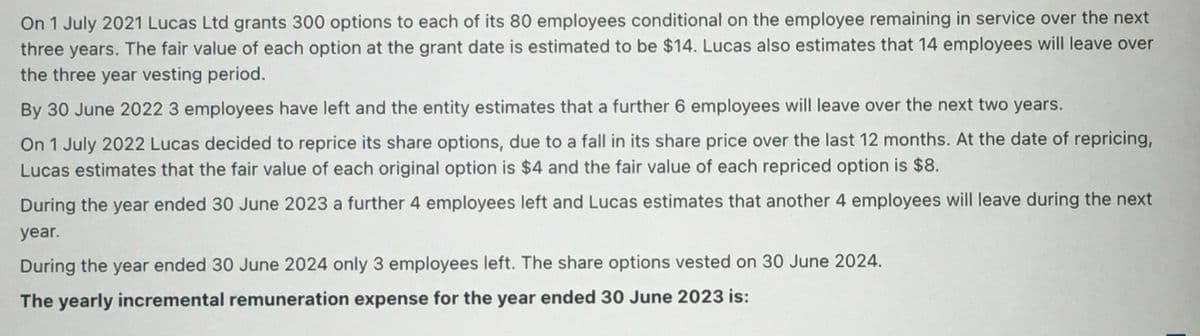

On 1 July 2021 Lucas Ltd grants 300 options to each of its 80 employees conditional on the employee remaining in service over the next three years. The fair value of each option at the grant date is estimated to be $14. Lucas also estimates that 14 employees will leave over the three year vesting period. By 30 June 2022 3 employees have left and the entity estimates that a further 6 employees will leave over the next two years. On 1 July 2022 Lucas decided to reprice its share options, due to a fall in its share price over the last 12 months. At the date of repricing, Lucas estimates that the fair value of each original option is $4 and the fair value of each repriced option is $8. During the year ended 30 June 2023 a further 4 employees left and Lucas estimates that another 4 employees will leave during the next year. During the year ended 30 June 2024 only 3 employees left. The share options vested on 30 June 2024. The yearly incremental remuneration expense for the year ended 30 June 2023 is:

On 1 July 2021 Lucas Ltd grants 300 options to each of its 80 employees conditional on the employee remaining in service over the next three years. The fair value of each option at the grant date is estimated to be $14. Lucas also estimates that 14 employees will leave over the three year vesting period. By 30 June 2022 3 employees have left and the entity estimates that a further 6 employees will leave over the next two years. On 1 July 2022 Lucas decided to reprice its share options, due to a fall in its share price over the last 12 months. At the date of repricing, Lucas estimates that the fair value of each original option is $4 and the fair value of each repriced option is $8. During the year ended 30 June 2023 a further 4 employees left and Lucas estimates that another 4 employees will leave during the next year. During the year ended 30 June 2024 only 3 employees left. The share options vested on 30 June 2024. The yearly incremental remuneration expense for the year ended 30 June 2023 is:

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter19: Accounting For Post Retirement Benefits

Section: Chapter Questions

Problem 6RE

Related questions

Question

Transcribed Image Text:On 1 July 2021 Lucas Ltd grants 300 options to each of its 80 employees conditional on the employee remaining in service over the next

three years. The fair value of each option at the grant date is estimated to be $14. Lucas also estimates that 14 employees will leave over

the three year vesting period.

By 30 June 2022 3 employees have left and the entity estimates that a further 6 employees will leave over the next two years.

On 1 July 2022 Lucas decided to reprice its share options, due to a fall in its share price over the last 12 months. At the date of repricing,

Lucas estimates that the fair value of each original option is $4 and the fair value of each repriced option is $8.

During the year ended 30 June 2023 a further 4 employees left and Lucas estimates that another 4 employees will leave during the next

year.

During the year ended 30 June 2024 only 3 employees left. The share options vested on 30 June 2024.

The yearly incremental remuneration expense for the year ended 30 June 2023 is:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT