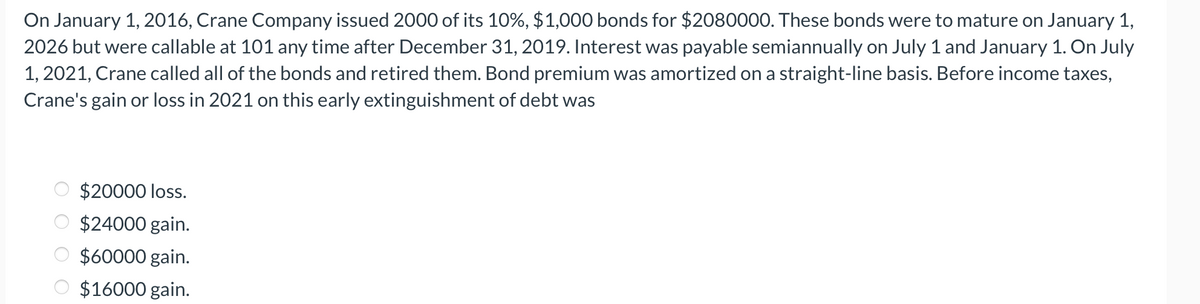

On January 1, 2016, Crane Company issued 2000 of its 10%, $1,000 bonds for $2080000. These bonds were to mature on January 1, 2026 but were callable at 101 any time after December 31, 2019. Interest was payable semiannually on July 1 and January 1. On July 1, 2021, Crane called all of the bonds and retired them. Bond premium was amortized on a straight-line basis. Before income taxes, Crane's gain or loss in 2021 on this early extinguishment of debt was O $20000 loss. O $24000 gain. O $60000 gain. O $16000 gain.

On January 1, 2016, Crane Company issued 2000 of its 10%, $1,000 bonds for $2080000. These bonds were to mature on January 1, 2026 but were callable at 101 any time after December 31, 2019. Interest was payable semiannually on July 1 and January 1. On July 1, 2021, Crane called all of the bonds and retired them. Bond premium was amortized on a straight-line basis. Before income taxes, Crane's gain or loss in 2021 on this early extinguishment of debt was O $20000 loss. O $24000 gain. O $60000 gain. O $16000 gain.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 8RE

Related questions

Question

Transcribed Image Text:On January 1, 2016, Crane Company issued 2000 of its 10%, $1,000 bonds for $2080000. These bonds were to mature on January 1,

2026 but were callable at 101 any time after December 31, 2019. Interest was payable semiannually on July 1 and January 1. On July

1, 2021, Crane called all of the bonds and retired them. Bond premium was amortized on a straight-line basis. Before income taxes,

Crane's gain or loss in 2021 on this early extinguishment of debt was

OOO O

$20000 loss.

$24000 gain.

$60000 gain.

$16000 gain.

Expert Solution

Step 1

The issuer of debt instruments such as callable bonds has the right to pay back the principal value of debt to the investor and discontinue the interest payment before the bond’s maturity period. At the time of the call of bonds, the issuer pays the call price together with the accumulated interest till the callable date.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College