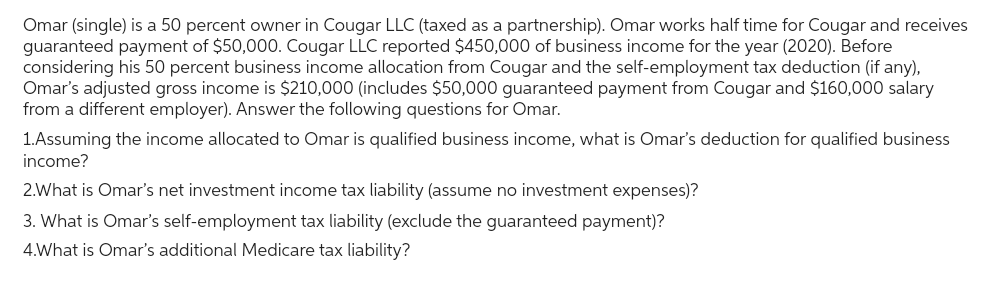

Omar (single) is a 50 percent owner in Cougar LLC (taxed as a partnership). Omar works half time for Cougar and receives guaranteed payment of $50,000. Cougar LLC reported $450,000 of business income for the year (2020). Before considering his 50 percent business income allocation from Cougar and the self-employment tax deduction (if any), Omar's adjusted gross income is $210,000 (includes $50,000 guaranteed payment from Cougar and $160,000 salary from a different employer). Answer the following questions for Omar. 1. Assuming the income allocated to Omar is qualified business income, what is Omar's deduction for qualified business income? 2.What is Omar's net investment income tax liability (assume no investment expenses)? 3. What is Omar's self-employment tax liability (exclude the guaranteed payment)? 4.What is Omar's additional Medicare tax liability?

Omar (single) is a 50 percent owner in Cougar LLC (taxed as a partnership). Omar works half time for Cougar and receives guaranteed payment of $50,000. Cougar LLC reported $450,000 of business income for the year (2020). Before considering his 50 percent business income allocation from Cougar and the self-employment tax deduction (if any), Omar's adjusted gross income is $210,000 (includes $50,000 guaranteed payment from Cougar and $160,000 salary from a different employer). Answer the following questions for Omar. 1. Assuming the income allocated to Omar is qualified business income, what is Omar's deduction for qualified business income? 2.What is Omar's net investment income tax liability (assume no investment expenses)? 3. What is Omar's self-employment tax liability (exclude the guaranteed payment)? 4.What is Omar's additional Medicare tax liability?

Chapter13: Choice Of Business Entity—general Tax And Nontax Factors/formation

Section: Chapter Questions

Problem 45P

Related questions

Question

Ef 541.

Transcribed Image Text:Omar (single) is a 50 percent owner in Cougar LLC (taxed as a partnership). Omar works half time for Cougar and receives

guaranteed payment of $50,000. Cougar LLC reported $450,000 of business income for the year (2020). Before

considering his 50 percent business income allocation from Cougar and the self-employment tax deduction (if any),

Omar's adjusted gross income is $210,000 (includes $50,000 guaranteed payment from Cougar and $160,000 salary

from a different employer). Answer the following questions for Omar.

1.Assuming the income allocated to Omar is qualified business income, what is Omar's deduction for qualified business

income?

2.What is Omar's net investment income tax liability (assume no investment expenses)?

3. What is Omar's self-employment tax liability (exclude the guaranteed payment)?

4.What is Omar's additional Medicare tax liability?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT