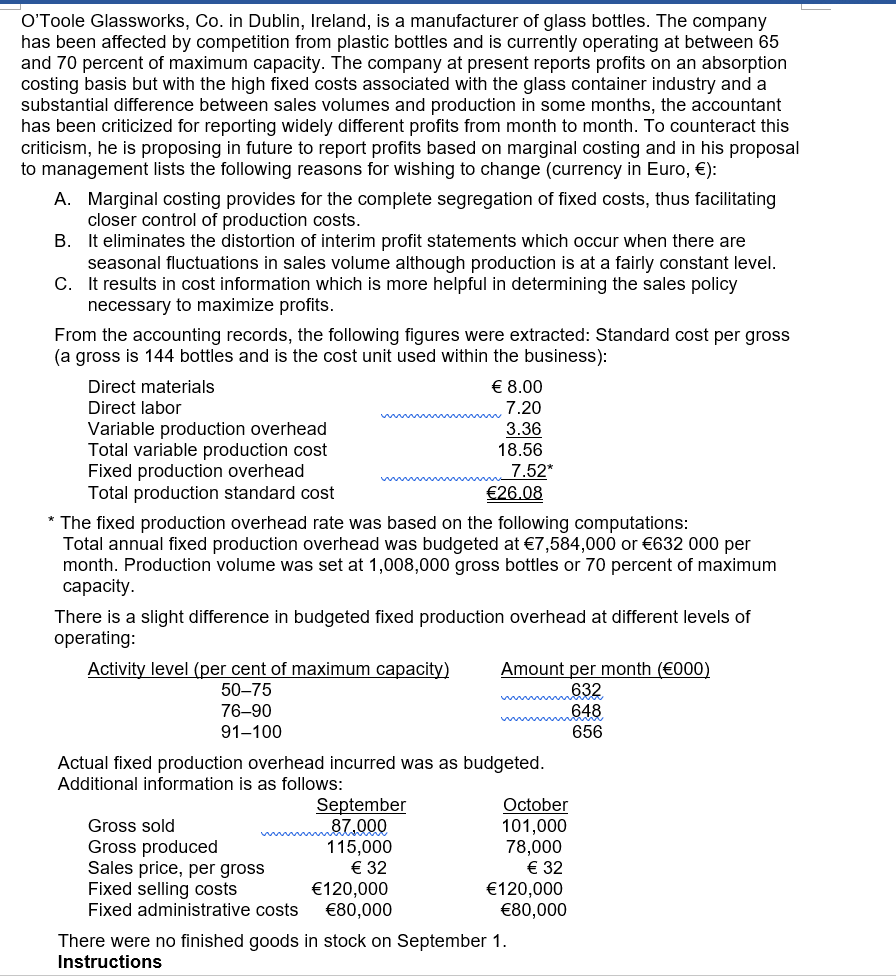

O'Toole Glassworks, Co. in Dublin, Ireland, is a manufacturer of glass bottles. The company has been affected by competition from plastic bottles and is currently operating at between 65 and 70 percent of maximum capacity. The company at present reports profits on an absorption costing basis but with the high fixed costs associated with the glass container industry and a substantial difference between sales volumes and production in some months, the accountant has been criticized for reporting widely different profits from month to month. To counteract this criticism, he is proposing in future to report profits based on marginal costing and in his proposal to management lists the following reasons for wishing to change (currency in Euro, €): A. Marginal costing provides for the complete segregation of fixed costs, thus facilitating closer control of production costs. B. It eliminates the distortion of interim profit statements which occur when there are seasonal fluctuations in sales volume although production is at a fairly constant level. C. It results in cost information which is more helpful in determining the sales policy necessary to maximize profits. From the accounting records, the following figures were extracted: Standard cost per gross (a gross is 144 bottles and is the cost unit used within the business): Direct materials € 8.00 Direct labor 7.20 Variable production overhead Total variable production cost Fixed production overhead Total production standard cost 3.36 18.56 7.52* €26.08 * The fixed production overhead rate was based on the following computations: Total annual fixed production overhead was budgeted at €7,584,000 or €632 000 per month. Production volume was set at 1,008,000 gross bottles or 70 percent of maximum сарacity. There is a slight difference in budgeted fixed production overhead at different levels of operating: Activity level (per cent of maximum capacity) Amount per month (€000) 632 648 50–75 76–90 91–100 656 Actual fixed production overhead incurred was as budgeted. Additional information is as follows: September 87.000 115,000 € 32 €120,000 Fixed administrative costs €80,000 October 101,000 78,000 € 32 €120,000 €80,000 Gross sold Gross produced Sales price, per gross Fixed selling costs There were no finished goods in stock on September 1.

O'Toole Glassworks, Co. in Dublin, Ireland, is a manufacturer of glass bottles. The company has been affected by competition from plastic bottles and is currently operating at between 65 and 70 percent of maximum capacity. The company at present reports profits on an absorption costing basis but with the high fixed costs associated with the glass container industry and a substantial difference between sales volumes and production in some months, the accountant has been criticized for reporting widely different profits from month to month. To counteract this criticism, he is proposing in future to report profits based on marginal costing and in his proposal to management lists the following reasons for wishing to change (currency in Euro, €): A. Marginal costing provides for the complete segregation of fixed costs, thus facilitating closer control of production costs. B. It eliminates the distortion of interim profit statements which occur when there are seasonal fluctuations in sales volume although production is at a fairly constant level. C. It results in cost information which is more helpful in determining the sales policy necessary to maximize profits. From the accounting records, the following figures were extracted: Standard cost per gross (a gross is 144 bottles and is the cost unit used within the business): Direct materials € 8.00 Direct labor 7.20 Variable production overhead Total variable production cost Fixed production overhead Total production standard cost 3.36 18.56 7.52* €26.08 * The fixed production overhead rate was based on the following computations: Total annual fixed production overhead was budgeted at €7,584,000 or €632 000 per month. Production volume was set at 1,008,000 gross bottles or 70 percent of maximum сарacity. There is a slight difference in budgeted fixed production overhead at different levels of operating: Activity level (per cent of maximum capacity) Amount per month (€000) 632 648 50–75 76–90 91–100 656 Actual fixed production overhead incurred was as budgeted. Additional information is as follows: September 87.000 115,000 € 32 €120,000 Fixed administrative costs €80,000 October 101,000 78,000 € 32 €120,000 €80,000 Gross sold Gross produced Sales price, per gross Fixed selling costs There were no finished goods in stock on September 1.

Chapter6: Activity-based, Variable, And Absorption Costing

Section: Chapter Questions

Problem 14PA: Summarized data for Walrus Co. for its first year of operations are: A. Prepare an income statement...

Related questions

Question

Transcribed Image Text:Instructions

1. Prepare monthly profit statements for September and October using

A.

B. Marginal costing

Transcribed Image Text:O'Toole Glassworks, Co. in Dublin, Ireland, is a manufacturer of glass bottles. The company

has been affected by competition from plastic bottles and is currently operating at between 65

and 70 percent of maximum capacity. The company at present reports profits on an absorption

costing basis but with the high fixed costs associated with the glass container industry and a

substantial difference between sales volumes and production in some months, the accountant

has been criticized for reporting widely different profits from month to month. To counteract this

criticism, he is proposing in future to report profits based on marginal costing and in his proposal

to management lists the following reasons for wishing to change (currency in Euro, €):

A. Marginal costing provides for the complete segregation of fixed costs, thus facilitating

closer control of production costs.

B. It eliminates the distortion of interim profit statements which occur when there are

seasonal fluctuations in sales volume although production is at a fairly constant level.

C. It results in cost information which is more helpful in determining the sales policy

necessary to maximize profits.

From the accounting records, the following figures were extracted: Standard cost per gross

(a gross is 144 bottles and is the cost unit used within the business):

Direct materials

€ 8.00

Direct labor

7.20

Variable production overhead

Total variable production cost

Fixed production overhead

Total production standard cost

3.36

18.56

7.52*

€26.08

* The fixed production overhead rate was based on the following computations:

Total annual fixed production overhead was budgeted at €7,584,000 or €632 000 per

month. Production volume was set at 1,008,000 gross bottles or 70 percent of maximum

сарacity.

There is a slight difference in budgeted fixed production overhead at different levels of

operating:

Activity level (per cent of maximum capacity)

Amount per month (€000)

632

648

656

50–75

76-90

91-100

Actual fixed production overhead incurred was as budgeted.

Additional information is as follows:

September

87.000

115,000

€ 32

€120,000

€80,000

October

101,000

78,000

€ 32

€120,000

€80,000

Gross sold

Gross produced

Sales price, per gross

Fixed selling costs

Fixed administrative costs

There were no finished goods in stock on September 1.

Instructions

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,