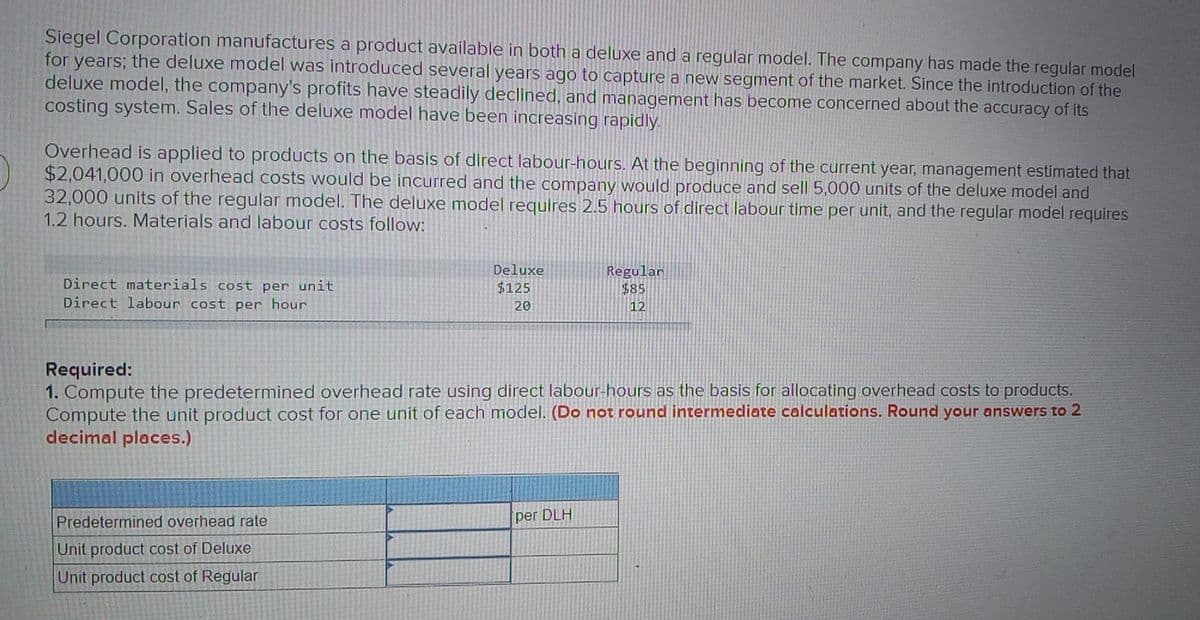

Siegel Corporation manufactures a product available in both a deluxe and a regular model. The company has made the regular model for years; the deluxe model was introduced several years ago to capture a new segment of the market. Since the introduction of the deluxe model, the company's profits have steadily declined, and management has become concerned about the accuracy of its costing system. Sales of the deluxe model have been increasing rapidly. Overhead is applied to products on the basis of direct labour-hours. At the beginning of the current year, management estimated that $2,041,000 in overhead costs would be incurred and the company would produce and sell 5,000 units of the deluxe model and 32,000 units of the regular model. The deluxe model requires 2.5 hours of direct labour time per unit, and the regular model requires 1.2 hours. Materials and labour costs follow: Direct materials cost per unit Direct labour cost per hour Deluxe $125 Regular $85 20 12 Required: 1. Compute the predetermined overhead rate using direct labour-hours as the basis for allocating overhead costs to products. Compute the unit product cost for one unit of each model. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Predetermined overhead rate per DLH Unit product cost of Deluxe Unit product cost of Regular

Q: Required: a. How much overhead will be assigned to each product if these three cost drivers are…

A:

Q: Laredo Leather Company manufactures high-quality leather goods. The company’s profits have declined…

A: INTRODUCTION: Management accountants work with public enterprises, private firms, and government…

Q: Maglie Company manufactures two video game consoles: handheld and home. The handheld consoles are…

A: Case 1:Under ABC CostingActivity based costing allocates manufacturing overhead on a more logical…

Q: Q.Compare the costs of the doors in requirements 1 and 2. Why do the simple and activity-based…

A: Compare the cost of the doors in requirement 1 and 2 and to find the reason for difference in the…

Q: Required: a. How much overhead will be assigned to each product if these three cost drivers are…

A: In this Numerical Has Covered The concept of Activity Based Costing and Traditional Costing.…

Q: Tool Industries manufactures large workbenches for industrial use. Sam Hartnet, the Vice President…

A: According to the question, we are required to compute the current cost per unit or workbenches. As…

Q: Pix Paper Inc. produces photographic paper for printing digital images. One of the processes for…

A: Computation of Cost per pound - Working

Q: Golf courses are demanding in their quest for high-quality carts because of the critical need for…

A: Formula used: Lost profit=Number of units sold×Lost profit per tank Total failure cost=Lost…

Q: Harris Systems has decided to adopt ABC. To remain competitive, Harris Systems’s management believes…

A:

Q: Please answer last subpart labeled D. Comment on Sterling's current cost system and the reason the…

A: Comment on Sterling's current cost system and the reason the company is facing fierce competition…

Q: Laredo Leather Company manufactures high-quality leather goods. The company's profits have declined…

A: Process costing: It is a type of costing method, where the direct costs are accumulated and indirect…

Q: Silver Company manufactures a product that is available in both a complex model and a regular model.…

A: Model Complex Regular Total Estimated production 5000 40000 (*) Direct labor hours per…

Q: How much overhead will be assigned to each product if these three cost drivers are used to allocate…

A:

Q: Quality Industries manufactures large workbenches for industrial use. Yewell Hartnet, the Vice…

A: Unit cost for 14,100=8,299,75014,100=588.63 or 589 Thus, the unit cost for 14,100 tables is 589.

Q: Weston Corporation manufactures a product that is available in both a deluxe and a regular model.…

A: Overhead refers to the expenses that are indirectly associated with the product and is hard to…

Q: 1) What reasons could explain why competitors are forcing the company to lower prices on its…

A:

Q: Weston Corporation manufactures a product that is available in both a deluxe and a regular model.…

A: OH amount as per part 1 =3080000 Basis is direct labour hours

Q: DK manufactures three products, W, X and Y. Each product uses the same materials and the same type…

A: As you have posted multiple independent questions, we are answering the first two questions. Kindly…

Q: Marwick Innovations, Inc. produces exercise and fitness gear. Two of its newer products require a…

A: The question is related to limiting factor. In the given question machine hours is limiting factor.…

Q: . A company produces two kinds of hammers: one with longer handles and one with shorter handles. The…

A: Contribution margin = Sales price - Variable expenses

Q: Maxwell Company produces a variety of kitchen appliances, including cooking ranges and dishwashers.…

A:

Q: Marwick Innovations, Inc. produces exercise and fitness gear. Two of its newer products require a…

A: This question deals with the theory of constrain. As the name suggest, constrain is a lack resources…

Q: Current Operations Proposal of Vice President of Sales $2.5 $2 280,000 units Unit Price Unit Sales…

A: Income statement: Under this Statement showing the company’s performance over a period of time by…

Q: Weston Corporation manufactures a product that is available in both a deluxe and a…

A: SOLUTION- OVERHEAD RATE IS A COST ALLOCATION TO THE PRODUCTION OF A PRODUCT OR SERVICE.

Q: Maglie Company manufactures two video game consoles: handheld and home. The handheld consoles are…

A: The overhead cost is allocated to the production on the basis of predetermined overhead rate.

Q: Weston Corporation manufactures a product that is available in both a deluxe and a regular model.…

A: Solution A: Allocation of overhead and computation of overhead cost per unit Activity Estimated…

Q: Laredo Leather Company manufactures high-quality leather goods. The company's profits have declined…

A: Process costing: It is a type of costing method, where the direct costs are accumulated and indirect…

Q: Laredo Leather Company manufactures high-quality leather goods. The company’s profits have declined…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: Laredo Leather Company manufactures high-quality leather goods. The company’s profits have declined…

A: Weighted Average Cost - It is the average cost which divide the total cost of goods by no of units…

Q: Great Company manufactures 60,000 units of part XL-40 each year for use on its…

A: Note: Since you have posted multiple questions, we will solve the second question as first question…

Q: Maglie Company manufactures two video game consoles: handheld and home. The handheld consoles are…

A: Formula: Allocation of overhead = ( Individual activity level / total activity level ) x Total cost…

Q: Carla Vista Innovations, Inc. produces exercise and fitness gear. Two of its newer products require…

A:

Q: Bata Ltd manufactures two different models of its famous video game console: the sBox and xSquare…

A: Under Traditional costing, predetermined overhead rate will be computed and on that basis…

Q: DK manufactures three products, W, X and Y. Each product uses the same materials and the same type…

A: Labor hour per unit W=Per unitPer hour=$4010=$4

Q: Weston Corporation manufactures a product that is available in both a deluxe and a…

A: We’ll answer the first question since the exact one wasn’t specified. Please submit a new question…

Q: Carla Vista Innovations, Inc. produces exercise and fitness gear. Two of its newer products require…

A: Contribution margin = Sales - Variable cost

Q: After reviewing the new activity-based costing system that Nancy Chen has implemented at IVC's…

A:

Q: For years, Tamarindo Company produced only one product: backpacks. Recently, Tamarindo added a line…

A:

Q: Weston Corporation manufactures a product that is available in both a deluxe and a regular model.…

A: Activity based costing means where the product is valued on the basis of actual direct material ,…

Q: Maglie Company manufactures two video game consoles: handheld and home. The handheld consoles are…

A: Total cost = Direct materials + direct labor + overhead applied Predetermined overhead rate =…

Q: Marwick Innovations, Inc. produces exercise and fitness gear. Two of its newer products require a…

A: This question deals with the concept of theory of constrain. As the name suggest, constrain is a…

Q: Weston Corporation manufactures a product that is available in both a deluxe and a…

A: The overhead rate is the rate or the cost that is being alloted to the product production.

Q: Weston Corporation manufactures a product that is available in both a deluxe and a regular model.…

A: Pre-determined overhead rate: It is the rate that is calculated by dividing the estimated total…

Q: Marwick Innovations, Inc. produces exercise and fitness gear. Two of its newer products require a…

A: Contribution is the amount after reducing the variable costs from the sales revenue of an entity.

Q: DK manufactures three products, W, X and Y. Each product uses the same materials and the same type…

A: The following concept is related to DK manufactures.

Q: Alexandria Ltd. manufactures high-quality pens. For many years the company manufactured only one…

A: Manufacturing overheads are indirect costs and expenses related with the manufacturing and…

Q: Sylar Company manufactures a product that is available in both a Deluxe model and a Regular model.…

A: Calvulation of manufacturing overhead rate per Direct Labour Hour:: Manufacturing overhead…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

- Wright Plastic Products is a small company that specialized in the production of plastic dinner plates until several years ago. Although profits for the company had been good, they have been declining in recent years because of increased competition. Many competitors offer a full range of plastic products, and management felt that this created a competitive disadvantage. The output of the companys plants was exclusively devoted to plastic dinner plates. Three years ago, management made a decision to add additional product lines. They determined that existing idle capacity in each plant could easily be adapted to produce other plastic products. Each plant would produce one additional product line. For example, the Atlanta plant would add a line of plastic cups. Moreover, the variable cost of producing a package of cups (one dozen) was virtually identical to that of a package of plastic plates. (Variable costs referred to here are those that change in total as the units produced change. The costs include direct materials, direct labor, and unit-based variable overhead such as power and other machine costs.) Since the fixed expenses would not change, the new product was forecast to increase profits significantly (for the Atlanta plant). Two years after the addition of the new product line, the profits of the Atlanta plant (as well as other plants) had not improvedin fact, they had dropped. Upon investigation, the president of the company discovered that profits had not increased as expected because the so-called fixed cost pool had increased dramatically. The president interviewed the manager of each support department at the Atlanta plant. Typical responses from four of those managers are given next. Materials handling: The additional batches caused by the cups increased the demand for materials handling. We had to add one forklift and hire additional materials handling labor. Inspection: Inspecting cups is more complicated than plastic plates. We only inspect a sample drawn from every batch, but you need to understand that the number of batches has increased with this new product line. We had to hire more inspection labor. Purchasing: The new line increased the number of purchase orders. We had to use more resources to handle this increased volume. Accounting: There were more transactions to process than before. We had to increase our staff. Required: 1. Explain why the results of adding the new product line were not accurately projected. 2. Could this problem have been avoided with an activity-based cost management system? If so, would you recommend that the company adopt this type of system? Explain and discuss the differences between an activity-based cost management system and a traditional cost management system.Jadlow Company produces handcrafted leather purses. Virtually all of the manufacturing cost consists of materials and labor. Over the past several years, profits have been declining because the cost of the two major inputs has been increasing. Janice Jadlow, the president of the company, has indicated that the price of the purses cannot be increased; thus, the only way to improve or at least stabilize profits is to increase overall productivity. At the beginning of 20x2, Janice implemented a new cutting and assembly process that promised less materials waste and a faster production time. At the end of 20x2, Janice wants to know how much profits have changed from the prior year because of the new process. In order to provide this information to Janice, the controller of the company gathered the following data: Required: 1. Compute the productivity profile for each year. Comment on the effectiveness of the new production process. 2. Compute the increase in profits attributable to increased productivity. 3. Calculate the price-recovery component, and comment on its meaning.Maxwell Company produces a variety of kitchen appliances, including cooking ranges and dishwashers. Over the past several years, competition has intensified. In order to maintainand perhaps increaseits market share, Maxwells management decided that the overall quality of its products had to be increased. Furthermore, costs needed to be reduced so that the selling prices of its products could be reduced. After some investigation, Maxwell concluded that many of its problems could be traced to the unreliability of the parts that were purchased from outside suppliers. Many of these components failed to work as intended, causing performance problems. Over the years, the company had increased its inspection activity of the final products. If a problem could be detected internally, then it was usually possible to rework the appliance so that the desired performance was achieved. Management also had increased its warranty coverage; warranty work had been increasing over the years. David Haight, president of Maxwell Company, called a meeting with his executive committee. Lee Linsenmeyer, chief engineer; Kit Applegate, controller; and Jeannie Mitchell, purchasing manager, were all in attendance. How to improve the companys competitive position was the meetings topic. The conversation of the meeting was recorded as seen on the following page: DAVID: We need to find a way to improve the quality of our products and at the same time reduce costs. Lee, you said that you have done some research in this area. Would you share your findings? LEE: As you know, a major source of our quality problems relates to the poor quality of the parts we acquire from the outside. We have a lot of different parts, and this adds to the complexity of the problem. What I thought would be helpful would be to redesign our products so that they can use as many interchangeable parts as possible. This will cut down the number of different parts, make it easier to inspect, and cheaper to repair when it comes to warranty work. My engineering staff has already come up with some new designs that will do this for us. JEANNIE: I like this idea. It will simplify the purchasing activity significantly. With fewer parts, I can envision some significant savings for my area. Lee has shown me the designs so I know exactly what parts would be needed. I also have a suggestion. We need to embark on a supplier evaluation program. We have too many suppliers. By reducing the number of different parts, we will need fewer suppliers. And we really dont need to use all the suppliers that produce the parts demanded by the new designs. We should pick suppliers that will work with us and provide the quality of parts that we need. I have done some preliminary research and have identified five suppliers that seem willing to work with us and assure us of the quality we need. Lee may need to send some of his engineers into their plants to make sure that they can do what they are claiming. DAVID: This sounds promising. Kit, can you look over the proposals and their estimates and give us some idea if this approach will save us any money? And if so, how much can we expect to save? KIT: Actually, I am ahead of the game here. Lee and Jeannie have both been in contact with me and have provided me with some estimates on how these actions would affect different activities. I have prepared a handout that includes an activity table revealing what I think are the key activities affected. I have also assembled some tentative information about activity costs. The table gives the current demand and the expected demand after the changes are implemented. With this information, we should be able to assess the expected cost savings. Additionally, the following activity cost data are provided: Purchasing parts: Variable activity cost: 30 per part number; 20 salaried clerks, each earning a 45,000 annual salary. Each clerk is capable of processing orders associated with 100 part numbers. Inspecting parts: Twenty-five inspectors, each earning a salary of 40,000 per year. Each inspector is capable of 2,000 hours of inspection. Reworking products: Variable activity cost: 25 per unit reworked (labor and parts). Warranty: Twenty repair agents, each paid a salary of 35,000 per year. Each repair agent is capable of repairing 500 units per year. Variable activity costs: 15 per product repaired. Required: 1. Compute the total savings possible as reflected by Kits handout. Assume that resource spending is reduced where possible. 2. Explain how redesign and supplier evaluation are linked to the savings computed in Requirement 1. Discuss the importance of recognizing and exploiting internal and external linkages. 3. Identify the organizational and operational activities involved in the strategy being considered by Maxwell Company. What is the relationship between organizational and operational activities?

- At the beginning of the last quarter of 20x1, Youngston, Inc., a consumer products firm, hired Maria Carrillo to take over one of its divisions. The division manufactured small home appliances and was struggling to survive in a very competitive market. Maria immediately requested a projected income statement for 20x1. In response, the controller provided the following statement: After some investigation, Maria soon realized that the products being produced had a serious problem with quality. She once again requested a special study by the controllers office to supply a report on the level of quality costs. By the middle of November, Maria received the following report from the controller: Maria was surprised at the level of quality costs. They represented 30 percent of sales, which was certainly excessive. She knew that the division had to produce high-quality products to survive. The number of defective units produced needed to be reduced dramatically. Thus, Maria decided to pursue a quality-driven turnaround strategy. Revenue growth and cost reduction could both be achieved if quality could be improved. By growing revenues and decreasing costs, profitability could be increased. After meeting with the managers of production, marketing, purchasing, and human resources, Maria made the following decisions, effective immediately (end of November 20x1): a. More will be invested in employee training. Workers will be trained to detect quality problems and empowered to make improvements. Workers will be allowed a bonus of 10 percent of any cost savings produced by their suggested improvements. b. Two design engineers will be hired immediately, with expectations of hiring one or two more within a year. These engineers will be in charge of redesigning processes and products with the objective of improving quality. They will also be given the responsibility of working with selected suppliers to help improve the quality of their products and processes. Design engineers were considered a strategic necessity. c. Implement a new process: evaluation and selection of suppliers. This new process has the objective of selecting a group of suppliers that are willing and capable of providing nondefective components. d. Effective immediately, the division will begin inspecting purchased components. According to production, many of the quality problems are caused by defective components purchased from outside suppliers. Incoming inspection is viewed as a transitional activity. Once the division has developed a group of suppliers capable of delivering nondefective components, this activity will be eliminated. e. Within three years, the goal is to produce products with a defect rate less than 0.10 percent. By reducing the defect rate to this level, marketing is confident that market share will increase by at least 50 percent (as a consequence of increased customer satisfaction). Products with better quality will help establish an improved product image and reputation, allowing the division to capture new customers and increase market share. f. Accounting will be given the charge to install a quality information reporting system. Daily reports on operational quality data (e.g., percentage of defective units), weekly updates of trend graphs (posted throughout the division), and quarterly cost reports are the types of information required. g. To help direct the improvements in quality activities, kaizen costing is to be implemented. For example, for the year 20x1, a kaizen standard of 6 percent of the selling price per unit was set for rework costs, a 25 percent reduction from the current actual cost. To ensure that the quality improvements were directed and translated into concrete financial outcomes, Maria also began to implement a Balanced Scorecard for the division. By the end of 20x2, progress was being made. Sales had increased to 26,000,000, and the kaizen improvements were meeting or beating expectations. For example, rework costs had dropped to 1,500,000. At the end of 20x3, two years after the turnaround quality strategy was implemented, Maria received the following quality cost report: Maria also received an income statement for 20x3: Maria was pleased with the outcomes. Revenues had grown, and costs had been reduced by at least as much as she had projected for the two-year period. Growth next year should be even greater as she was beginning to observe a favorable effect from the higher-quality products. Also, further quality cost reductions should materialize as incoming inspections were showing much higher-quality purchased components. Required: 1. Identify the strategic objectives, classified by the Balanced Scorecard perspective. Next, suggest measures for each objective. 2. Using the results from Requirement 1, describe Marias strategy using a series of if-then statements. Next, prepare a strategy map. 3. Explain how you would evaluate the success of the quality-driven turnaround strategy. What additional information would you like to have for this evaluation? 4. Explain why Maria felt that the Balanced Scorecard would increase the likelihood that the turnaround strategy would actually produce good financial outcomes. 5. Advise Maria on how to encourage her employees to align their actions and behavior with the turnaround strategy.The demand for solvent, one of numerous products manufactured by Logan Industries Inc., has dropped sharply because of recent competition from a similar product. The companys chemists are currently completing tests of various new formulas, and it is anticipated that the manufacture of a superior product can be started on November 1, one month in the future. No changes will be needed in the present production facilities to manufacture the new product because only the mixture of the various materials will be changed. The controller has been asked by the president of the company for advice on whether to continue production during October or to suspend the manufacture of solvent until November 1. The following data have been assembled: The production costs and selling and administrative expenses, based on production of 10,000 units in September, are as follows: Sales for October are expected to drop about 40% below those of September. No significant changes are anticipated in the fixed costs or variable costs per unit. No extra costs will be incurred in discontinuing operations in the portion of the plant associated with solvent. The inventory of solvent at the beginning and end of October is not expected to be significant (material). Instructions 1. Prepare an estimated income statement in absorption costing form for October for solvent, assuming that production continues during the month. 2. Prepare an estimated income statement in variable costing form for October for solvent, assuming that production continues during the month. 3. What would be the estimated operating loss if the solvent production were temporarily suspended for October? 4. What advice should you give to management?Paladin Company manufactures plain-paper fax machines in a small factory in Minnesota. Sales have increased by 50 percent in each of the past three years, as Paladin has expanded its market from the United States to Canada and Mexico. As a result, the Minnesota factory is at capacity. Beryl Adams, president of Paladin, has examined the situation and developed the following alternatives. 1. Add a permanent second shift at the plant. However, the semiskilled workers who assemble the fax machines are in short supply, and the wage rate of 15 per hour would probably have to be increased across the board to 18 per hour in order to attract sufficient workers from out of town. The total wage increase (including fringe benefits) would amount to 125,000. The heavier use of plant facilities would lead to increased plant maintenance and small tool cost. 2. Open a new plant and locate it in Mexico. Wages (including fringe benefits) would average 3.50 per hour. Investment in plant and equipment would amount to 300,000. 3. Open a new plant and locate it in a foreign trade zone, possibly in Dallas. Wages would be somewhat lower than in Minnesota, but higher than in Mexico. The advantages of postponing tariff payments on parts imported from Asia could amount to 50,000 per year. Required: Advise Beryl of the advantages and disadvantages of each of her alternatives.

- Suppose that Kicker had the following sales and cost experience (in thousands of dollars) for May of the current year and for May of the prior year: In May of the prior year, Kicker started an intensive quality program designed to enable it to build original equipment manufacture (OEM) speaker systems for a major automobile company. The program was housed in research and development. In the beginning of the current year, Kickers accounting department exercised tighter control over sales commissions, ensuring that no dubious (e.g., double) payments were made. The increased sales in the current year required additional warehouse space that Kicker rented in town. (Round ratios to four decimal places. Round sales dollars computations to the nearest dollar.) Required: 1. Calculate the contribution margin ratio for May of both years. 2. Calculate the break-even point in sales dollars for both years. 3. Calculate the margin of safety in sales dollars for both years. 4. CONCEPTUAL CONNECTION Analyze the differences shown by your calculations in Requirements 1, 2, and 3.Nico Parts, Inc., produces electronic products with short life cycles (of less than two years). Development has to be rapid, and the profitability of the products is tied strongly to the ability to find designs that will keep production and logistics costs low. Recently, management has also decided that post-purchase costs are important in design decisions. Last month, a proposal for a new product was presented to management. The total market was projected at 200,000 units (for the two-year period). The proposed selling price was 130 per unit. At this price, market share was expected to be 25 percent. The manufacturing and logistics costs were estimated to be 120 per unit. Upon reviewing the projected figures, Brian Metcalf, president of Nico, called in his chief design engineer, Mark Williams, and his marketing manager, Cathy McCourt. The following conversation was recorded: BRIAN: Mark, as you know, we agreed that a profit of 15 per unit is needed for this new product. Also, as I look at the projected market share, 25 percent isnt acceptable. Total profits need to be increased. Cathy, what suggestions do you have? CATHY: Simple. Decrease the selling price to 125 and we expand our market share to 35 percent. To increase total profits, however, we need some cost reductions as well. BRIAN: Youre right. However, keep in mind that I do not want to earn a profit that is less than 15 per unit. MARK: Does that 15 per unit factor in preproduction costs? You know we have already spent 100,000 on developing this product. To lower costs will require more expenditure on development. BRIAN: Good point. No, the projected cost of 120 does not include the 100,000 we have already spent. I do want a design that will provide a 15-per-unit profit, including consideration of preproduction costs. CATHY: I might mention that post-purchase costs are important as well. The current design will impose about 10 per unit for using, maintaining, and disposing our product. Thats about the same as our competitors. If we can reduce that cost to about 5 per unit by designing a better product, we could probably capture about 50 percent of the market. I have just completed a marketing survey at Marks request and have found out that the current design has two features not valued by potential customers. These two features have a projected cost of 6 per unit. However, the price consumers are willing to pay for the product is the same with or without the features. Required: 1. Calculate the target cost associated with the initial 25 percent market share. Does the initial design meet this target? Now calculate the total life-cycle profit that the current (initial) design offers (including preproduction costs). 2. Assume that the two features that are apparently not valued by consumers will be eliminated. Also assume that the selling price is lowered to 125. a. Calculate the target cost for the 125 price and 35 percent market share. b. How much more cost reduction is needed? c. What are the total life-cycle profits now projected for the new product? d. Describe the three general approaches that Nico can take to reduce the projected cost to this new target. Of the three approaches, which is likely to produce the most reduction? 3. Suppose that the Engineering Department has two new designs: Design A and Design B. Both designs eliminate the two nonvalued features. Both designs also reduce production and logistics costs by an additional 8 per unit. Design A, however, leaves post-purchase costs at 10 per unit, while Design B reduces post-purchase costs to 4 per unit. Developing and testing Design A costs an additional 150,000, while Design B costs an additional 300,000. Assuming a price of 125, calculate the total life-cycle profits under each design. Which would you choose? Explain. What if the design you chose cost an additional 500,000 instead of 150,000 or 300,000? Would this have changed your decision? 4. Refer to Requirement 3. For every extra dollar spent on preproduction activities, how much benefit was generated? What does this say about the importance of knowing the linkages between preproduction activities and later activities?Bienestar, Inc., has two plants that manufacture a line of wheelchairs. One is located in Kansas City, and the other in Tulsa. Each plant is set up as a profit center. During the past year, both plants sold their tilt wheelchair model for 1,620. Sales volume averages 20,000 units per year in each plant. Recently, the Kansas City plant reduced the price of the tilt model to 1,440. Discussion with the Kansas City manager revealed that the price reduction was possible because the plant had reduced its manufacturing and selling costs by reducing what was called non-value-added costs. The Kansas City manufacturing and selling costs for the tilt model were 1,260 per unit. The Kansas City manager offered to loan the Tulsa plant his cost accounting manager to help it achieve similar results. The Tulsa plant manager readily agreed, knowing that his plant must keep pacenot only with the Kansas City plant but also with competitors. A local competitor had also reduced its price on a similar model, and Tulsas marketing manager had indicated that the price must be matched or sales would drop dramatically. In fact, the marketing manager suggested that if the price were dropped to 1,404 by the end of the year, the plant could expand its share of the market by 20 percent. The plant manager agreed but insisted that the current profit per unit must be maintained. He also wants to know if the plant can at least match the 1,260 per-unit cost of the Kansas City plant and if the plant can achieve the cost reduction using the approach of the Kansas City plant. The plant controller and the Kansas City cost accounting manager have assembled the following data for the most recent year. The actual cost of inputs, their value-added (ideal) quantity levels, and the actual quantity levels are provided (for production of 20,000 units). Assume there is no difference between actual prices of activity units and standard prices. Required: 1. Calculate the target cost for expanding the Tulsa plants market share by 20 percent, assuming that the per-unit profitability is maintained as requested by the plant manager. 2. Calculate the non-value-added cost per unit. Assuming that non-value-added costs can be reduced to zero, can the Tulsa plant match the Kansas City per-unit cost? Can the target cost for expanding market share be achieved? What actions would you take if you were the plant manager? 3. Describe the role that benchmarking played in the effort of the Tulsa plant to protect and improve its competitive position.

- Boxer Production, Inc., is in the process of considering a flexible manufacturing system that will help the company react more swiftly to customer needs. The controller, Mick Morrell, estimated that the system will have a 10-year life and a required return of 10% with a net present value of negative $500,000. Nevertheless, he acknowledges that he did not quantify the potential sales increases that might result from this improvement on the issue of on-time delivery, because it was too difficult to quantify. If there is a general agreement that qualitative factors may offer an additional net cash flow of $150,000 per year, how should Boxer proceed with this Investment?Kimball Company has developed the following cost formulas: Materialusage:Ym=80X;r=0.95Laborusage(direct):Yl=20X;r=0.96Overheadactivity:Yo=350,000+100X;r=0.75Sellingactivity:Ys=50,000+10X;r=0.93 where X=Directlaborhours The company has a policy of producing on demand and keeps very little, if any, finished goods inventory (thus, units produced equals units sold). Each unit uses one direct labor hour for production. The president of Kimball Company has recently implemented a policy that any special orders will be accepted if they cover the costs that the orders cause. This policy was implemented because Kimballs industry is in a recession and the company is producing well below capacity (and expects to continue doing so for the coming year). The president is willing to accept orders that minimally cover their variable costs so that the company can keep its employees and avoid layoffs. Also, any orders above variable costs will increase overall profitability of the company. Required: 1. Compute the total unit variable cost. Suppose that Kimball has an opportunity to accept an order for 20,000 units at 220 per unit. Should Kimball accept the order? (The order would not displace any of Kimballs regular orders.) 2. Explain the significance of the coefficient of correlation measures for the cost formulas. Did these measures have a bearing on your answer in Requirement 1? Should they have a bearing? Why or why not? 3. Suppose that a multiple regression equation is developed for overhead costs: Y = 100,000 + 100X1 + 5,000X2 + 300X3, where X1 = direct labor hours, X2 = number of setups, and X3 = engineering hours. The coefficient of determination for the equation is 0.94. Assume that the order of 20,000 units requires 12 setups and 600 engineering hours. Given this new information, should the company accept the special order referred to in Requirement 1? Is there any other information about cost behavior that you would like to have? Explain.Posavek is a wholesale supplier of building supplies building contractors, hardware stores, and home-improvement centers in the Boston metropolitan area. Over the years, Posavek has expanded its operations to serve customers across the nation and now employs over 200 people as technical representatives, buyers, warehouse workers, and sales and office staff. Most recently, Posavek has experienced fierce competition from the large online discount stores. In addition, the company is suffering from operational inefficiencies related to its archaic information system. Posavek revenue cycle procedures are described in the following paragraphs. Revenue Cycle Posaveks sales department representatives receive orders via traditional mail, e-mail, telephone, and the occasional walk-in customer. Because Posavek is a wholesaler, the vast majority of its business is conducted on a credit basis. The process begins in the sales department, where the sales clerk enters the customers order into the centralized computer sales order system. The computer and file server are housed in Posaveks small data processing department. If the customer has done business with Posavek in the past, his or her data are already on file. If the customer is a first-time buyer, however, the clerk creates a new record in the customer account file. The system then creates a record of the transaction in the open sales order file. When the order is entered, an electronic copy of it is sent to the customers e-mail address as confirmation. A clerk in the warehouse department periodically reviews the open sales order file from a terminal and prints two copies of a stock release document for each new sale, which he uses to pick the items sold from the shelves. The warehouse clerk sends one copy of the stock release to the sales department and the second copy, along with the goods, to the shipping department. The warehouse clerk then updates the inventory subsidiary file to reflect the items and quantities shipped. Upon receipt of the stock release document, the sales clerk accesses the open sales order file from a terminal, closes the sales order, and files the stock release document in the sales department. The sales order system automatically posts these transactions to the sales, inventory control, and cost-of-goods-sold accounts in the general ledger file. Upon receipt of the goods and the stock release, the shipping department clerk prepares the goods for shipment to the customer. The clerk prepares three copies of the bill of lading. Two of these go with the goods to the carrier and the third, along with the stock release document, is filed in the shipping department. The billing department clerk reviews the closed sales orders from a terminal and prepares two copies of the sales invoice. One copy is mailed to the customer, and the other is filed in the billing department. The clerk then creates a new record in the accounts receivable subsidiary file. The sales order system automatically updates the accounts receivable control account in the general ledger file. CASH RECEIPTS PROCEDURES Mail room clerks open customer cash receipts, reviews the check and remittance advices for completeness, and prepares two copies of a remittance list. One copy is sent with the checks to the cash receipts department. The second copy of the remittance advices are sent to the billing department. When the cash receipts clerk receives the checks and remittance list, he verifies the checks received against those on the remittance list and signs the checks For Deposit Only. Once the checks are endorsed, he records the receipts in the cash receipts journal from his terminal. The clerk then fills out a deposit slip and deposits the checks in the bank. Upon receipt of the remittances, the billing department clerk records the amounts in the accounts receivable subsidiary ledger from the department terminal. The system automatically updates the AR control account in the general ledger Posavek has hired your public accounting firm to review its sales order procedures for internal control compliance and to make recommendations for changes. Required a. Create a data flow diagram of the current system. b. Create a system flowchart of the existing system. c. Analyze the physical internal control weaknesses in the system. d. (Optional) Prepare a system flowchart of a redesigned computer-based system that resolves the control weaknesses that you identified. Explain your solution.