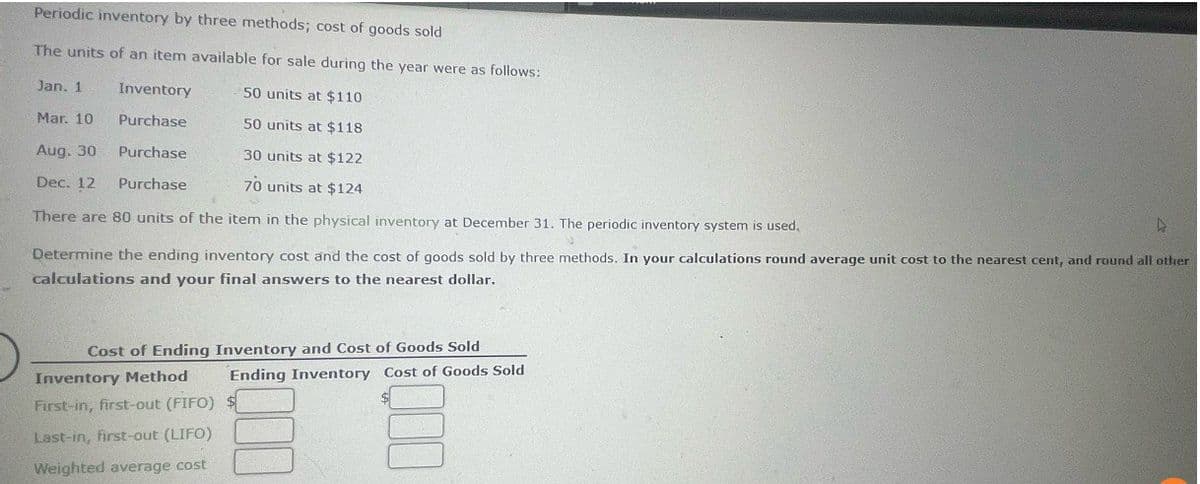

Periodic inventory by three methods; cost of goods sold The units of an item available for sale during the year were as follows: Jan. 1 Mar. 10 Aug. 30 Inventory Purchase 50 units at $110 50 units at $118 Purchase 30 units at $122 Dec. 12 Purchase 70 units at $124 There are 80 units of the item in the physical inventory at December 31. The periodic inventory system is used. 4 Determine the ending inventory cost and the cost of goods sold by three methods. In your calculations round average unit cost to the nearest cent, and round all other calculations and your final answers to the nearest dollar. Cost of Ending Inventory and Cost of Goods Sold Inventory Method First-in, first-out (FIFO) Last-in, first-out (LIFO) Weighted average cost Ending Inventory Cost of Goods Sold

Periodic inventory by three methods; cost of goods sold The units of an item available for sale during the year were as follows: Jan. 1 Mar. 10 Aug. 30 Inventory Purchase 50 units at $110 50 units at $118 Purchase 30 units at $122 Dec. 12 Purchase 70 units at $124 There are 80 units of the item in the physical inventory at December 31. The periodic inventory system is used. 4 Determine the ending inventory cost and the cost of goods sold by three methods. In your calculations round average unit cost to the nearest cent, and round all other calculations and your final answers to the nearest dollar. Cost of Ending Inventory and Cost of Goods Sold Inventory Method First-in, first-out (FIFO) Last-in, first-out (LIFO) Weighted average cost Ending Inventory Cost of Goods Sold

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter6: Inventories

Section: Chapter Questions

Problem 2PB: LIFO perpetual inventory The beginning inventory for Dunne Co. and data on purchases and sales for a...

Related questions

Question

please solve with all workings like explanation , computation for each part and steps clearly in proper format answer in text form

Transcribed Image Text:Periodic inventory by three methods; cost of goods sold

The units of an item available for sale during the year were as follows:

Jan. 1

Mar. 10

Aug. 30

Inventory

Purchase

50 units at $110

50 units at $118

Purchase

30 units at $122

Dec. 12

Purchase

70 units at $124

There are 80 units of the item in the physical inventory at December 31. The periodic inventory system is used.

4

Determine the ending inventory cost and the cost of goods sold by three methods. In your calculations round average unit cost to the nearest cent, and round all other

calculations and your final answers to the nearest dollar.

Cost of Ending Inventory and Cost of Goods Sold

Inventory Method

First-in, first-out (FIFO)

Last-in, first-out (LIFO)

Weighted average cost

Ending Inventory Cost of Goods Sold

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning