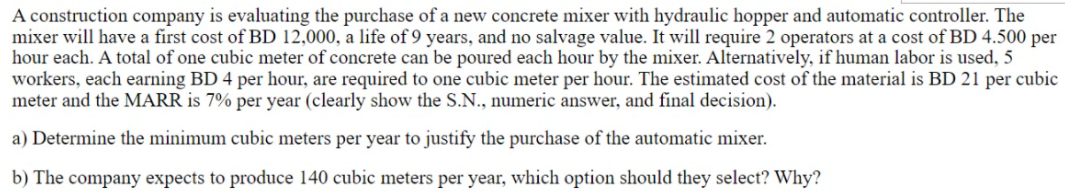

A construction company is evaluating the purchase of a new concrete mixer with hydraulic hopper and automatic controller. The mixer will have a first cost of BD 12,000, a life of 9 years, and no salvage value. It will require 2 operators at a cost of BD 4.500 per hour each. A total of one cubic meter of concrete can be poured each hour by the mixer. Alternatively, if human labor is used, 5 workers, each earning BD 4 per hour, are required to one cubic meter per hour. The estimated cost of the material is BD 21 per cubic meter and the MARR is 7% per year (clearly show the S.N., numeric answer, and final decision). a) Determine the minimum cubic meters per year to justify the purchase of the automatic mixer. b) The company expects to produce 140 cubic meters per year, which option should they select? Why?

A construction company is evaluating the purchase of a new concrete mixer with hydraulic hopper and automatic controller. The mixer will have a first cost of BD 12,000, a life of 9 years, and no salvage value. It will require 2 operators at a cost of BD 4.500 per hour each. A total of one cubic meter of concrete can be poured each hour by the mixer. Alternatively, if human labor is used, 5 workers, each earning BD 4 per hour, are required to one cubic meter per hour. The estimated cost of the material is BD 21 per cubic meter and the MARR is 7% per year (clearly show the S.N., numeric answer, and final decision). a) Determine the minimum cubic meters per year to justify the purchase of the automatic mixer. b) The company expects to produce 140 cubic meters per year, which option should they select? Why?

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 9P

Related questions

Question

Transcribed Image Text:A construction company is evaluating the purchase of a new concrete mixer with hydraulic hopper and automatic controller. The

mixer will have a first cost of BD 12,000, a life of 9 years, and no salvage value. It will require 2 operators at a cost of BD 4.500 per

hour each. A total of one cubic meter of concrete can be poured each hour by the mixer. Alternatively, if human labor is used, 5

workers, each earning BD 4 per hour, are required to one cubic meter per hour. The estimated cost of the material is BD 21 per cubic

meter and the MARR is 7% per year (clearly show the S.N., numeric answer, and final decision).

a) Determine the minimum cubic meters per year to justify the purchase of the automatic mixer.

b) The company expects to produce 140 cubic meters per year, which option should they select? Why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning