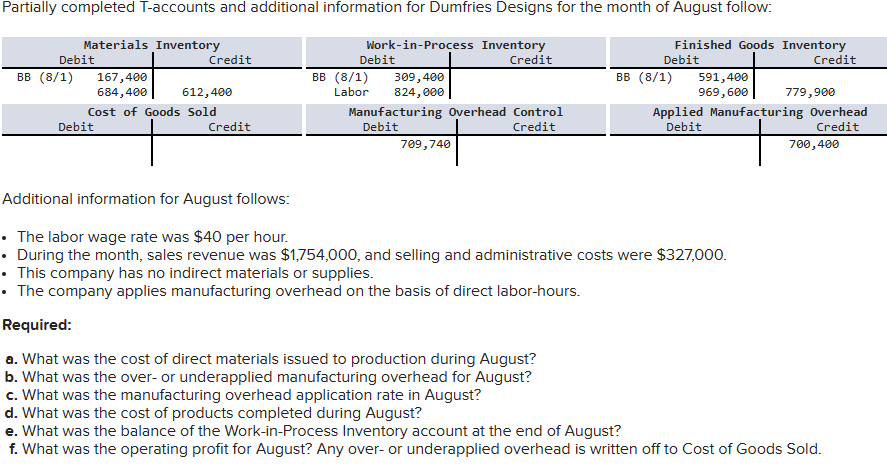

Partially completed T-accounts and additional information for Dumfries Designs for the month of August follow: Work-in-Process Inventory Finished Goods Inventory Debit Credit Credit Materials Inventory Debit BB (8/1) 167,400 684,400 Cost of Goods Sold Credit Debit 612,400 Credit Debit BB (8/1) Labor 309,400 824,000 Manufacturing Overhead Control Debit Credit 709,740 BB (8/1) 591,400 969,600 • This company has no indirect materials or supplies. • The company applies manufacturing overhead on the basis of direct labor-hours. Required: a. What was the cost of direct materials issued to production during August? b. What was the over- or underapplied manufacturing overhead for August? c. What was the manufacturing overhead application rate in August? Additional information for August follows: • The labor wage rate was $40 per hour. • During the month, sales revenue was $1,754,000, and selling and administrative costs were $327,000. 779,900 Applied Manufacturing Overhead Debit Credit 700,400 d. What was the cost of products completed during August? e. What was the balance of the Work-in-Process Inventory account at the end of August? f. What was the operating profit for August? Any over- or underapplied overhead is written off to Cost of Goods Sold.

Partially completed T-accounts and additional information for Dumfries Designs for the month of August follow: Work-in-Process Inventory Finished Goods Inventory Debit Credit Credit Materials Inventory Debit BB (8/1) 167,400 684,400 Cost of Goods Sold Credit Debit 612,400 Credit Debit BB (8/1) Labor 309,400 824,000 Manufacturing Overhead Control Debit Credit 709,740 BB (8/1) 591,400 969,600 • This company has no indirect materials or supplies. • The company applies manufacturing overhead on the basis of direct labor-hours. Required: a. What was the cost of direct materials issued to production during August? b. What was the over- or underapplied manufacturing overhead for August? c. What was the manufacturing overhead application rate in August? Additional information for August follows: • The labor wage rate was $40 per hour. • During the month, sales revenue was $1,754,000, and selling and administrative costs were $327,000. 779,900 Applied Manufacturing Overhead Debit Credit 700,400 d. What was the cost of products completed during August? e. What was the balance of the Work-in-Process Inventory account at the end of August? f. What was the operating profit for August? Any over- or underapplied overhead is written off to Cost of Goods Sold.

Chapter4: Job Order Costing

Section: Chapter Questions

Problem 12PB: The following data summarize the operations during the year. Prepare a journal entry for each...

Related questions

Question

Transcribed Image Text:Partially completed T-accounts and additional information for Dumfries Designs for the month of August follow:

Work-in-Process Inventory

Finished Goods Inventory

Debit

Credit

Credit

Materials Inventory

Debit

BB (8/1) 167,400

684,400

Cost of Goods Sold

Credit

Debit

612,400

Credit

Debit

BB (8/1)

Labor

309,400

824,000

Manufacturing Overhead Control

Debit

Credit

709,740

BB (8/1) 591,400

969,600

• This company has no indirect materials or supplies.

• The company applies manufacturing overhead on the basis of direct labor-hours.

Required:

a. What was the cost of direct materials issued to production during August?

b. What was the over- or underapplied manufacturing overhead for August?

c. What was the manufacturing overhead application rate in August?

Additional information for August follows:

• The labor wage rate was $40 per hour.

• During the month, sales revenue was $1,754,000, and selling and administrative costs were $327,000.

779,900

Applied Manufacturing Overhead

Debit

Credit

700,400

d. What was the cost of products completed during August?

e. What was the balance of the Work-in-Process Inventory account at the end of August?

f. What was the operating profit for August? Any over- or underapplied overhead is written off to Cost of Goods Sold.

Expert Solution

Step 1 Introduction

Total Manufacturing Cost :— It is the sum of direct material used, direct labour and manufacturing overhead applied.

Cost of Goods Manufactured :— It is the total cost incurred in the manufacturing of completed finished goods during the period.

Operating Profit :— It is the difference between sales revenue and operating expenses.

Trending now

This is a popular solution!

Step by step

Solved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning