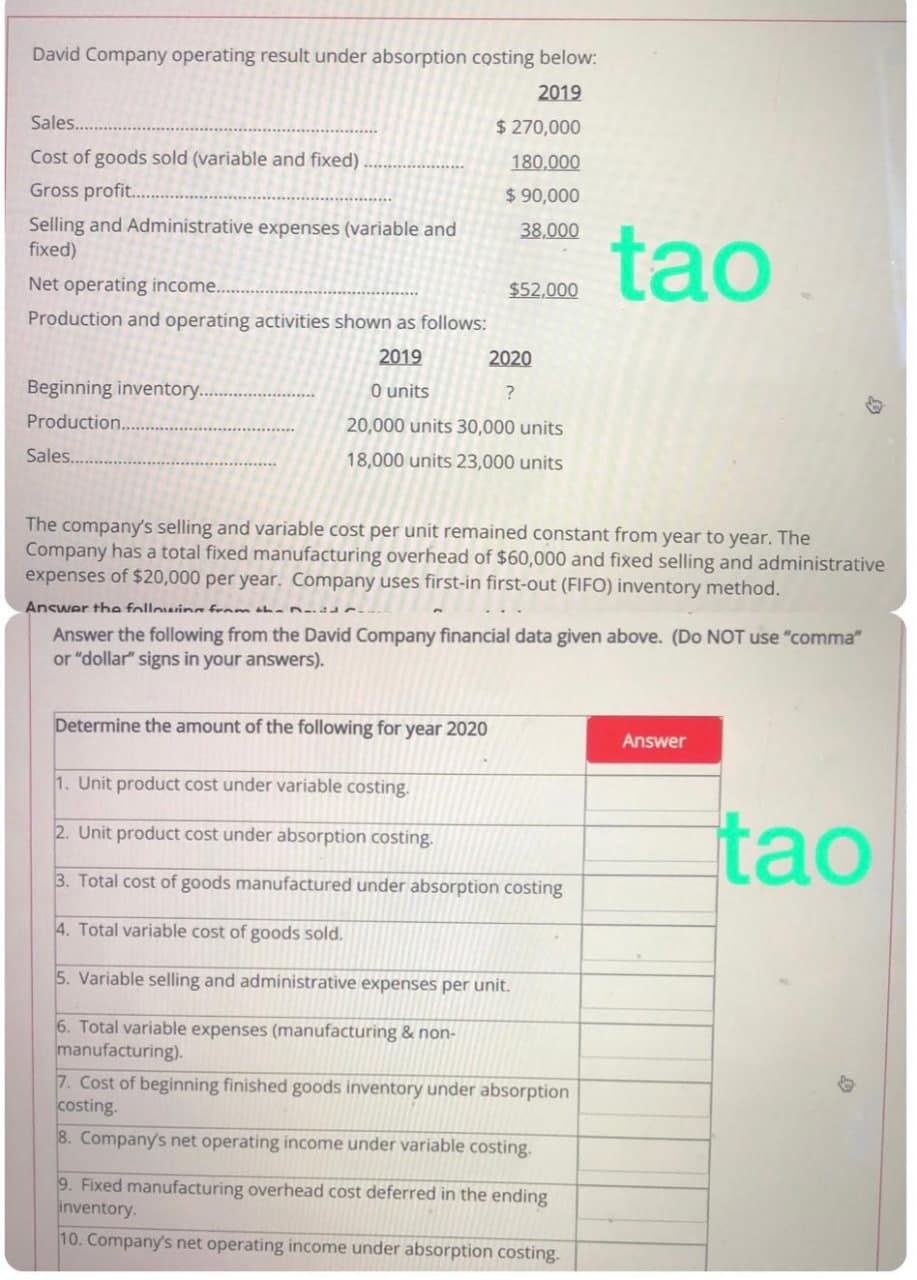

David Company operating result under absorption costing below: 2019 Sales.. $ 270,000 Cost of goods sold (variable and fixed) 180,000 Gross profit.... $ 90,000 Selling and Administrative expenses (variable and fixed) 38,000 tao Net operating income... $52,000 Production and operating activities shown as follows: 2019 2020 Beginning inventory.. O units Production... 20,000 units 30,000 units Sales. . 18,000 units 23,000 units The company's selling and variable cost per unit remained constant from year to year. The Company has a total fixed manufacturing overhead of $60,000 and fixed selling and administrative expenses of $20,000 per year. Company uses first-in first-out (FIFO) inventory method. Answer the followina from shaDd Answer the following from the David Company financial data given above. (Do NOT use "comma" or "dollar" signs in your answers). Determine the amount of the following for year 2020 Answer 1. Unit product cost under variable costing. ta 2. Unit product cost under absorption costing. o 3. Total cost of goods manufactured under absorption costing

David Company operating result under absorption costing below: 2019 Sales.. $ 270,000 Cost of goods sold (variable and fixed) 180,000 Gross profit.... $ 90,000 Selling and Administrative expenses (variable and fixed) 38,000 tao Net operating income... $52,000 Production and operating activities shown as follows: 2019 2020 Beginning inventory.. O units Production... 20,000 units 30,000 units Sales. . 18,000 units 23,000 units The company's selling and variable cost per unit remained constant from year to year. The Company has a total fixed manufacturing overhead of $60,000 and fixed selling and administrative expenses of $20,000 per year. Company uses first-in first-out (FIFO) inventory method. Answer the followina from shaDd Answer the following from the David Company financial data given above. (Do NOT use "comma" or "dollar" signs in your answers). Determine the amount of the following for year 2020 Answer 1. Unit product cost under variable costing. ta 2. Unit product cost under absorption costing. o 3. Total cost of goods manufactured under absorption costing

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 22E: Ellerson Company provided the following information for the last calendar year: During the year,...

Related questions

Question

answer quickly

Transcribed Image Text:David Company operating result under absorption costing below:

2019

Sales..

$ 270,000

Cost of goods sold (variable and fixed)

180,000

...

Gross profit.

$90,000

Selling and Administrative expenses (variable and

fixed)

38,000

tao

Net operating income...

$52,000

Production and operating activities shown as follows:

2019

2020

Beginning inventory..

O units

?

Production...

20,000 units 30,000 units

Sales..

18,000 units 23,000 units

The company's selling and variable cost per unit remained constant from year to year. The

Company has a total fixed manufacturing overhead of $60,000 and fixed selling and administrative

expenses of $20,000 per year. Company uses first-in first-out (FIFO) inventory method.

Answer the followin fram tha D-id

Answer the following from the David Company financial data given above. (Do NOT use "comma"

or "dollar" signs in your answers).

Determine the amount of the following for year 2020

Answer

1. Unit product cost under variable costing.

tao

2. Unit product cost under absorption costing.

3. Total cost of goods manufactured under absorption costing

4. Total variable cost of goods sold.

5. Variable selling and administrative expenses per unit.

6. Total variable expenses (manufacturing & non-

manufacturing).

7. Cost of beginning finished goods inventory under absorption

costing.

8. Company's net operating income under variable costing.

9. Fixed manufacturing overhead cost deferred in the ending

inventory.

10. Company's net operating income under absorption costing.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning