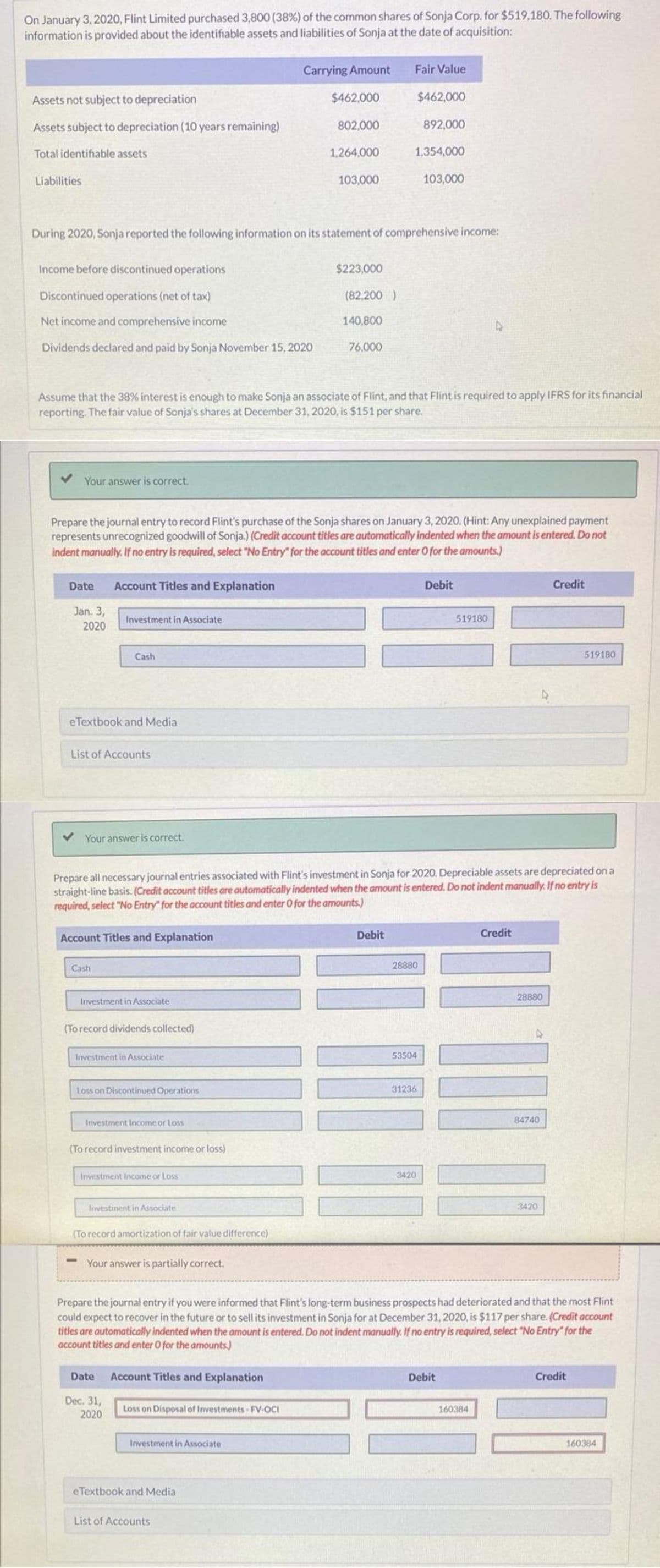

On January 3, 2020, Flint Limited purchased 3,800 (38%) of the common shares of Sonja Corp. for $519,180. The following information is provided about the identifiable assets and liabilities of Sonja at the date of acquisition: Assets not subject to depreciation Assets subject to depreciation (10 years remaining) Total identifiable assets Liabilities Income before discontinued operations Discontinued operations (net of tax) Net income and comprehensive income Dividends declared and paid by Sonja November 15, 2020 Your answer is correct. Date Jan. 3, 2020 Account Titles and Explanation During 2020, Sonja reported the following information on its statement of comprehensive income: Investment in Associate eTextbook and Media Cash List of Accounts Cash Your answer is correct. Assume that the 38% interest is enough to make Sonja an associate of Flint, and that Flint is required to apply IFRS for its financiall reporting. The fair value of Sonja's shares at December 31, 2020, is $151 per share. Investment in Associate Prepare the journal entry to record Flint's purchase of the Sonja shares on January 3, 2020. (Hint: Any unexplained payment represents unrecognized goodwill of Sonja.) (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (To record dividends collected) Investment in Associate Loss on Discontinued Operations Investment Income or loss (To record investment income or loss) Investment Income or Loss Investment in Associate (To record amortization of fair value difference) Carrying Amount Your answer is partially correct. Dec. 31, 2020 $462,000 Date Account Titles and Explanation 802,000 1,264,000 Loss on Disposal of Investments-FV-OCI 103,000 Prepare all necessary journal entries associated with Flint's investment in Sonja for 2020. Depreciable assets are depreciated on a straight-line basis. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts) Account Titles and Explanation Investment in Associate $223,000 (82,200 ) 140,800 76,000 Fair Value $462,000 1,354,000 Debit 892,000 28880 103,000 53504 31236 3420 Debit 519180 Debit Credit Prepare the journal entry if you were informed that Flint's long-term business prospects had deteriorated and that the most Flint could expect to recover in the future or to sell its investment in Sonja for at December 31, 2020, is $117 per share. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts) 160384 28880 84740 Credit 3420 519180 Credit 160384

