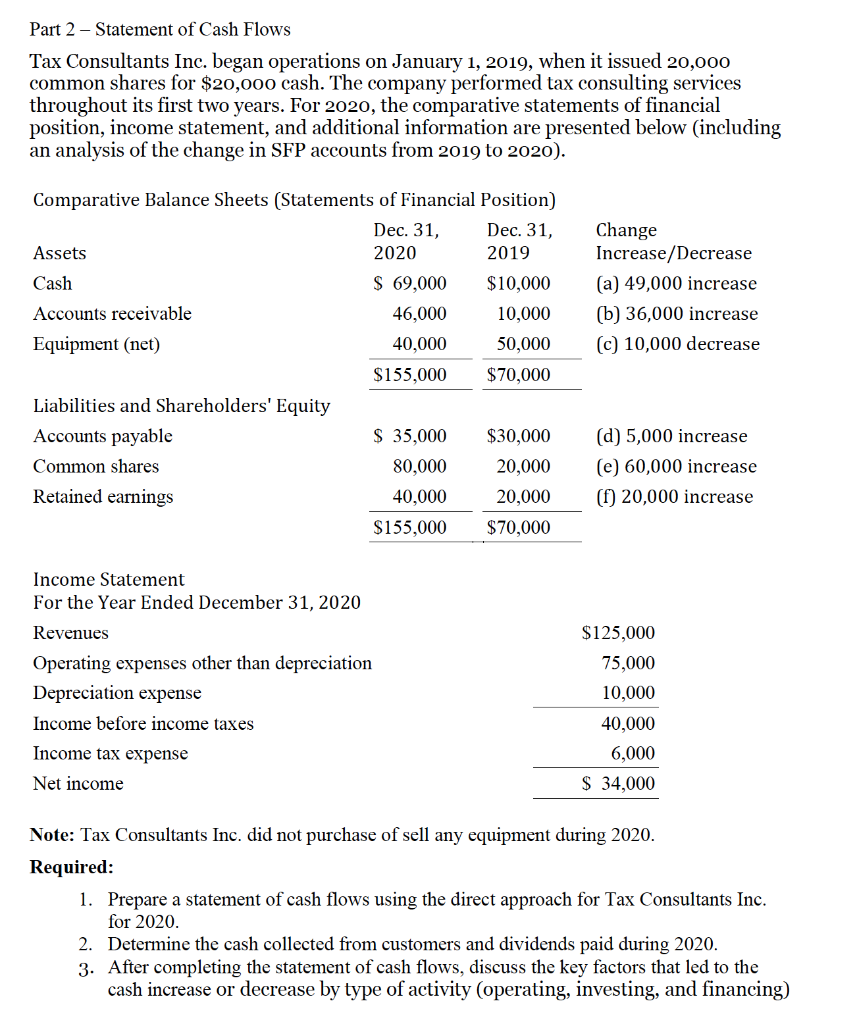

Part 2 – Statement of Cash Flows Tax Consultants Inc. began operations on January 1, 2019, when it issued 20,000 common shares for $20,000 cash. The company performed tax consulting services throughout its first two years. For 2020, the comparative statements of financial position, income statement, and additional information are presented below (including an analysis of the change in SFP accounts from 2019 to 2020). Comparative Balance Sheets (Statements of Financial Position) Dec. 31, Dec. 31, Change Increase/Decrease Assets 2020 2019 Cash $ 69,000 $10,000 (a) 49,000 increase Accounts receivable 46,000 10,000 (b) 36,000 increase Equipment (net) 40,000 50,000 (c) 10,000 decrease $155,000 $70,000 Liabilities and Shareholders' Equity Accounts payable $ 35,000 $30,000 (d) 5,000 increase Common shares 80,000 20,000 (e) 60,000 increase Retained earnings 40,000 20,000 (f) 20,000 increase $155,000 $70,000 Income Statement For the Year Ended December 31, 2020 Revenues $125,000 Operating expenses other than depreciation 75,000 Depreciation expense 10,000 Income before income taxes 40,000 Income tax expense 6,000 Net income $ 34,000 Note: Tax Consultants Inc. did not purchase of sell any equipment during 2020. Required: 1. Prepare a statement of cash flows using the direct approach for Tax Consultants Inc. for 2020. 2. Determine the cash collected from customers and dividends paid during 2020. 3. After completing the statement of cash flows, discuss the key factors that led to the cash increase or decrease by type of activity (operating, investing, and financing)

Part 2 – Statement of Cash Flows Tax Consultants Inc. began operations on January 1, 2019, when it issued 20,000 common shares for $20,000 cash. The company performed tax consulting services throughout its first two years. For 2020, the comparative statements of financial position, income statement, and additional information are presented below (including an analysis of the change in SFP accounts from 2019 to 2020). Comparative Balance Sheets (Statements of Financial Position) Dec. 31, Dec. 31, Change Increase/Decrease Assets 2020 2019 Cash $ 69,000 $10,000 (a) 49,000 increase Accounts receivable 46,000 10,000 (b) 36,000 increase Equipment (net) 40,000 50,000 (c) 10,000 decrease $155,000 $70,000 Liabilities and Shareholders' Equity Accounts payable $ 35,000 $30,000 (d) 5,000 increase Common shares 80,000 20,000 (e) 60,000 increase Retained earnings 40,000 20,000 (f) 20,000 increase $155,000 $70,000 Income Statement For the Year Ended December 31, 2020 Revenues $125,000 Operating expenses other than depreciation 75,000 Depreciation expense 10,000 Income before income taxes 40,000 Income tax expense 6,000 Net income $ 34,000 Note: Tax Consultants Inc. did not purchase of sell any equipment during 2020. Required: 1. Prepare a statement of cash flows using the direct approach for Tax Consultants Inc. for 2020. 2. Determine the cash collected from customers and dividends paid during 2020. 3. After completing the statement of cash flows, discuss the key factors that led to the cash increase or decrease by type of activity (operating, investing, and financing)

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 19SP

Related questions

Question

Transcribed Image Text:Part 2 – Statement of Cash Flows

Tax Consultants Inc. began operations on January 1, 2019, when it issued 20,000

common shares for $20,000 cash. The company performed tax consulting services

throughout its first two years. For 2020, the comparative statements of financial

position, income statement, and additional information are presented below (including

an analysis of the change in SFP accounts from 2019 to 2020).

Comparative Balance Sheets (Statements of Financial Position)

Dec. 31,

Change

Increase/Decrease

Dec. 31,

Assets

2020

2019

Cash

$ 69,000

$10,000

(a) 49,000 increase

Accounts receivable

46,000

10,000

(b) 36,000 increase

Equipment (net)

40,000

50,000

(c) 10,000 decrease

$155,000

$70,000

Liabilities and Shareholders' Equity

Accounts payable

$ 35,000

$30,000

(d) 5,000 increase

Common shares

80,000

20,000

(e) 60,000 increase

Retained earnings

40,000

20,000

(f) 20,000 increase

$155,000

$70,000

Income Statement

For the Year Ended December 31, 2020

Revenues

$125,000

Operating expenses other than depreciation

75,000

Depreciation expense

10,000

Income before income taxes

40,000

Income tax expense

6,000

Net income

$ 34,000

Note: Tax Consultants Inc. did not purchase of sell any equipment during 2020.

Required:

1. Prepare a statement of cash flows using the direct approach for Tax Consultants Inc.

for 2020.

2. Determine the cash collected from customers and dividends paid during 2020.

3. After completing the statement of cash flows, discuss the key factors that led to the

cash increase or decrease by type of activity (operating, investing, and financing)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning