on the Climbing Wall, and 10 on the canteen. The depreciation of the Centre is £121,000 per year and should be apportioned by size. The canteen is used by all employees in the surf and climbing centres and its cost should be re-apportioned on that basis. An external firm is used for maintenance of the equipment in the two centres. In the past, the invoices from this firm have been charged as an overhead cost. The invoice for this year was £43,000 for 75 hours work. One-third of this related to work on the Climbing Centre and the remainder related to the Surf Centre. Variable costs related to the Surf Centre were £600,000 and for the Climbing Centre were £110,000. Required (a) Apportion the overheads between the three departments. Clearly state the basis used for apportioning each of the costs. (b) Re-apportion the canteen costs between the two centres. (c) Calculate the Contribution and Profit for the two centres. (d) Discuss the relative performance of the two centres in relation to the two methods of assessment. Make a recommendation for how Mr Honnold should assess the two in the future.

on the Climbing Wall, and 10 on the canteen. The depreciation of the Centre is £121,000 per year and should be apportioned by size. The canteen is used by all employees in the surf and climbing centres and its cost should be re-apportioned on that basis. An external firm is used for maintenance of the equipment in the two centres. In the past, the invoices from this firm have been charged as an overhead cost. The invoice for this year was £43,000 for 75 hours work. One-third of this related to work on the Climbing Centre and the remainder related to the Surf Centre. Variable costs related to the Surf Centre were £600,000 and for the Climbing Centre were £110,000. Required (a) Apportion the overheads between the three departments. Clearly state the basis used for apportioning each of the costs. (b) Re-apportion the canteen costs between the two centres. (c) Calculate the Contribution and Profit for the two centres. (d) Discuss the relative performance of the two centres in relation to the two methods of assessment. Make a recommendation for how Mr Honnold should assess the two in the future.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter11: Strategic Cost Management

Section: Chapter Questions

Problem 4CE: Kagle design engineers are in the process of developing a new green product, one that will...

