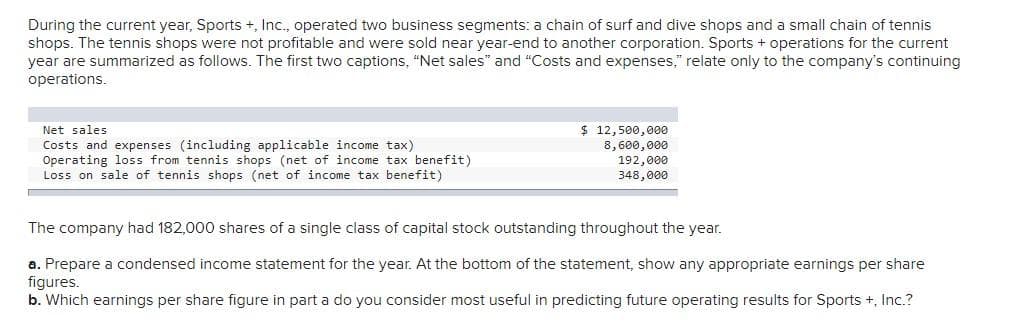

During the current year, Sports +, Inc., operated two business segments: a chain of surf and dive shops and a small chain of tennis shops. The tennis shops were not profitable and were sold near year-end to another corporation. Sports + operations for the current year are summarized as follows. The first two captions, "Net sales" and "Costs and expenses," relate only to the company's continuing operations. Net sales Costs and expenses (including applicable income tax) Operating loss from tennis shops (net of income tax benefit) Loss on sale of tennis shops (net of income tax benefit) $ 12,500,000 8,600,000 192,000 348,000 The company had 182,000 shares of a single class of capital stock outstanding throughout the year. a. Prepare a condensed income statement for the year. At the bottom of the statement, show any appropriate earnings per share figures. b. Which earnings per share figure in part a do you consider most useful in predicting future operating results for Sports +, Inc.?

During the current year, Sports +, Inc., operated two business segments: a chain of surf and dive shops and a small chain of tennis shops. The tennis shops were not profitable and were sold near year-end to another corporation. Sports + operations for the current year are summarized as follows. The first two captions, "Net sales" and "Costs and expenses," relate only to the company's continuing operations. Net sales Costs and expenses (including applicable income tax) Operating loss from tennis shops (net of income tax benefit) Loss on sale of tennis shops (net of income tax benefit) $ 12,500,000 8,600,000 192,000 348,000 The company had 182,000 shares of a single class of capital stock outstanding throughout the year. a. Prepare a condensed income statement for the year. At the bottom of the statement, show any appropriate earnings per share figures. b. Which earnings per share figure in part a do you consider most useful in predicting future operating results for Sports +, Inc.?

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter1: Accounting As A Form Of Communication

Section: Chapter Questions

Problem 1.3DC: Comparing Two Companies in the Same Industry: Chipotle and Panera Bread Refer to the financial...

Related questions

Question

Don't give answer in image format

Transcribed Image Text:During the current year, Sports +, Inc., operated two business segments: a chain of surf and dive shops and a small chain of tennis

shops. The tennis shops were not profitable and were sold near year-end to another corporation. Sports + operations for the current

year are summarized as follows. The first two captions, "Net sales" and "Costs and expenses," relate only to the company's continuing

operations.

Net sales

Costs and expenses (including applicable income tax)

Operating loss from tennis shops (net of income tax benefit)

Loss on sale of tennis shops (net of income tax benefit)

$ 12,500,000

8,600,000

192,000

348,000

The company had 182,000 shares of a single class of capital stock outstanding throughout the year.

a. Prepare a condensed income statement for the year. At the bottom of the statement, show any appropriate earnings per share

figures.

b. Which earnings per share figure in part a do you consider most useful in predicting future operating results for Sports +, Inc.?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College