PIPO P SP saf NOREN COMPANY Comparative Income Statments Year Ended December 31, 2019 Original Categories Categories Change Net Credit Sales $1,270,000 $1,270,000 Cost of Goods Sold 60,000 60,000 Gross Margin $1,210,000 $1,210,000 Expenses: General and Administrative Expense $300,500 $300,500 Bad Debt Expense Total Expenses Net Income (Loss) D. How does the new total uncollectible amount affect net income and net accounts receivable? a. Bad debt expense is lower, net income is higher, and net receivables are higher. b. Bad debt expense is lower, net income is higher, and net receivables are lower. c. Bad debt expense is higher, net income is lower, and net receivables are higher. d. Bad debt expense is higher, net income is lower, and net receivables are lower.

PIPO P SP saf NOREN COMPANY Comparative Income Statments Year Ended December 31, 2019 Original Categories Categories Change Net Credit Sales $1,270,000 $1,270,000 Cost of Goods Sold 60,000 60,000 Gross Margin $1,210,000 $1,210,000 Expenses: General and Administrative Expense $300,500 $300,500 Bad Debt Expense Total Expenses Net Income (Loss) D. How does the new total uncollectible amount affect net income and net accounts receivable? a. Bad debt expense is lower, net income is higher, and net receivables are higher. b. Bad debt expense is lower, net income is higher, and net receivables are lower. c. Bad debt expense is higher, net income is lower, and net receivables are higher. d. Bad debt expense is higher, net income is lower, and net receivables are lower.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 74E

Related questions

Question

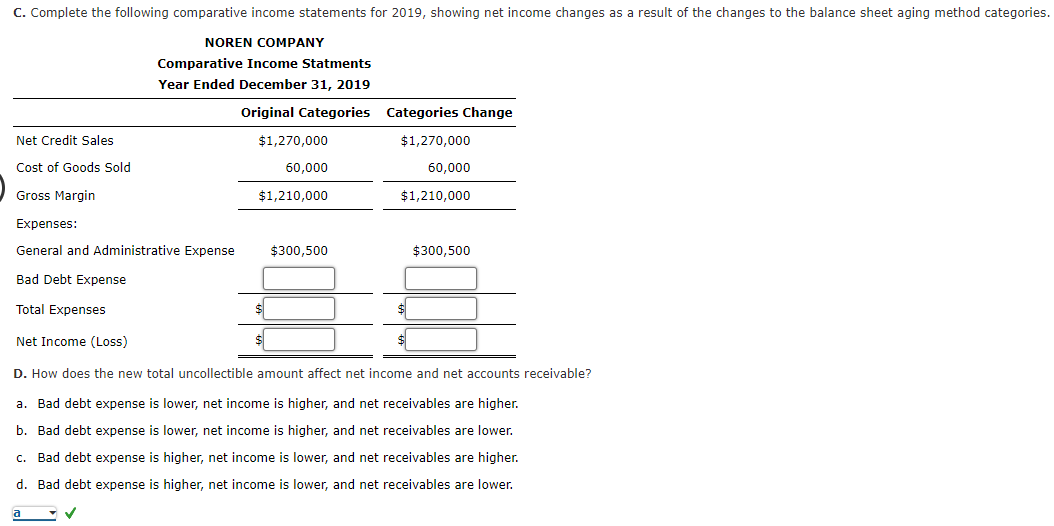

Transcribed Image Text:C. Complete the following comparative income statements for 2019, showing net income changes as a result of the changes to the balance sheet aging method categories.

NOREN COMPANY

Comparative Income Statments

Year Ended December 31, 2019

Original Categories Categories Change

Net Credit Sales

$1,270,000

$1,270,000

Cost of Goods Sold

60,000

60,000

Gross Margin

$1,210,000

$1,210,000

Expenses:

General and Administrative Expense

$300,500

$300,500

Bad Debt Expense

Total Expenses

Net Income (Loss)

D. How does the new total uncollectible amount affect net income and net accounts receivable?

a. Bad debt expense is lower, net income is higher, and net receivables are higher.

b. Bad debt expense is lower, net income is higher, and net receivables are lower.

c. Bad debt expense is higher, net income is lower, and net receivables are higher.

d. Bad debt expense is higher, net income is lower, and net receivables are lower.

Transcribed Image Text:三要等

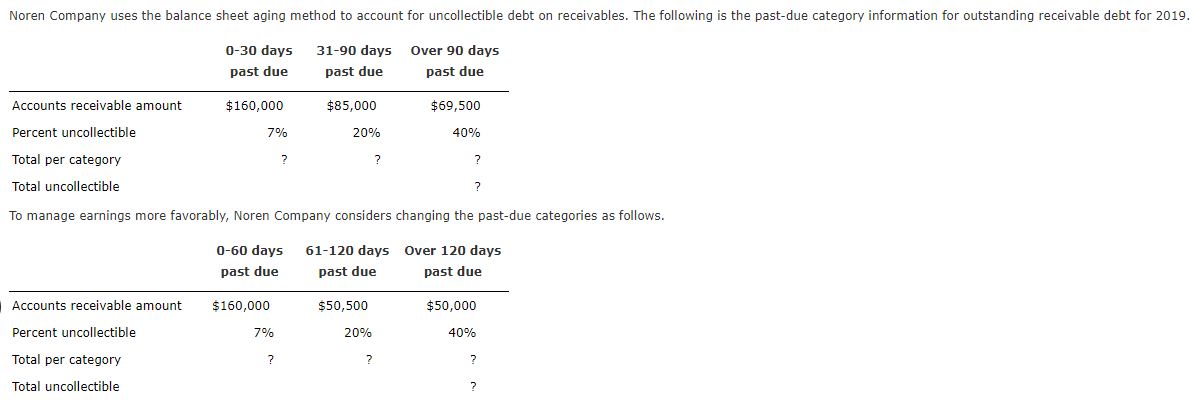

Noren Company uses the balance sheet aging method to account for uncollectible debt on receivables. The following is the past-due category information for outstanding receivable debt for 2019.

0-30 days

31-90 days

Over 90 days

past due

past due

past due

Accounts receivable amount

$160,000

$85,000

$69,500

Percent uncollectible

7%

20%

40%

Total per category

?

Total uncollectible

?

To manage earnings more favorably, Noren Company considers changing the past-due categories as follows.

0-60 days

61-120 days Over 120 days

past due

past due

past due

Accounts receivable amount

$160,000

$50,500

$50,000

Percent uncollectible

7%

20%

40%

Total per category

?

Total uncollectible

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage