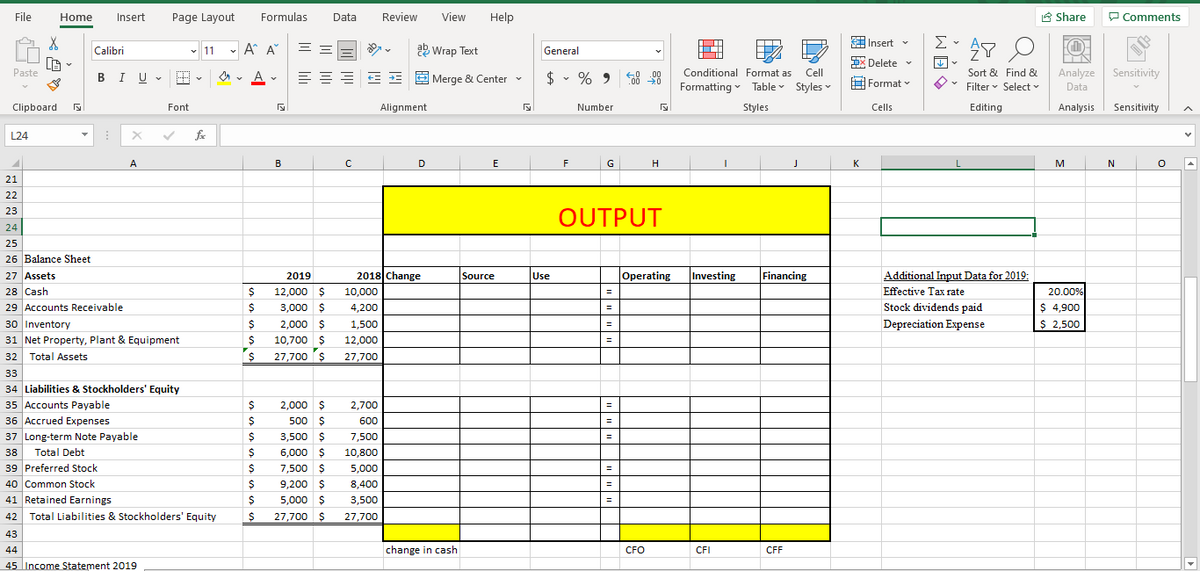

OUTPUT Operating Investing Financing 2018 Change 10,000 4,200 Source Use 1,500 12,000 27,700 2,700 600 7,500 10,800 5,000 8,400 3,500 27,700 change in cash CFO CFI CFF

OUTPUT Operating Investing Financing 2018 Change 10,000 4,200 Source Use 1,500 12,000 27,700 2,700 600 7,500 10,800 5,000 8,400 3,500 27,700 change in cash CFO CFI CFF

Chapter8: Budgets And Bank Reconciliations

Section: Chapter Questions

Problem 2.7C

Related questions

Question

Transcribed Image Text:File

Home

Insert

Page Layout

Formulas

Data

Review

View

Help

A Share

P Comments

E Insert v

Calibri

- A A

ΞΞ

ab Wrap Text

v 11

General

5* Delete v

LE

Paste

$ - % 9

Analyze Sensitivity

BIU V

A

= E E E E E Merge & Center -

Conditional Format as

Cell

Sort & Find &

.00

Formatting v Table Styles v

H Format v

Filter v Select v

Data

Clipboard

Font

Alignment

Number

Styles

Cells

Editing

Analysis

Sensitivity

L24

fe

A

B

D

E

F

G

H

K

M

21

22

23

OUTPUT

24

25

26 Balance Sheet

27 Assets

2018 Change

Source

Operating

Investing

Financing

Additional Input Data for 2019:

2019

Use

20.00%

$ 4,900

$ 2,500

28 Cash

12,000 $

10,000

Effective Tax rate

%3D

29 Accounts Receivable

30 Inventory

31 Net Property, Plant & Equipment

32 Total Assets

3,000 $

4,200

Stock dividends paid

%3D

2,000 $

1,500

Depreciation Expense

%3D

10,700 $

12,000

%3D

27,700 $

27,700

33

34 Liabilities & Stockholders' Equity

35 Accounts Payable

36 Accrued Expenses

37 Long-term Note Payable

2,000 $

2,700

500 $

600

%3D

3,500 $

7,500

%3D

38

Total Debt

6,000 $

10,800

39 Preferred Stock

40 Common Stock

41 Retained Earnings

7,500 $

5,000

9,200 $

8,400

%3D

5,000 $

3,500

%3D

42

Total Liabilities & Stockholders' Equity

27,700 $

27.700

43

44

change in cash

CFO

CFI

CFF

45 Income Statement 2019

尔

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you