Related questions

Question

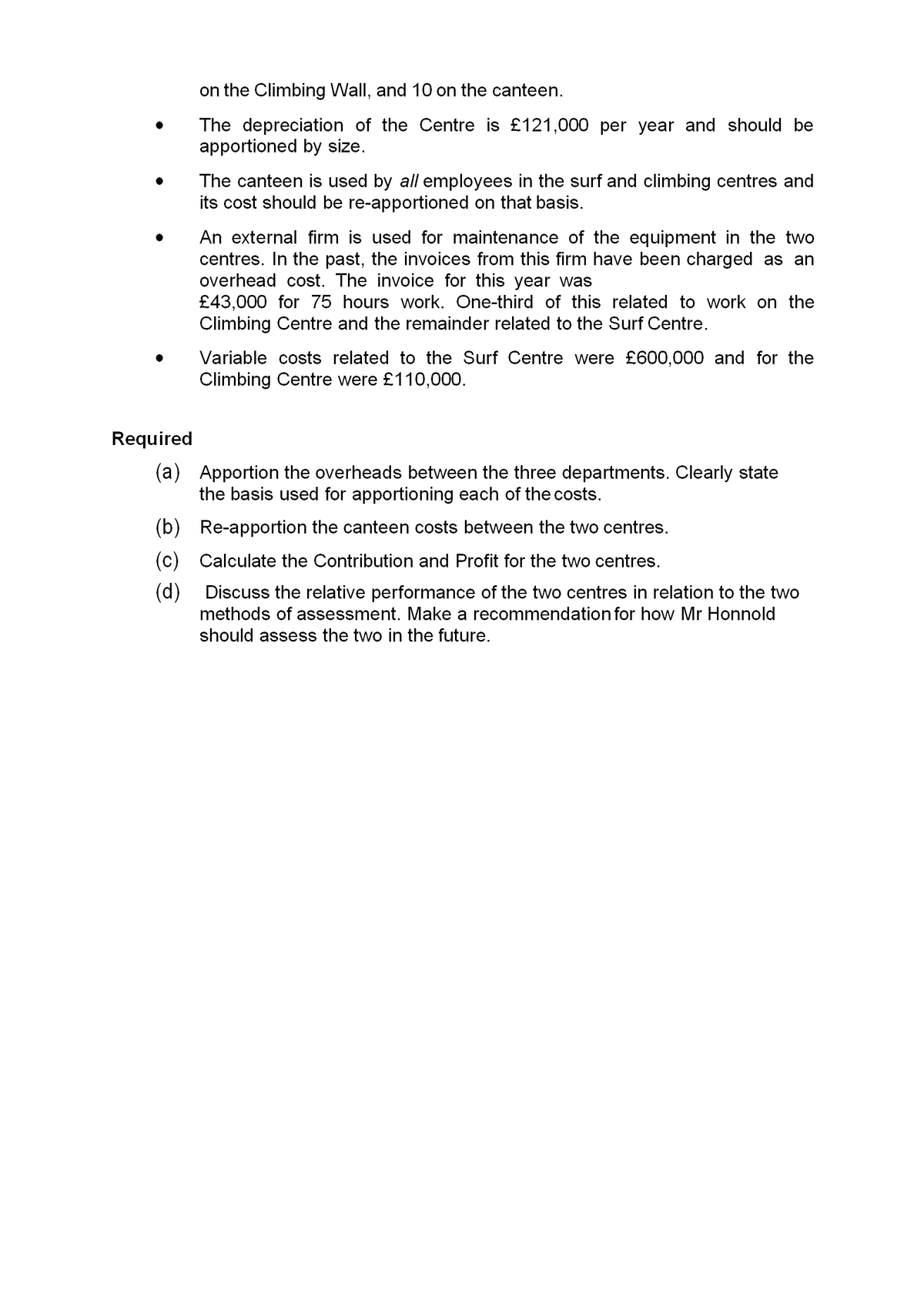

Transcribed Image Text:on the Climbing Wall, and 10 on the canteen.

The depreciation of the Centre is £121,000 per year and should be

apportioned by size.

The canteen is used by all employees in the surf and climbing centres and

its cost should be re-apportioned on that basis.

An external firm is used for maintenance of the equipment in the two

centres. In the past, the invoices from this firm have been charged as an

overhead cost. The invoice for this year was

£43,000 for 75 hours work. One-third of this related to work on the

Climbing Centre and the remainder related to the Surf Centre.

Variable costs related to the Surf Centre were £600,000 and for the

Climbing Centre were £110,000.

Required

(a) Apportion the overheads between the three departments. Clearly state

the basis used for apportioning each of the costs.

(b) Re-apportion the canteen costs between the two centres.

(c) Calculate the Contribution and Profit for the two centres.

(d)

Discuss the relative performance of the two centres in relation to the two

methods of assessment. Make a recommendation for how Mr Honnold

should assess the two in the future.

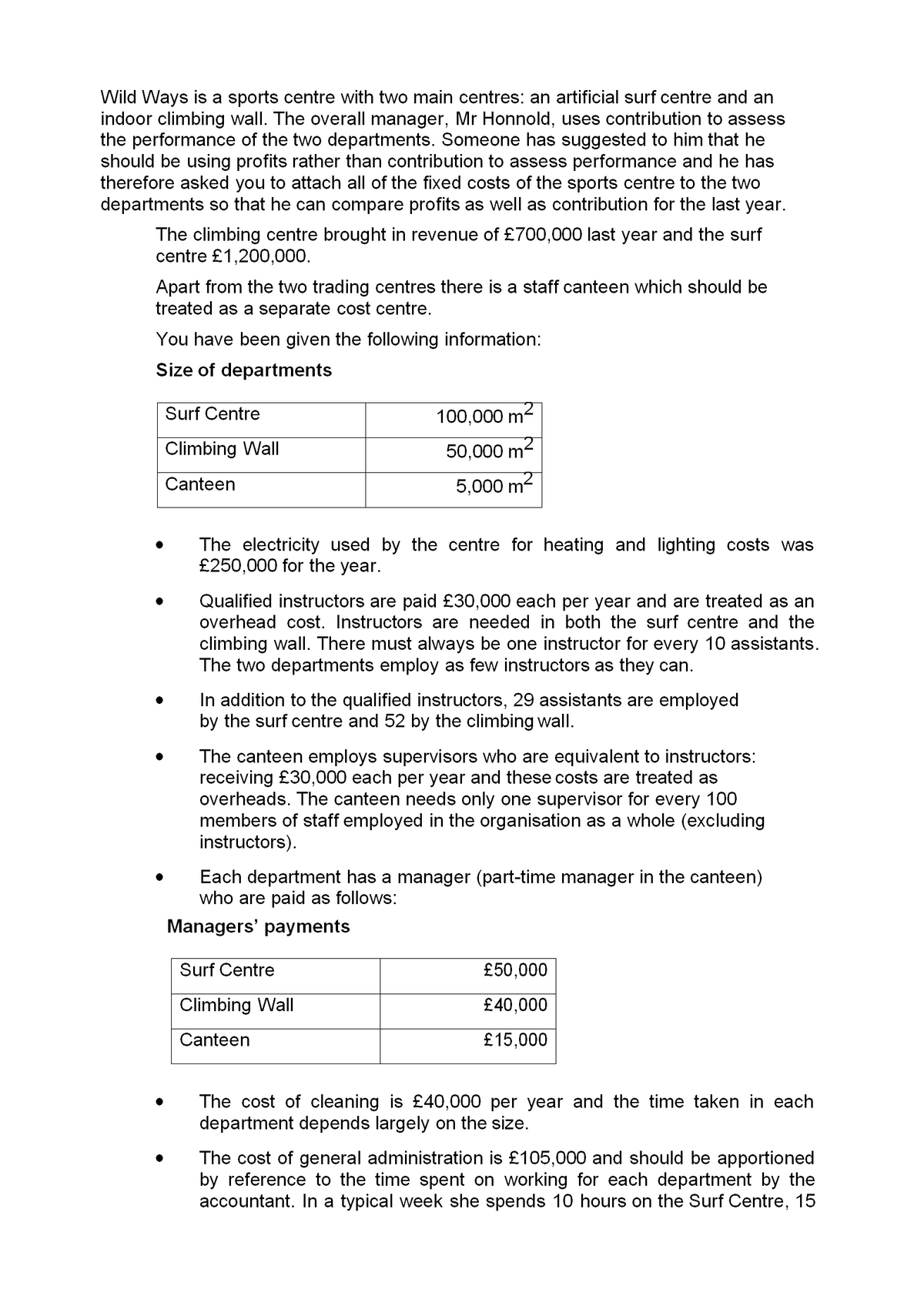

Transcribed Image Text:Wild Ways is a sports centre with two main centres: an artificial surf centre and an

indoor climbing wall. The overall manager, Mr Honnold, uses contribution to assess

the performance of the two departments. Someone has suggested to him that he

should be using profits rather than contribution to assess performance and he has

therefore asked you to attach all of the fixed costs of the sports centre to the two

departments so that he can compare profits as well as contribution for the last year.

The climbing centre brought in revenue of £700,000 last year and the surf

centre £1,200,000.

Apart from the two trading centres there is a staff canteen which should be

treated as a separate cost centre.

You have been given the following information:

Size of departments

Surf Centre

100,000 m2

Climbing Wall

50,000 m2

Canteen

5,000 m2

The electricity used by the centre for heating and lighting costs was

£250,000 for the year.

Qualified instructors are paid £30,000 each per year and are treated as an

overhead cost. Instructors are needed in both the surf centre and the

climbing wall. There must always be one instructor for every 10 assistants.

The two departments employ as few instructors as they can.

In addition to the qualified instructors, 29 assistants are employed

by the surf centre and 52 by the climbing wall.

The canteen employs supervisors who are equivalent to instructors:

receiving £30,000 each per year and these costs are treated as

overheads. The canteen needs only one supervisor for every 100

members of staff employed in the organisation as a whole (excluding

instructors).

Each department has a manager (part-time manager in the canteen)

who are paid as follows:

Managers' payments

Surf Centre

£50,000

Climbing Wall

£40,000

Canteen

£15,000

The cost of cleaning is £40,000 per year and the time taken in each

department depends largely on the size.

The cost of general administration is £105,000 and should be apportioned

by reference to the time spent on working for each department by the

accountant. In a typical week she spends 10 hours on the Surf Centre, 15

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College