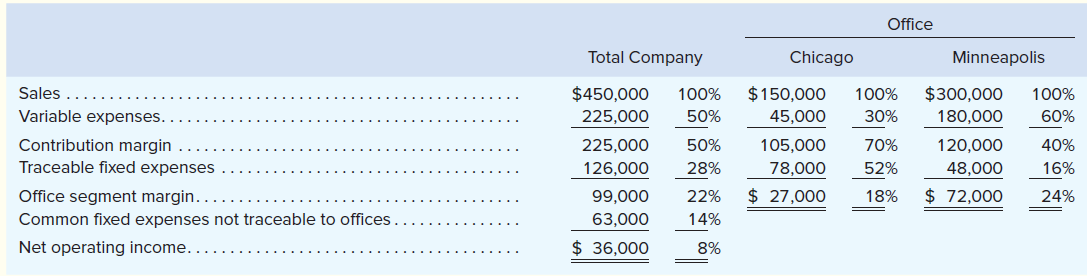

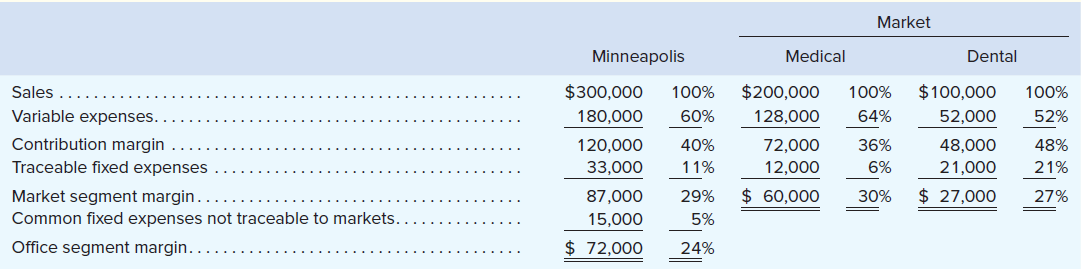

Office Total Company Chicago Minneapolis Sales $450,000 100% $150,000 100% $300,000 100% Variable expenses.. 225,000 50% 45,000 30% 180,000 60% Contribution margin Traceable fixed expenses 225,000 50% 105,000 70% 120,000 40% 126,000 28% 78,000 52% 48,000 16% Office segment margin.. 99,000 22% $ 27,000 18% $ 72,000 24% Common fixed expenses not traceable to offices . 63,000 14% Net operating income. $ 36,000 8% Market Minneapolis Medical Dental Sales $300,000 100% $200,000 100% $100,000 100% Variable expenses. 180,000 60% 128,000 64% 52,000 52% Contribution margin 120,000 40% 72,000 36% 48,000 48% Traceable fixed expenses 33,000 11% 12,000 6% 21,000 21% $ 60,000 $ 27,000 Market segment margin. Common fixed expenses not traceable to markets.. 87,000 29% 30% 27% 15,000 5% Office segment margin.. $ 72,000 24%

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Refer to the data in Exercise 6–16. Assume that Minneapolis’ sales by major market are:

The company would like to initiate an intensive advertising campaign in one of the two market segments during the next month. The campaign would cost $5,000. Marketing studies indicate that such a campaign would increase sales in the Medical market by $40,000 or increase sales in the Dental market by $35,000.

Required:

1. How much would the company’s profits increase (decrease) if it implemented the advertising campaign in the Medical Market?

2. How much would the company’s profits increase (decrease) if it implemented the advertising campaign in the Dental Market?

3. In which of the markets would you recommend that the company focus its advertising campaign?

4. In Exercise 6–16, Minneapolis shows $48,000 in traceable fixed expenses. What happened to the $48,000 in this exercise?

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images