On January 1, 2021, Alamar Corporation acquired a 40 percent interest in Burks, Inc., for $210,000. On that date, Burks's balance sheet disclosed net assets with both a fair and book value of $360,000. During 2021, Burks reported net income of $80,000 and declared and paid cash dividends of $25,000. Alamar sold inventory costing $30,000 to Burks during 2021 for $40,000. Burks used all of this merchandise in its operations during 2021. Prepare all of Alamar's 2021 journal entries to apply the equity method to this investment. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

On January 1, 2021, Alamar Corporation acquired a 40 percent interest in Burks, Inc., for $210,000. On that date, Burks's balance sheet disclosed net assets with both a fair and book value of $360,000. During 2021, Burks reported net income of $80,000 and declared and paid cash dividends of $25,000. Alamar sold inventory costing $30,000 to Burks during 2021 for $40,000. Burks used all of this merchandise in its operations during 2021. Prepare all of Alamar's 2021 journal entries to apply the equity method to this investment. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Chapter3: Setting Up A New Company

Section: Chapter Questions

Problem 3.7C

Related questions

Question

Please help me with all answers thanku

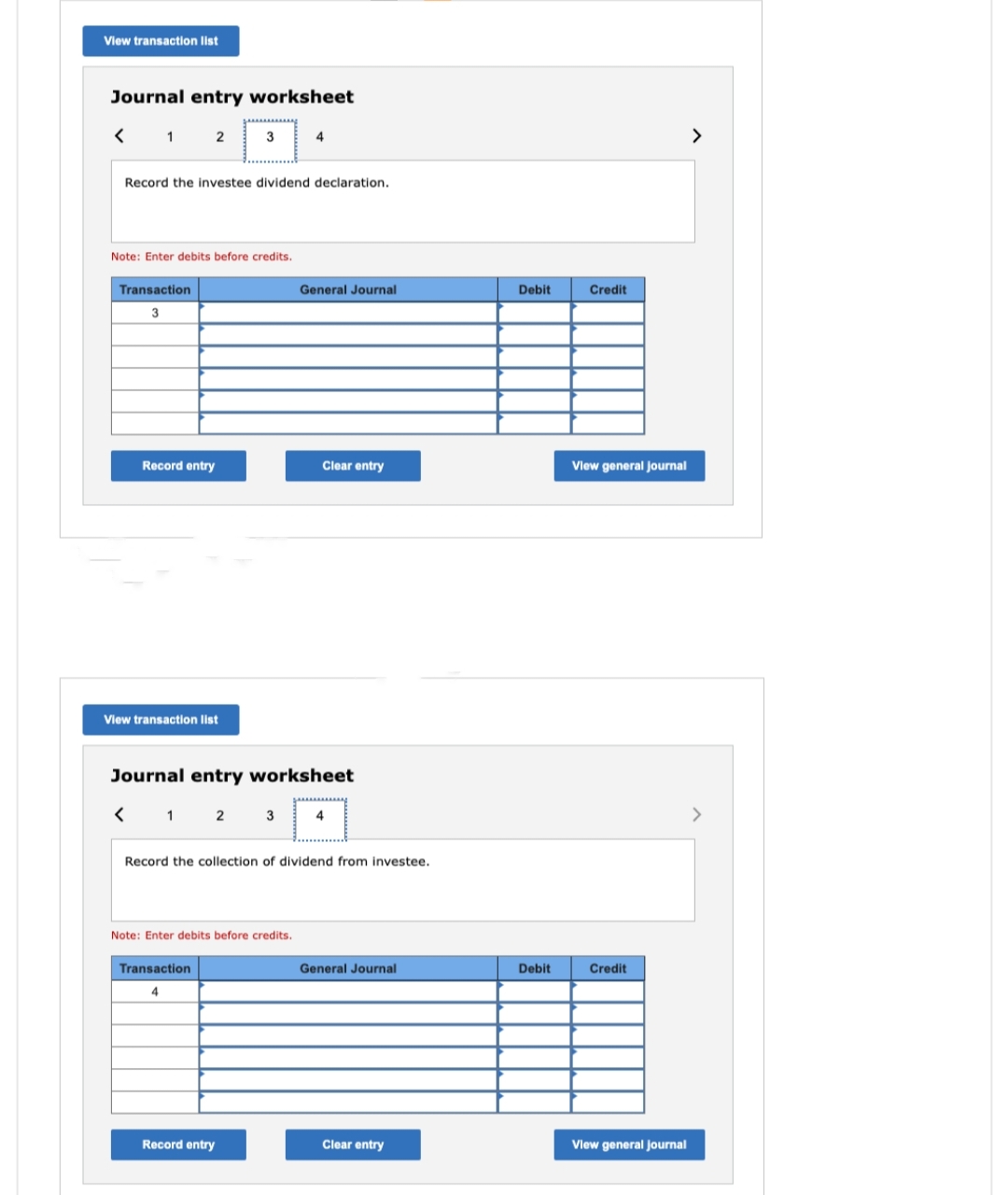

Transcribed Image Text:View transaction list

Journal entry worksheet

< 1 2 3

Record the investee dividend declaration.

Note: Enter debits before credits.

Transaction.

3

Record entry

View transaction list

4

Note: Enter debits before credits.

Journal entry worksheet

< 1 2 3

Transaction.

4

General Journal

Record entry

Clear entry

Record the collection of dividend from investee.

4

General Journal

Clear entry

Debit

Debit

Credit

View general Journal

Credit

View general Journal

>

>

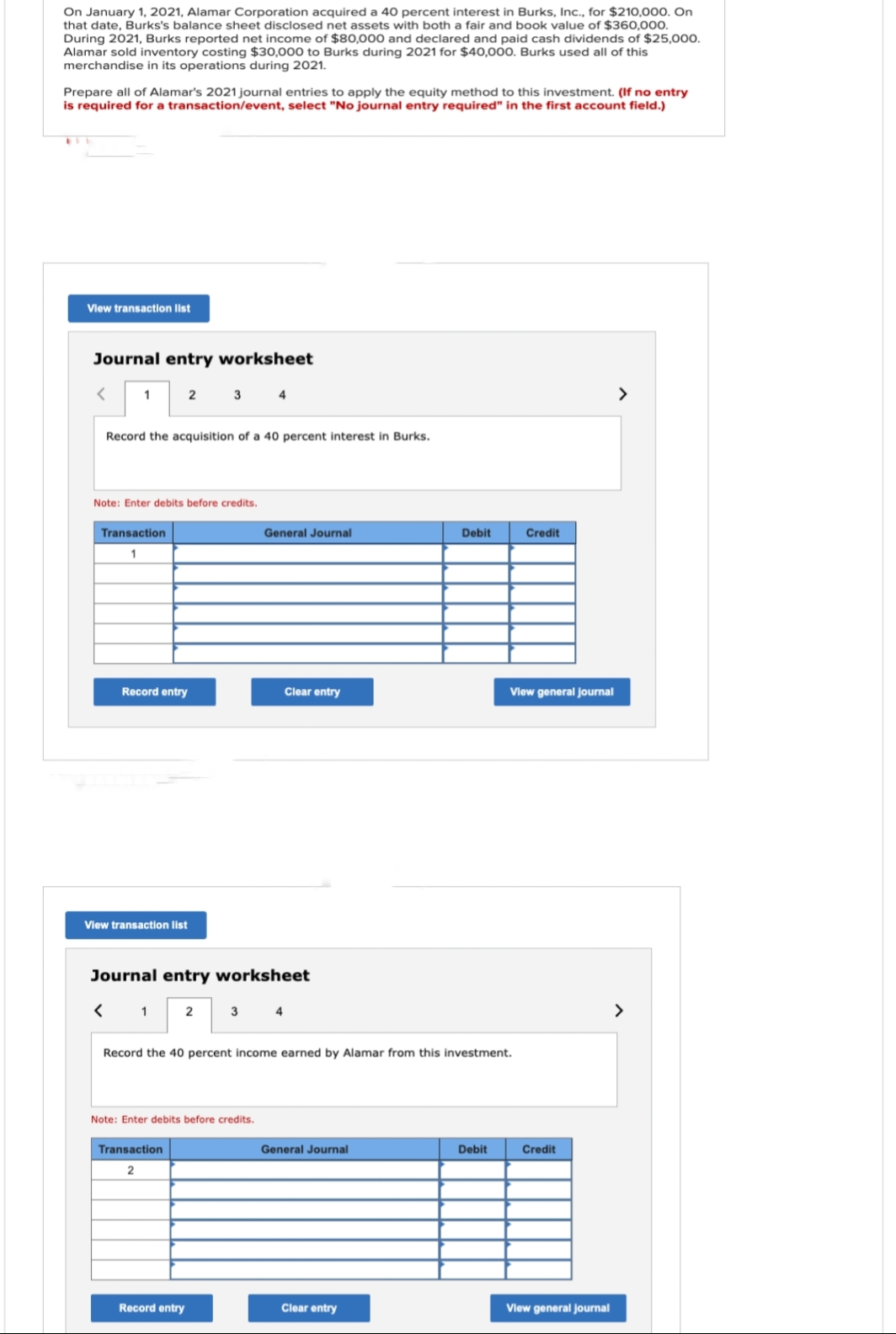

Transcribed Image Text:On January 1, 2021, Alamar Corporation acquired a 40 percent interest in Burks, Inc., for $210,000. On

that date, Burks's balance sheet disclosed net assets with both a fair and book value of $360,000.

During 2021, Burks reported net income of $80,000 and declared and paid cash dividends of $25,000.

Alamar sold inventory costing $30,000 to Burks during 2021 for $40,000. Burks used all of this

merchandise in its operations during 2021.

Prepare all of Alamar's 2021 journal entries to apply the equity method to this investment. (If no entry

is required for a transaction/event, select "No journal entry required" in the first account field.)

View transaction list

Journal entry worksheet

1

Record the acquisition of a 40 percent interest in Burks.

Note: Enter debits before credits.

Transaction

1

2 3 4

Record entry

View transaction list

Journal entry worksheet

< 1 2

Transaction

2

General Journal

Note: Enter debits before credits.

Record entry

Clear entry

3 4

Record the 40 percent income earned by Alamar from this investment.

General Journal

Debit

Clear entry

Debit

Credit

View general Journal

Credit

View general Journal

>

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College