On January 3, 2020, Flint Limited purchased 3,800 (38%) of the common shares of Sonja Corp. for $519,180. The following information is provided about the identifiable assets and liabilities of Sonja at the date of acquisition: Assets not subject to depreciation Assets subject to depreciation (10 years remaining) Total identifiable assets Liabilities Income before discontinued operations Discontinued operations (net of tax) Net income and comprehensive income Dividends declared and paid by Sonja November 15, 2020 Your answer is correct. Date Jan. 3, 2020 Account Titles and Explanation During 2020, Sonja reported the following information on its statement of comprehensive income: Investment in Associate eTextbook and Media Cash List of Accounts Cash Your answer is correct. Assume that the 38% interest is enough to make Sonja an associate of Flint, and that Flint is required to apply IFRS for its financiall reporting. The fair value of Sonja's shares at December 31, 2020, is $151 per share. Investment in Associate Prepare the journal entry to record Flint's purchase of the Sonja shares on January 3, 2020. (Hint: Any unexplained payment represents unrecognized goodwill of Sonja.) (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (To record dividends collected) Investment in Associate Loss on Discontinued Operations Investment Income or loss (To record investment income or loss) Investment Income or Loss Investment in Associate (To record amortization of fair value difference) Carrying Amount Your answer is partially correct. Dec. 31, 2020 $462,000 Date Account Titles and Explanation 802,000 1,264,000 Loss on Disposal of Investments-FV-OCI 103,000 Prepare all necessary journal entries associated with Flint's investment in Sonja for 2020. Depreciable assets are depreciated on a straight-line basis. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts) Account Titles and Explanation Investment in Associate $223,000 (82,200 ) 140,800 76,000 Fair Value $462,000 1,354,000 Debit 892,000 28880 103,000 53504 31236 3420 Debit 519180 Debit Credit Prepare the journal entry if you were informed that Flint's long-term business prospects had deteriorated and that the most Flint could expect to recover in the future or to sell its investment in Sonja for at December 31, 2020, is $117 per share. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts) 160384 28880 84740 Credit 3420 519180 Credit 160384

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 19E

Related questions

Question

need help with the last part.

Transcribed Image Text:On January 3, 2020, Flint Limited purchased 3,800 (38 %) of the common shares of Sonja Corp. for $519,180. The following

information is provided about the identifiable assets and liabilities of Sonja at the date of acquisition:

Assets not subject to depreciation

Assets subject to depreciation (10 years remaining)

Total identifiable assets

Liabilities

Income before discontinued operations

Discontinued operations (net of tax)

Net income and comprehensive income

Dividends declared and paid by Sonja November 15, 2020

Your answer is correct.

During 2020, Sonja reported the following information on its statement of comprehensive income:

Date

Jan. 3,

2020

Investment in Associate

Cash

eTextbook and Media

List of Accounts

Assume that the 38% interest is enough to make Sonja an associate of Flint, and that Flint is required to apply IFRS for its financial

reporting. The fair value of Sonja's shares at December 31, 2020, is $151 per share.

Your answer is correct.

Cash

Prepare the journal entry to record Flint's purchase of the Sonja shares on January 3, 2020. (Hint: Any unexplained payment

represents unrecognized goodwill of Sonja.) (Credit account titles are automatically indented when the amount is entered. Do not

indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Account Titles and Explanation

Account Titles and Explanation

Investment in Associate

(To record dividends collected)

Investment in Associate

Loss on Discontinued Operations

Investment Income or loss

(To record investment income or loss)

Investment Income or Loss

Investment in Associate

(To record amortization of fair value difference)

- Your answer is partially correct.

Carrying Amount

$462,000

Prepare all necessary journal entries associated with Flint's investment in Sonja for 2020. Depreciable assets are depreciated on a

straight-line basis. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is

required, select "No Entry" for the account titles and enter O for the amounts.)

Date Account Titles and Explanation

Dec. 31,

2020

802,000

1,264,000

Loss on Disposal of Investments-FV-OCI

103,000

Investment in Associate

eTextbook and Media

$223,000

List of Accounts

(82,200 )

140,800

76,000

Fair Value

$462,000

892,000

1,354,000

103,000

Debit

28880

100

53504

31236

Debit

3420

519180

Debit

Credit

deteriorated

and that the most Flint

Prepare the journal entry if you were informed that Flint's long-term business prospects had

could expect to recover in the future or to sell its investment in Sonja for at December 31, 2020, is $117 per share. (Credit account

titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the

account titles and enter O for the amounts.)

28880

101 11

160384

84740

Credit

3420

519180

Credit

160384

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning