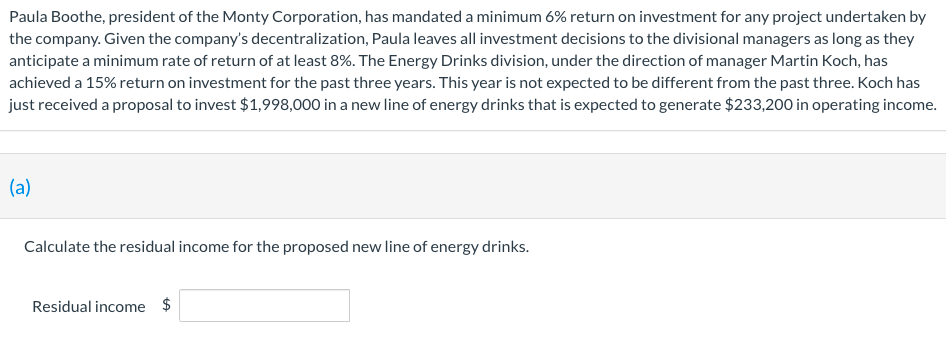

Paula Boothe, president of the Monty Corporation, has mandated a minimum 6% return on investment for any project undertaken by the company. Given the company's decentralization, Paula leaves all investment decisions to the divisional managers as long as they anticipate a minimum rate of return of at least 8%. The Energy Drinks division, under the direction of manager Martin Koch, has achieved a 15% return on investment for the past three years. This year is not expected to be different from the past three. Koch has just received a proposal to invest $1,998,000 in a new line of energy drinks that is expected to generate $233,200 in operating income.

Q: Sunshine Industrial Ltd, a massive retailer of electronic products, is organised in four separate…

A: Return on investment (ROI) is a financial ratio used to calculate the benefit an investor will…

Q: Each year, Sunshine Motos surveys 7,500 former and prospective customers regarding satisfaction and…

A: The difference in the total costs as a result of the change in certain activities is known as the…

Q: Paula Boothe, president of the Marigold Corporation, has mandated a minimum 10% return on investment…

A: Economic value added = Net operating profit after tax - (Invested capital×weighted average cost of…

Q: Complete the following Divisional Income Statements. If there is no amount or an amount is zero,…

A: Income statement: The financial statement which reports revenues and expenses from business…

Q: Give a detailed explanation of the question below; “Alisha May, division manager of Shotgun Inc.,…

A: SOLUTION- RESIDUAL INCOME IS INCOME THAT ONE CONTINUES TO RECEIVE AFTER THE COMPLETION OF THE…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: Payback period is an amount of time required to recover initial investment. Payback period =Initial…

Q: Mr. Bailey asks that you prepare Divisional Income Statements showing what 20Y1 results would have…

A: Income statement: The financial statement which reports revenues and expenses from business…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A:

Q: The divisional managers of West plc have requested that the method for calculating bonuses at the…

A: Residual income is that income of the division which remains after deducting income at weighted cost…

Q: Required: 1. Calculate the payback period for each product. 2. Calculate the net present value…

A: Pay Back period is calculated by the Business Entities to know that in how many years their…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: Calculation of Annual net cash inflow: Product A Product B Annual Sales revenue $380,000…

Q: Paula Boothe, president of the Indigo Corporation, has mandated a minimum 8% return on investment…

A: Return on Investment = Operating income/Investment

Q: 1 know headquarters wants us to add that new product line," said Dell Havesi, manager of Billings…

A: Note: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question…

Q: a. What is the division's residual income before considering the project? b. What is the division's…

A: Residual income= operating income - (minimum required return * operating assets) a. Operation income…

Q: Colonial Pharmaceuticals is a small firm specializing in new products. It is organized into two…

A: Answer - Working Note- Statement of Divisional Income Particular AC Division SO…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: Net present value method: Net present value method is the method which is used to compare the…

Q: Paula Boothe, president of the Bramble Corporation, has mandated a minimum 10% return on investment…

A: Economic value added is calculated by subtracting the product of capital invested and…

Q: Phoenix Press produces consumer magazines. Thehouse and home division, which sells home-improvement…

A: The motivations for G to improve the division’s year-end operating earnings are listed as follows:…

Q: Lindell Manufacturing embarked on an ambitious quality program that is centered on continual…

A: Transparency, impartiality, and equality are characteristics of ethical behaviour in interpersonal,…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: Profitability index compares the present value of inflow and present value of outflow of a project.…

Q: Sunland Corporation recently announced a bonus plan to reward the manager of its most profitable…

A: The question is based on the concept of Cost Accounting.

Q: Phoenix Press produces consumer magazines. Thehouse and home division, which sells home-improvement…

A: The steps Gellar must do about the pressure to improve performance are as follows: Gellar must…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: Internal rate of return : It is the return that the project is estimated to generate to cover its…

Q: Lou Barlow, a divisional manager for Sage Company, has an ooportunity to manufacture and sell one of…

A: "Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Paula Boothe, president of the Bramble Corporation, has mandated a minimum 9% return on investment…

A: Return on investment = (Return or operating income/Investment)×100

Q: If the department is discontinued, what would be the annual change in the company's overall net…

A: Any organization can have departments that work as either profit centers and cost centers . It is…

Q: Schulz GmbH, a German company, set an 18 percent target rate of return for its U.S. division for the…

A: Return on investment (ROI) is a financial ratio which calculate the benefit an investor will receive…

Q: Compute the following measures for 2021 and 2023: a. actual velocity and cycle time (2021 and 2023)…

A: answer with calculation are as follows:

Q: A company's returns department incurs annual overhead costs of $333,000 and budgets 9,000 returns…

A: Overhead means the cost which is incurred indirectly and not directly.

Q: Kamil, manager of a Dairy Products Division, was pleased with his division's performance over the…

A: According to the data given above, Initial investment of Proposal A = RM250,000 Cost of capital of…

Q: ) Khesrow Sadiqi is chief operations officer for Herat Manufacturing, and has been given an…

A: Profitability index is simply equal to present value of cash inflows divided by initial investment…

Q: The vice president of manufacturing is perplexed. When the new Sunbeam Plant bega rations three…

A: Here asked for multi question as per guidelines we will solve first question for you. If you need…

Q: Recognising that there would be fierce competition to regain lost markets, Management felt that…

A: The production cost report prepared for process costing consists of costs incurred for completed…

Q: A study has been conducted to determine if one of the departments in Your Company should be…

A: Discontinuing a department means that department is no longer operated, it is either shut down…

Q: Recognising that there would be fierce competition to regain lost markets, Management felt that…

A: First we will calculate production cost for Jan based on given information.…

Q: Calculate the payback period for each product. 2. Calculate the net present value for each product.…

A: Payback Period: It refers to the period in which an investment or a project recovers its initial…

Q: You have been recently promoted to the divisional manager of Hadi Ltd (“the Company”), a company…

A: Hadi Ltd.'s Head office expects the controllable profit of a division = 35% sales For the month of…

Q: Assume that as a result of reorganizing the production process, the management of Benoit…

A: Operating income indicates to an earning remain after deducting all the expenses incurred in the…

Q: The directors of Gaston Bridge plc (GB) are meeting to discuss the annual divisional performance…

A: While the two companies are competitors and hence are in the same industry comparing the ROIs…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: "I know headquarters wants us to add that new product line," said Dell Havasi, manager of Billings…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: IRR is a rate at which the present value of cash inflows is equal to the present value of cash…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: Hey, since there are multiple requirements posted, we will answer the first three requirements. If…

Q: The Singer Division of Patio Enterprises currently earns $3.48 million and has divisional assets of…

A: Residual income: It is the amount of income that remains after paying all the debt and expenses.

Q: Recognising that there would be fierce competition to regain lost markets, Management felt that…

A: The question is based on the concept of Cost Accounting.

Q: The Pakistan Cables (Pvt) Ltd., a manufacturer of quality electric cables, has experienced a steady…

A:

Q: Colonial Pharmaceuticals is a small firm specializing in new products. It is organized into two…

A: AC division: Adjusted capital=Divisional investement+R&D×50%=$10,500+$2,750×50%=$11,875

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Forchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).Recently, Ulrich Company received a report from an external consulting group on its quality costs. The consultants reported that the companys quality costs total about 21 percent of its sales revenues. Somewhat shocked by the magnitude of the costs, Rob Rustin, president of Ulrich Company, decided to launch a major quality improvement program. For the coming year, management decided to reduce quality costs to 17 percent of sales revenues. Although the amount of reduction was ambitious, most company officials believed that the goal could be realized. To improve the monitoring of the quality improvement program, Rob directed Pamela Golding, the controller, to prepare monthly performance reports comparing budgeted and actual quality costs. Budgeted costs and sales for the first two months of the year are as follows: The following actual sales and actual quality costs were reported for January: Required: 1. Reorganize the monthly budgets so that quality costs are grouped in one of four categories: appraisal, prevention, internal failure, or external failure. (Essentially, prepare a budgeted cost of quality report.) Also, identify each cost as variable (V) or fixed (F). (Assume that no costs are mixed.) 2. Prepare a performance report for January that compares actual costs with budgeted costs. Comment on the companys progress in improving quality and reducing its quality costs.Dantrell Palmer has just been appointed manager of Kirchner Glass Products Division. He has two years to make the division profitable. If the division is still showing a loss after two years, it will be eliminated, and Dantrell will be reassigned as an assistant divisional manager in another division. The divisional income statement for the most recent year is as follows: Upon arriving at the division, Dantrell requested the following data on the divisions three products: He also gathered data on a proposed new product (Product D). If this product is added, it would displace one of the current products; the quantity that could be produced and sold would equal the quantity sold of the product it displaces, although demand limits the maximum quantity that could be sold to 20,000 units. Because of specialized production equipment, it is not possible for the new product to displace part of the production of a second product. The information on Product D is as follows: Required: 1. Prepare segmented income statements for Products A, B, and C. 2. Determine the products that Dantrell should produce for the coming year. Prepare segmented income statements that prove your combination is the best for the division. By how much will profits improve given the combination that you selected? (Hint: Your combination may include one, two, or three products.)

- In 20x5, Major Company initiated a full-scale, quality improvement program. At the end of the year, Jack Aldredge, the president, noted with some satisfaction that the defects per unit of product had dropped significantly compared to the prior year. He was also pleased that relationships with suppliers had improved and defective materials had declined. The new quality training program was also well accepted by employees. Of most interest to the president, however, was the impact of the quality improvements on profitability. To help assess the dollar impact of the quality improvements, the actual sales and the actual quality costs for 20x4 and 20x5 are as follows by quality category: All prevention costs are fixed (by discretion). Assume all other quality costs are unit-level variable. Required: 1. Compute the relative distribution of quality costs for each year and prepare a pie chart. Do you believe that the company is moving in the right direction in terms of the balance among the quality cost categories? Explain. 2. Prepare a one-year trend performance report for 20x5 (compare the actual costs of 20x5 with those of 20x4, adjusted for differences in sales volume). How much have profits increased because of the quality improvements made by Major Company? 3. Estimate the additional improvement in profits if Major Company ultimately reduces its quality costs to 2.5 percent of sales revenues (assume sales of 10 million).Jane Erickson, manager of an electronics division, was not pleased with the results that had recently been reported concerning the divisions activity-based management implementation project. For one thing, the project had taken eight months longer than projected and had exceeded the budget by nearly 35 percent. But even more vexatious was the fact that after all was said and done, about three-fourths of the plants were reporting that the activity-based product costs were not much different for most of the products than those of the old costing system. Plant managers were indicating that they were continuing to use the old costs as they were easier to compute and understand. Yet, at the same time, they were complaining that they were having a hard time meeting the bids of competitors. Reliable sources were also revealing that the divisions product costs were higher than many competitors. This outcome perplexed plant managers because their control system still continued to report favorable materials and labor efficiency variances. They complained that ABM had failed to produce any significant improvement in cost performance. Jane decided to tour several of the plants and talk with the plant managers. After the tour, she realized that her managers did not understand the concept of non-value-added costs nor did they have a good grasp of the concept of kaizen costing. No efforts were being made to carefully consider the activity information that had been produced. One typical plant manager threw up his hands and said: This is too much data. Why should I care about all this detail? I do not see how this can help me improve my plants performance. They tell me that inspection is not a necessary activity and does not add value. I simply cant believe that inspecting isnt value-added and necessary. If we did not inspect, we would be making and sending more bad products to customers. Required: Explain why Janes division is having problems with its ABM implementation.Lindell Manufacturing embarked on an ambitious quality program that is centered on continual improvement. This improvement is operationalized by declining quality costs from year to year. Lindell rewards plant managers, production supervisors, and workers with bonuses ranging from 1,000 to 10,000 if their factory meets its annual quality cost goals. Len Smith, manager of Lindells Boise plant, felt obligated to do everything he could to provide this increase to his employees. Accordingly, he has decided to take the following actions during the last quarter of the year to meet the plants budgeted quality cost targets: a. Decrease inspections of the process and final product by 50% and transfer inspectors temporarily to quality training programs. Len believes this move will increase the inspectors awareness of the importance of quality; also, decreasing inspection will produce significantly less downtime and less rework. By increasing the output and decreasing the costs of internal failure, the plant can meet the budgeted reductions for internal failure costs. Also, by showing an increase in the costs of quality training, the budgeted level for prevention costs can be met. b. Delay replacing and repairing defective products until the beginning of the following year. While this may increase customer dissatisfaction somewhat, Len believes that most customers expect some inconvenience. Besides, the policy of promptly dealing with customers who are dissatisfied could be reinstated in 3 months. In the meantime, the action would significantly reduce the costs of external failure, allowing the plant to meet its budgeted target. c. Cancel scheduled worker visits to customers plants. This program, which has been very well received by customers, enables Lindell workers to see just how the machinery they make is used by the customer and also gives them first-hand information on any remaining problems with the machinery. Workers who went on previous customer site visits came back enthusiastic and committed to Lindells quality program. Lindells quality program staff believes that these visits will reduce defects during the following year. Required: 1. Evaluate Lens ethical behavior. In this evaluation, consider his concern for his employees. Was he justified in taking the actions described? If not, what should he have done? 2. Assume that the company views Lens behavior as undesirable. What can the company do to discourage it? 3. Assume that Len is a CMA and a member of the IMA. Refer to the ethical code for management accountants in Chapter 1. Were any of these ethical standards violated?

- At the end of 20x1, Mejorar Company implemented a low-cost strategy to improve its competitive position. Its objective was to become the low-cost producer in its industry. A Balanced Scorecard was developed to guide the company toward this objective. To lower costs, Mejorar undertook a number of improvement activities such as JIT production, total quality management, and activity-based management. Now, after two years of operation, the president of Mejorar wants some assessment of the achievements. To help provide this assessment, the following information on one product has been gathered: Required: 1. Compute the following measures for 20x1 and 20x3: a. Actual velocity and cycle time b. Percentage of total revenue from new customers (assume one unit per customer) c. Percentage of very satisfied customers (assume each customer purchases one unit) d. Market share e. Percentage change in actual product cost (for 20x3 only) f. Percentage change in days of inventory (for 20x3 only) g. Defective units as a percentage of total units produced h. Total hours of training i. Suggestions per production worker j. Total revenue k. Number of new customers 2. For the measures listed in Requirement 1, list likely strategic objectives, classified according to the four Balance Scorecard perspectives. Assume there is one measure per objective.Luna Company is a printing company and a subsidiary of a large publishing company. Luna is in its fourth year of a 5-year, quality improvement program. The program began in 20X1 as a result of a report by a consulting firm that revealed that quality costs were about 20% of sales. Concerned about the level of quality costs, Lunas top management began a 5-year plan in 20X1 with the objective of lowering quality costs to 10% of sales by the end of 20X5. Sales and quality costs for each year are as follows: Quality costs by category are expressed as a percentage of sales as follows: The detail of the 20X5 budget for quality costs is also provided. Actual quality costs for 20X4 and 20X5 are as follows: Required: 1. Prepare an interim quality cost performance report for 20X5 that compares actual quality costs with budgeted quality costs. Comment on the firms ability to achieve its quality goals for the year. 2. Prepare a single-period quality performance report for 20X5 that compares the actual quality costs of 20X4 with the actual costs of 20X5. How much did profits change because of improved quality? 3. Prepare a graph that shows the trend in total quality costs as a percentage of sales since the inception of the quality improvement program. 4. Prepare a graph that shows the trend for all four quality cost categories for 20X1 through 20X5. How does this graph help management know that the reduction in total quality costs is attributable to quality improvements? 5. Assume that the company is preparing a second 5-year plan to reduce quality costs to 2.5% of sales. Prepare a long-range quality cost performance report that compares the costs for 20X5 with those planned for the end of the second 5-year period. Assume sales of 45 million at the end of 5 years. The final planned relative distribution of quality costs is as follows: proofreading, 50%; other inspection, 13%; quality training, 30%; and quality reporting, 7%. Assume that all prevention costs are fixed and all other costs are variable (with respect to sales).Iona Company, a large printing company, is in its fourth year of a five-year, quality improvement program. The program began in 20x0 with an internal study that revealed the quality costs being incurred. In that year, a five-year plan was developed to lower quality costs to 10 percent of sales by the end of 20x5. Sales and quality costs for each year are as follows: Budgeted figures. Quality costs by category are expressed as a percentage of sales as follows: The detail of the 20x5 budget for quality costs is also provided. All prevention costs are fixed; all other quality costs are variable. During 20x5, the company had 12 million in sales. Actual quality costs for 20x4 and 20x5 are as follows: Required: 1. Prepare an interim quality cost performance report for 20x5 that compares actual quality costs with budgeted quality costs. Comment on the firms ability to achieve its quality goals for the year. 2. Prepare a one-period quality performance report for 20x5 that compares the actual quality costs of 20x4 with the actual costs of 20x5. How much did profits change because of improved quality? 3. Prepare a graph that shows the trend in total quality costs as a percentage of sales since the inception of the quality improvement program. 4. Prepare a graph that shows the trend for all four quality cost categories for 20x1 through 20x5. How does this graph help management know that the reduction in total quality costs is attributable to quality improvements? 5. Assume that the company is preparing a second five-year plan to reduce quality costs to 2.5 percent of sales. Prepare a long-range quality cost performance report assuming sales of 15 million at the end of five years. Assume that the final planned relative distribution of quality costs is as follows: proofreading, 50 percent; other inspection, 13 percent; quality training, 30 percent; and quality reporting, 7 percent.

- Nico Parts, Inc., produces electronic products with short life cycles (of less than two years). Development has to be rapid, and the profitability of the products is tied strongly to the ability to find designs that will keep production and logistics costs low. Recently, management has also decided that post-purchase costs are important in design decisions. Last month, a proposal for a new product was presented to management. The total market was projected at 200,000 units (for the two-year period). The proposed selling price was 130 per unit. At this price, market share was expected to be 25 percent. The manufacturing and logistics costs were estimated to be 120 per unit. Upon reviewing the projected figures, Brian Metcalf, president of Nico, called in his chief design engineer, Mark Williams, and his marketing manager, Cathy McCourt. The following conversation was recorded: BRIAN: Mark, as you know, we agreed that a profit of 15 per unit is needed for this new product. Also, as I look at the projected market share, 25 percent isnt acceptable. Total profits need to be increased. Cathy, what suggestions do you have? CATHY: Simple. Decrease the selling price to 125 and we expand our market share to 35 percent. To increase total profits, however, we need some cost reductions as well. BRIAN: Youre right. However, keep in mind that I do not want to earn a profit that is less than 15 per unit. MARK: Does that 15 per unit factor in preproduction costs? You know we have already spent 100,000 on developing this product. To lower costs will require more expenditure on development. BRIAN: Good point. No, the projected cost of 120 does not include the 100,000 we have already spent. I do want a design that will provide a 15-per-unit profit, including consideration of preproduction costs. CATHY: I might mention that post-purchase costs are important as well. The current design will impose about 10 per unit for using, maintaining, and disposing our product. Thats about the same as our competitors. If we can reduce that cost to about 5 per unit by designing a better product, we could probably capture about 50 percent of the market. I have just completed a marketing survey at Marks request and have found out that the current design has two features not valued by potential customers. These two features have a projected cost of 6 per unit. However, the price consumers are willing to pay for the product is the same with or without the features. Required: 1. Calculate the target cost associated with the initial 25 percent market share. Does the initial design meet this target? Now calculate the total life-cycle profit that the current (initial) design offers (including preproduction costs). 2. Assume that the two features that are apparently not valued by consumers will be eliminated. Also assume that the selling price is lowered to 125. a. Calculate the target cost for the 125 price and 35 percent market share. b. How much more cost reduction is needed? c. What are the total life-cycle profits now projected for the new product? d. Describe the three general approaches that Nico can take to reduce the projected cost to this new target. Of the three approaches, which is likely to produce the most reduction? 3. Suppose that the Engineering Department has two new designs: Design A and Design B. Both designs eliminate the two nonvalued features. Both designs also reduce production and logistics costs by an additional 8 per unit. Design A, however, leaves post-purchase costs at 10 per unit, while Design B reduces post-purchase costs to 4 per unit. Developing and testing Design A costs an additional 150,000, while Design B costs an additional 300,000. Assuming a price of 125, calculate the total life-cycle profits under each design. Which would you choose? Explain. What if the design you chose cost an additional 500,000 instead of 150,000 or 300,000? Would this have changed your decision? 4. Refer to Requirement 3. For every extra dollar spent on preproduction activities, how much benefit was generated? What does this say about the importance of knowing the linkages between preproduction activities and later activities?Bradford Company, a manufacturer of small tools, implemented lean manufacturing at the end of 20x1. The companys goal for the year was to increase the ROS to 40 percent of sales. A value-stream team was established and began to work on lean improvements. During the year, the team was able to achieve significant results on several fronts. The Box Scorecard below reflects the performance measures at the beginning of the year, midyear, and end of year. Although the team members were pleased with their progress, they were disappointed in the financial results. They were still far from the targeted ROS of 40 percent. They were also puzzled as to why the improvements made did not translate into significantly improved financial performance. Required: 1. From the scorecard, what was the focus of the value-stream team for the first six months? The second six months? What are the implications of these changes? 2. Using information from the scorecard, offer an explanation for why the financial results were not as good as expected. 3. Suppose that on December 31, 20x2, a potential customer offered to purchase an order of goods that would increase weekly revenues in January by 100,000 and material cost by 30,000. Using the old standard cost system, the projected conversion cost of the order would be 60,000. Would you recommend that the order be accepted or rejected? Explain.Kent Tessman, manager of a Dairy Products Division, was pleased with his divisions performance over the past three years. Each year, divisional profits had increased, and he had earned a sizable bonus. (Bonuses are a linear function of the divisions reported income.) He had also received considerable attention from higher management. A vice president had told him in confidence that if his performance over the next three years matched his first three, he would be promoted to higher management. Determined to fulfill these expectations, Kent made sure that he personally reviewed every capital budget request. He wanted to be certain that any funds invested would provide good, solid returns. (The divisions cost of capital is 10 percent.) At the moment, he is reviewing two independent requests. Proposal A involves automating a manufacturing operation that is currently labor intensive. Proposal B centers on developing and marketing a new ice cream product. Proposal A requires an initial outlay of 250,000, and Proposal B requires 312,500. Both projects could be funded, given the status of the divisions capital budget. Both have an expected life of six years and have the following projected after-tax cash flows: After careful consideration of each investment, Kent approved funding of Proposal A and rejected Proposal B. Required: 1. Compute the NPV for each proposal. 2. Compute the payback period for each proposal. 3. According to your analysis, which proposal(s) should be accepted? Explain. 4. Explain why Kent accepted only Proposal A. Considering the possible reasons for rejection, would you judge his behavior to be ethical? Explain.